EURUSD in positive territory: rate expectations put pressure on the US dollar

The EURUSD pair rose to 1.1601. Market activity will be lower due to Thanksgiving Day. Find more details in our analysis for 27 November 2025.

EURUSD forecast: key trading points

- Market focus: the EURUSD pair may slightly correct before attempting a new rally

- Current trend: US statistics influence overall market sentiment

- EURUSD forecast for 27 November 2025: 1.1655

Fundamental analysis

The EURUSD rate climbed to 1.1601. Pressure on the US dollar has increased amid rising expectations of further Federal Reserve rate cuts.

The market is now pricing in roughly an 85% probability of a 25-basis-point rate cut in December, a sharp jump from around 30% just a week ago. In addition, investors expect three more cuts by the end of 2026.

These expectations strengthened after reports that Kevin Hassett, Director of the White House National Economic Council, is considered the main candidate for the next Fed chair. Markets view his potential appointment as consistent with Donald Trump’s preference for lower interest rates.

Wednesday’s releases also had an impact, with unemployment claims unexpectedly decreasing and durable goods orders beating forecasts.

Trading volumes are expected to remain low until Friday due to the Thanksgiving holiday in the US.

The EURUSD forecast is moderately positive.

EURUSD technical analysis

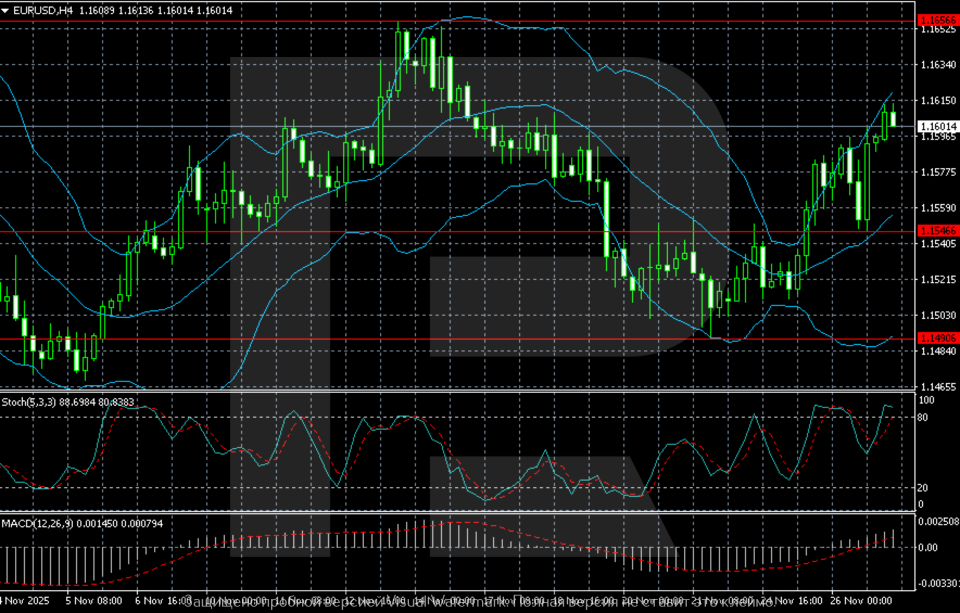

On the H4 chart, the EURUSD pair is confidently recovering towards the 1.1600–1.1615 area. The price broke above the intermediate resistance level at 1.1546, which now acts as the nearest support. The next key barrier for buyers is the 1.1655–1.1660 zone, where a local high formed in mid-month.

The pair is trading in the upper half of Bollinger Bands, with the price hovering near the upper band, indicating strong short-term momentum. The Stochastic Oscillator is in overbought territory (above 80), signalling a potential pause or pullback after the sharp rise. MACD is starting to recover, with the histogram reducing its negative zone. All of this confirms improving sentiment, but there is still no strong bullish signal.

The key levels include the 1.1655 resistance level, a crucial barrier for further upside potential. The support level is located at 1.1546, followed by the strategic level at 1.1490.

Summary

The EURUSD structure has shifted in favour of buyers, but with nuances. The EURUSD forecast for today, 27 November 2025, indicates a risk of a short-term pullback before an attempt to break above 1.1655.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.