EURUSD fell to support at 1.1500 ahead of Nonfarm Payrolls data

The EURUSD rate corrected downwards to the 1.1500 support level. Today, the market’s focus is on US labour market data for September. Find more details in our analysis for 20 November 2025.

EURUSD forecast: key trading points

- Market focus: the market is awaiting US Nonfarm Payrolls data today

- Current trend: moving downwards

- EURUSD forecast for 20 November 2025: 1.1650 or 1.1400

Fundamental analysis

The EURUSD pair is declining ahead of the key US employment report. The delayed Nonfarm Payrolls report for September will be published later today and is expected to show an increase in jobs.

The US Bureau of Labor Statistics stated that it will not release the regular October employment report because the household survey data cannot be collected retroactively, adding that the missing data will be incorporated into the postponed November report.

The latest FOMC meeting minutes showed policymakers split on whether further rate cuts are necessary, prompting traders to lower expectations for a December reduction. Markets are now pricing in roughly a 33% probability of a 25-basis-point rate cut next month, down from 50% a day earlier.

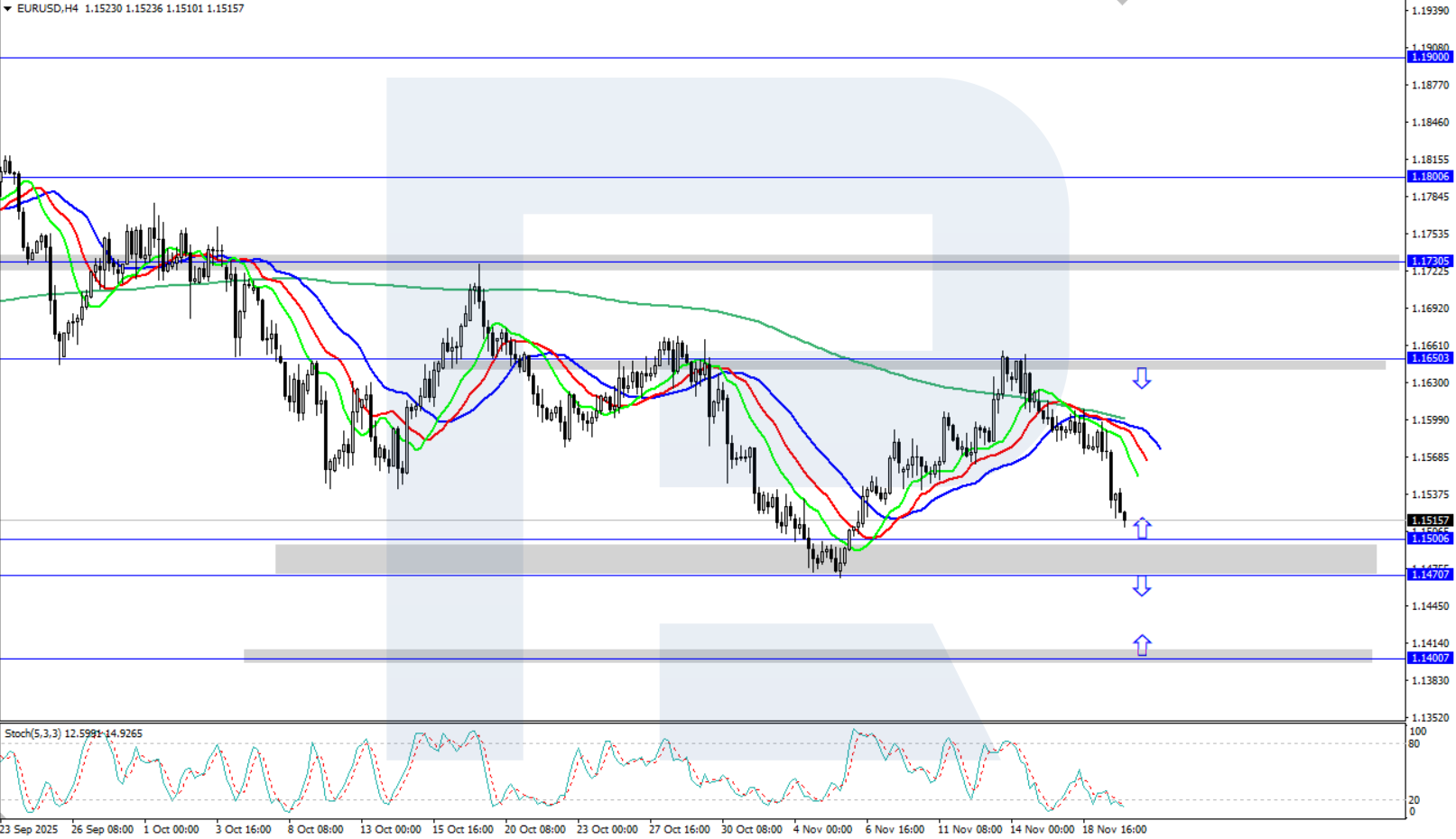

EURUSD technical analysis

On the H4 chart, the EURUSD pair is moving lower, falling to the 1.1500 support level. The Alligator indicator is turning downwards. If the price fails to stay above 1.1500, the decline may continue.

The short-term EURUSD forecast suggests growth towards 1.1650 in the near term if buyers push the pair upwards from the 1.1500 support level. However, if sellers keep control, the decline may extend towards the 1.1400 support level.

Summary

The EURUSD pair is declining, reaching the 1.1500 support level. Today, the market will focus on US labour market statistics for September.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.