EURUSD awaits news: labour data will set the direction

The EURUSD pair is holding steady near 1.1580 as traders await US data. Discover more in our analysis for 19 November 2025.

EURUSD forecast: key trading points

- The EURUSD pair remains under pressure

- The focus is on all the accumulated US statistics

- EURUSD forecast for 19 November 2025: 1.1561

Fundamental analysis

The EURUSD rate is stabilising around 1.1580 after the US dollar strengthened earlier in the week amid fading expectations of a quick Federal Reserve rate cut. The market is now pricing in only a 47% likelihood of a 25-basis-point December cut, down from more than 90% a month ago.

Several Fed officials warned against further easing due to inflation risks, although board member Christopher Waller again supported the idea of a rate cut, pointing to signs of labour market weakness.

The latest data from the US Department of Labor showed 232,000 initial jobless claims for the week ending 18 October. Continuing claims rose to 1.957 million, the highest since August. The highly anticipated September employment report will be released on Thursday.

Investors are also watching earnings from major US retailers to assess the resilience of consumer spending.

The EURUSD forecast is moderately negative.

EURUSD technical analysis

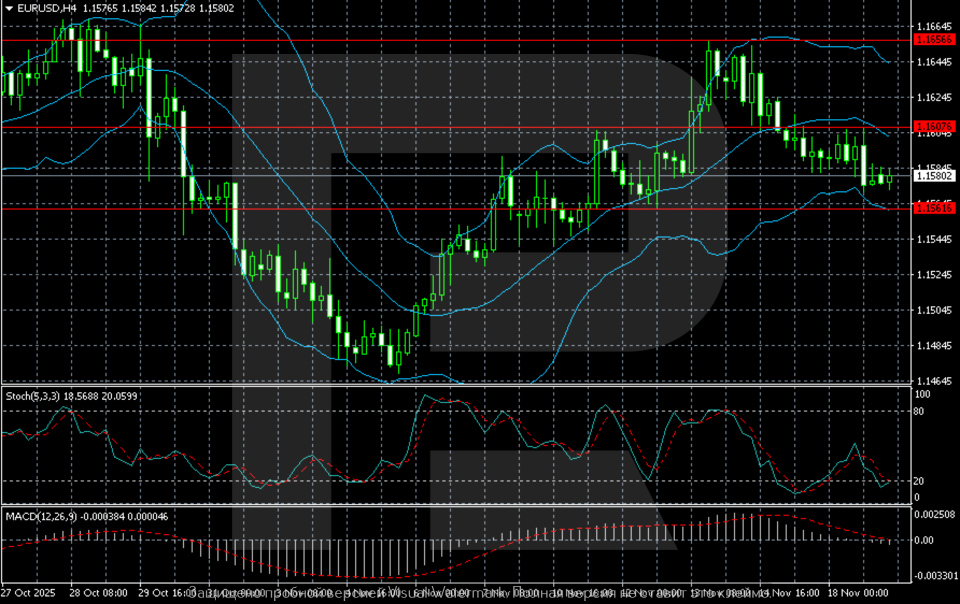

The EURUSD H4 chart shows a moderately downward structure, with consolidation near 1.1580 after the recent pullback from the local high at 1.1665. The price is hovering between the nearest levels: resistance at 1.1607–1.1665 and support at 1.1561.

Bollinger Bands are narrowing, indicating lower volatility. The price is moving along the middle band after a brief upside breakout, indicating the absence of a strong directional impulse. A consolidation below the lower band will reinforce bearish pressure.

While the Stochastic Oscillator is in oversold territory near 20, signalling a potential short technical rebound, its lines point downwards – no reversal signal yet.

MACD also reflects weakening bullish momentum: the histogram is shrinking and the signal line is turning downwards, supporting the bearish scenario.

Summary

The EURUSD pair remains under pressure below the key resistance level at 1.1607. The EURUSD forecast for today, 19 November 2025, suggests a slide towards 1.1561.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.