Europe surprises with data, EURUSD gears up for takeoff

Growth in US factory orders fails to impress the market, and the EURUSD rate may continue its upward trajectory towards 1.1655. Find more details in our analysis for 18 November 2025.

EURUSD forecast: key trading points

- US factory orders: previously at -1.3%, projected at 1.4%

- The European Commission raised the eurozone economic growth forecast by the end of 2025 to 1.3%

- EURUSD forecast for 18 November 2025: 1.1655

Fundamental analysis

The EURUSD outlook takes into account that US factory orders may rise to 1.4%, up from the previous negative reading of -1.3%. Following the US government shutdown, the market expects large batches of economic data, which could increase EURUSD volatility.

The European Commission raised its eurozone economic growth forecast for the end of 2025 to 1.3% from 0.9% previously. This improvement is attributed to strong exports, particularly in the first half of the year, indicating resilience in the economy despite external risks. Against this backdrop, the euro continues to strengthen against the USD.

Trade barriers, tariffs, and global trade tensions remain significant risks for the eurozone that may both support and limit growth. These risks must be taken into account, especially since the ECB is reacting cautiously to the current economic landscape and is more likely to maintain current interest rates than change them.

EURUSD technical analysis

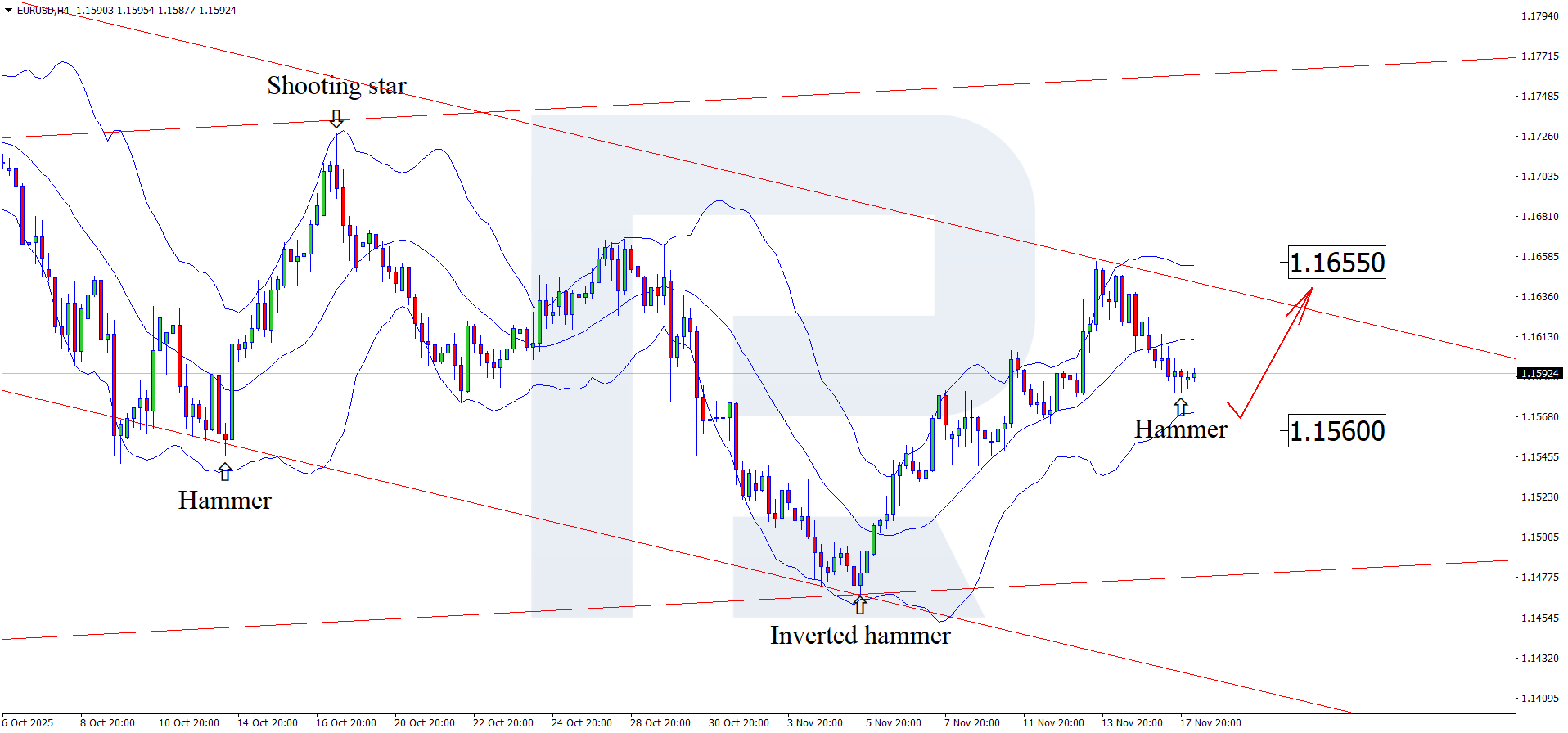

On the H4 chart, the EURUSD pair has formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, the pair may form an upward wave following the signal. Since the price remains within the descending channel, the EURUSD rate could attempt to break above the upper boundary and move towards 1.1655. A breakout above this level would open the way for continued upward momentum.

However, today’s EURUSD forecast also considers an alternative scenario in which the price may decline towards 1.1560 without testing the resistance level.

Summary

Today’s EURUSD outlook favours the euro, with technical analysis suggesting a rise towards the 1.1655 resistance level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.