EURUSD trades above 1.1700, eurozone inflation in focus

The EURUSD rate has consolidated above the 1.1700 level. Today, the market will focus on eurozone inflation data, particularly the Consumer Price Index (CPI). Find more details in our analysis for 17 October 2025.

EURUSD forecast: key trading points

- Market focus: the eurozone CPI is expected to rise by 2.2% in September

- Current trend: moderate upward movement

- EURUSD forecast for 17 October 2025: 1.1700 or 1.1800

Fundamental analysis

The euro is strengthening amid signs of political stabilisation in France. Prime Minister Sébastien Lecornu’s pledge to suspend the controversial pension reform has gained support from some left-wing lawmakers.

Meanwhile, the US dollar remains under pressure after Federal Reserve Chairman Jerome Powell highlighted weakness in the US labour market, reinforcing expectations of another key interest rate cut later this month.

Today, the eurozone CPI for September will be released, with a 2.2% annual increase and 0.1% monthly growth expected. A stronger-than-expected inflation reading could support the euro.

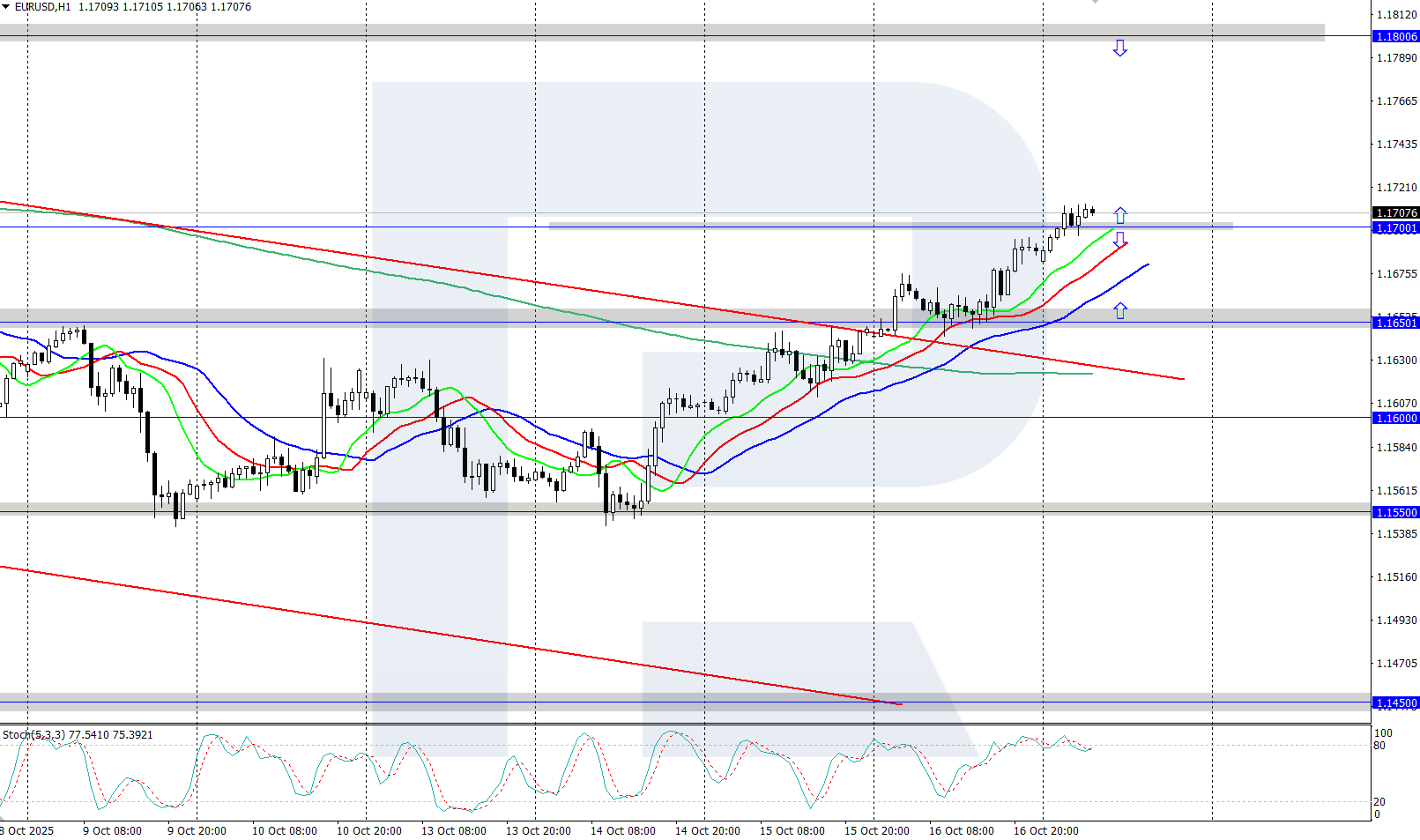

EURUSD technical analysis

On the H4 chart, EURUSD quotes are moderately rising, consolidating above the 1.1700 level. The daily momentum remains bullish, supported by an upward-trending Alligator indicator. After a brief correction, continued growth may follow.

The short-term EURUSD forecast suggests further growth towards 1.1800 if buyers hold the price above 1.1700. Conversely, if sellers push quotes back below 1.1700, the pair could dip to the 1.1650 support level.

Summary

The EURUSD rate has climbed above 1.1700. Today, the market’s primary focus will be on eurozone inflation data – the Consumer Price Index (CPI).

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.