Markets hold their breath: what will Powell say and how will it affect the EURUSD rate

Ahead of the Federal Reserve Chairman’s speech, the euro is strengthening, with the EURUSD rate testing the 1.1640 mark and preparing for growth. Find more details in our analysis for 9 October 2025.

EURUSD forecast: key trading points

- Speech by Federal Reserve Chairman Jerome Powell

- The euro is strengthening

- EURUSD forecast for 9 October 2025: 1.1700

Fundamental analysis

The EURUSD forecast takes into account that today, Federal Reserve Chairman Jerome Powell is scheduled to speak.

Main expectations from the speech:

- Clarification of the position on further rate cuts – Powell may give a clearer signal about how aggressively or cautiously the Fed intends to move towards further easing. The market is waiting to see whether he will support expectations of rate cuts in October–December or show caution due to inflationary pressure

- Comments on the state of the labour market and economic data – since the government shutdown has delayed some data releases, Powell may touch on the issue of statistical delays, the labour market, and how the Federal Reserve assesses the risks of a slowdown under these circumstances

- The tone of the speech – much depends on the phrasing and tone: if he emphasises caution and uncertainty, the dollar may weaken; if he highlights inflation risks, the dollar may gain support

- Reaction to the subtext of the minutes and internal disagreements – the minutes of the previous meeting have already shown differing opinions within the FOMC. Today, Powell may address these disagreements and indicate how the committee would respond under various scenarios (higher-than-expected inflation, weaker labour market)

The forecast for 8 October 2025 is not in favour of the USD; Powell’s speech may once again weaken the US currency and trigger growth in the EURUSD rate.

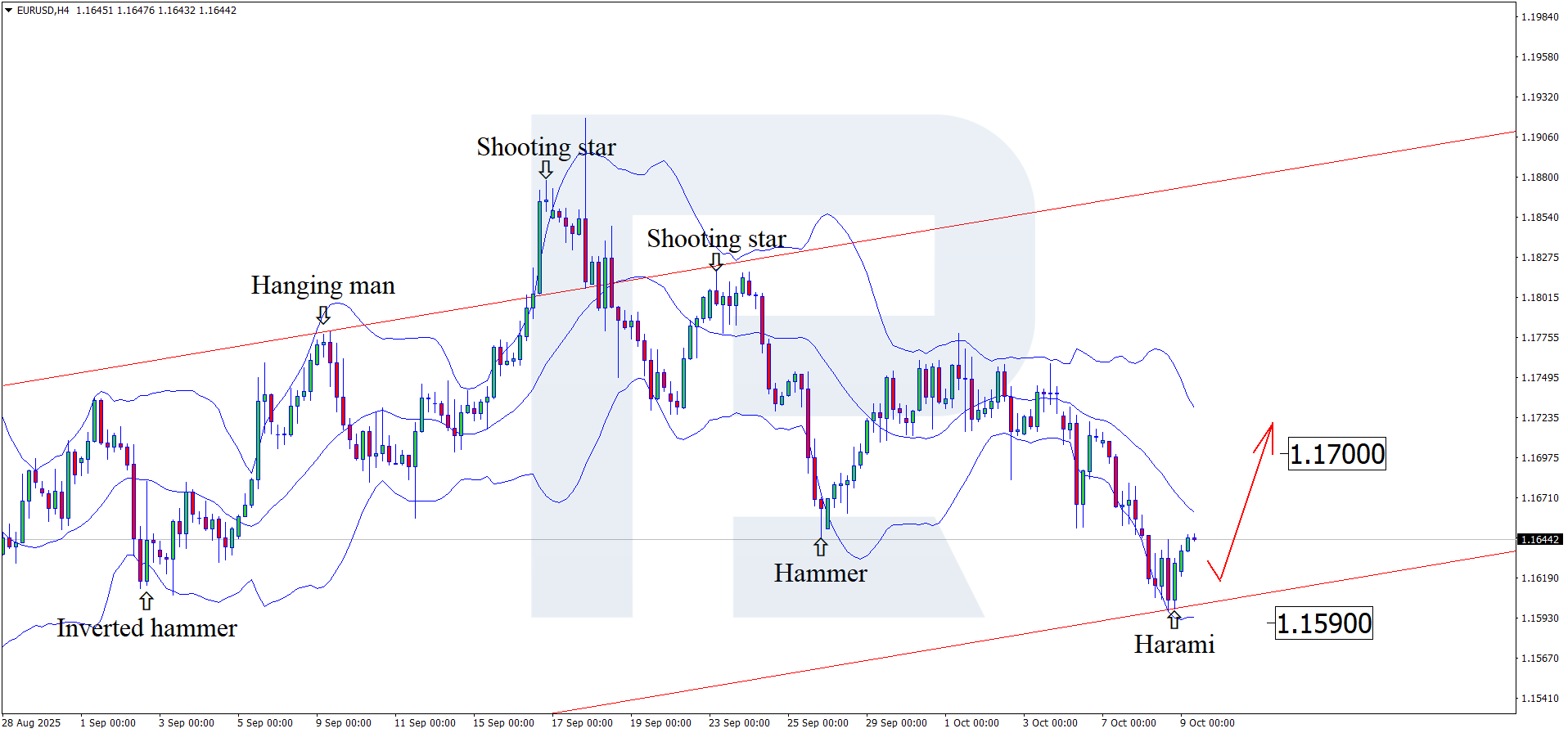

EURUSD technical analysis

On the H4 chart, the EURUSD pair has formed a Harami reversal pattern near the lower Bollinger Band. At this stage, it continues its upward trajectory following the signal. Since quotes remain within an ascending channel, there is potential for growth towards the nearest resistance level at 1.1700. If it is broken, the uptrend may continue further.

At the same time, a correction of the EURUSD rate towards 1.1590 before further growth should not be ruled out.

Summary

The EURUSD forecast for today may turn out positive for the euro, as the Fed Chair’s speech could shed light on future interest rate decisions. Meanwhile, the EURUSD technical analysis suggests a rise towards the 1.1700 USD resistance level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.