EURUSD fell below 1.1700

The EURUSD rate dipped below 1.1700 following the resignation of France’s newly appointed prime minister. Discover more in our analysis for 7 October 2025.

EURUSD forecast: key trading points

- Market focus: French Prime Minister Sébastien Lecornu resigned

- Current trend: moving downwards

- EURUSD forecast for 7 October 2025: 1.1700 or 1.1650

Fundamental analysis

On Monday, the EURUSD pair declined by more than 0.5% to around 1.1650, its lowest since 25 September. The fall followed the resignation of recently appointed French Prime Minister Sébastien Lecornu.

The reason for his departure was President Emmanuel Macron’s decision to make almost no changes to his cabinet, which triggered a sharp backlash from the opposition.

The upcoming fiscal plan, aimed at reducing France’s largest budget deficit in the eurozone, is expected to include unpopular measures such as spending cuts and tax increases. These steps could heighten political instability and anxiety in financial markets.

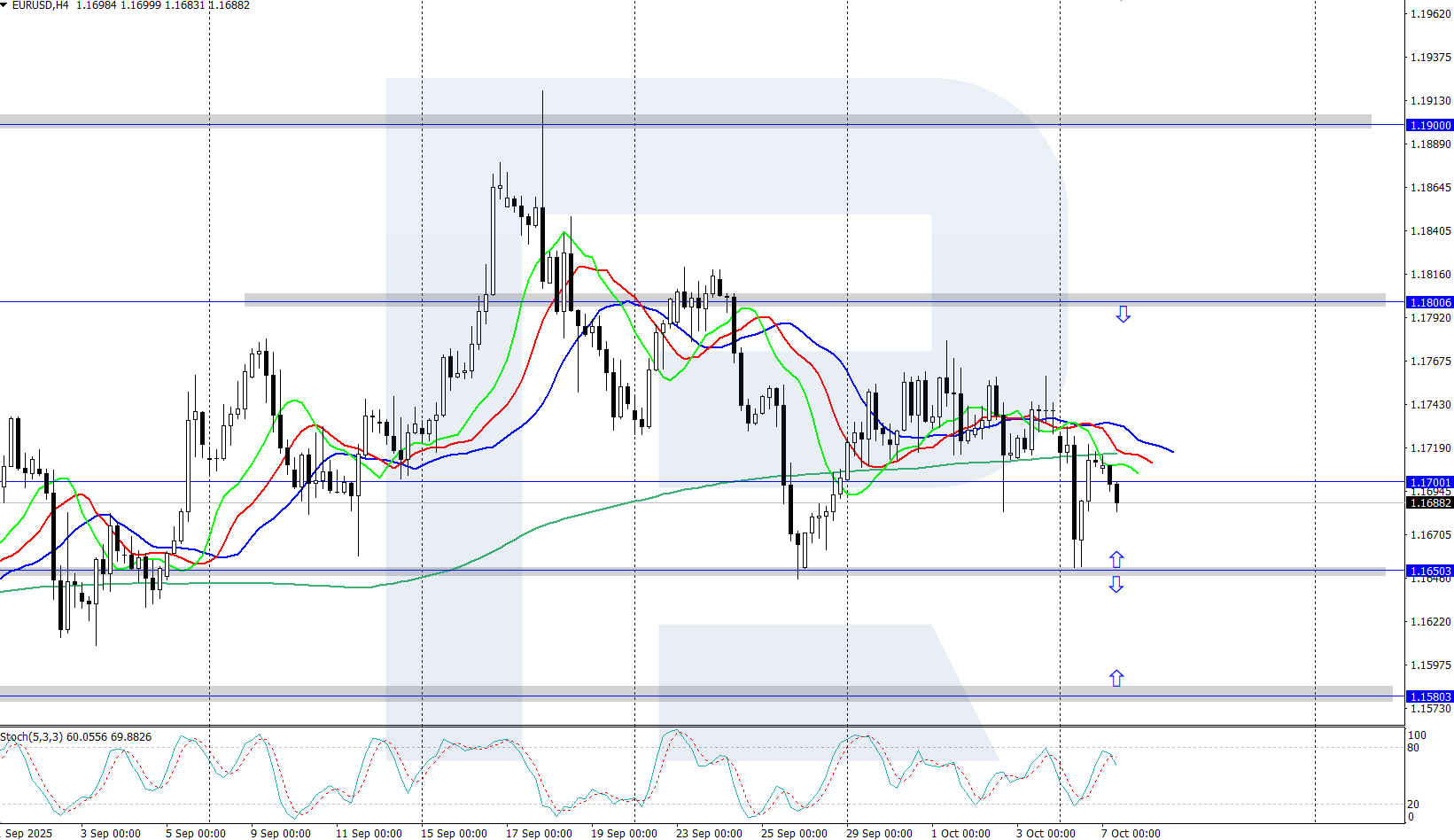

EURUSD technical analysis

On the H4 chart, the EURUSD pair is reversing downwards from the 1.1900 resistance level. A local downward correction is currently underway, after which growth may resume. The key support level lies at 1.1650.

The short-term EURUSD forecast suggests a further rise towards 1.1800 if bulls push the price back above 1.1700. However, if bears gain a foothold below 1.1650, the pair could dip further to 1.1580.

Summary

The EURUSD pair entered a downward correction, dropping below 1.1700, with political instability in France exerting additional pressure on the euro.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.