EURUSD on pause: everyone is waiting for US news

The EURUSD pair has settled within the 1.1727 range. The market is conserving energy while awaiting news on the US government shutdown. Discover more in our analysis for 6 October 2025.

EURUSD forecast: key trading points

- The EURUSD pair is consolidating sideways amid uncertainty surrounding the US government shutdown

- With no fresh headlines, investors are watching secondary data releases

- EURUSD forecast for 6 October 2025: 1.1660 or 1.1780

Fundamental analysis

The EURUSD rate remains neutral around 1.1727 amid concerns over the consequences of the prolonged US government shutdown. Congress once again failed to agree on a temporary budget, leading to the suspension of several federal programs and the delay of key macroeconomic reports, including the September Nonfarm Payrolls.

On the monetary front, markets continue to price in two Federal Reserve rate cuts in October and December, each by 25 basis points. Recent data have strengthened expectations that the Fed will maintain its policy easing trajectory.

This week will be marked by speeches from Federal Reserve officials, with the focus on comments from Board member Stephen Miran on Wednesday and Chairman Jerome Powell on Thursday.

The EURUSD forecast is neutral.

EURUSD technical analysis

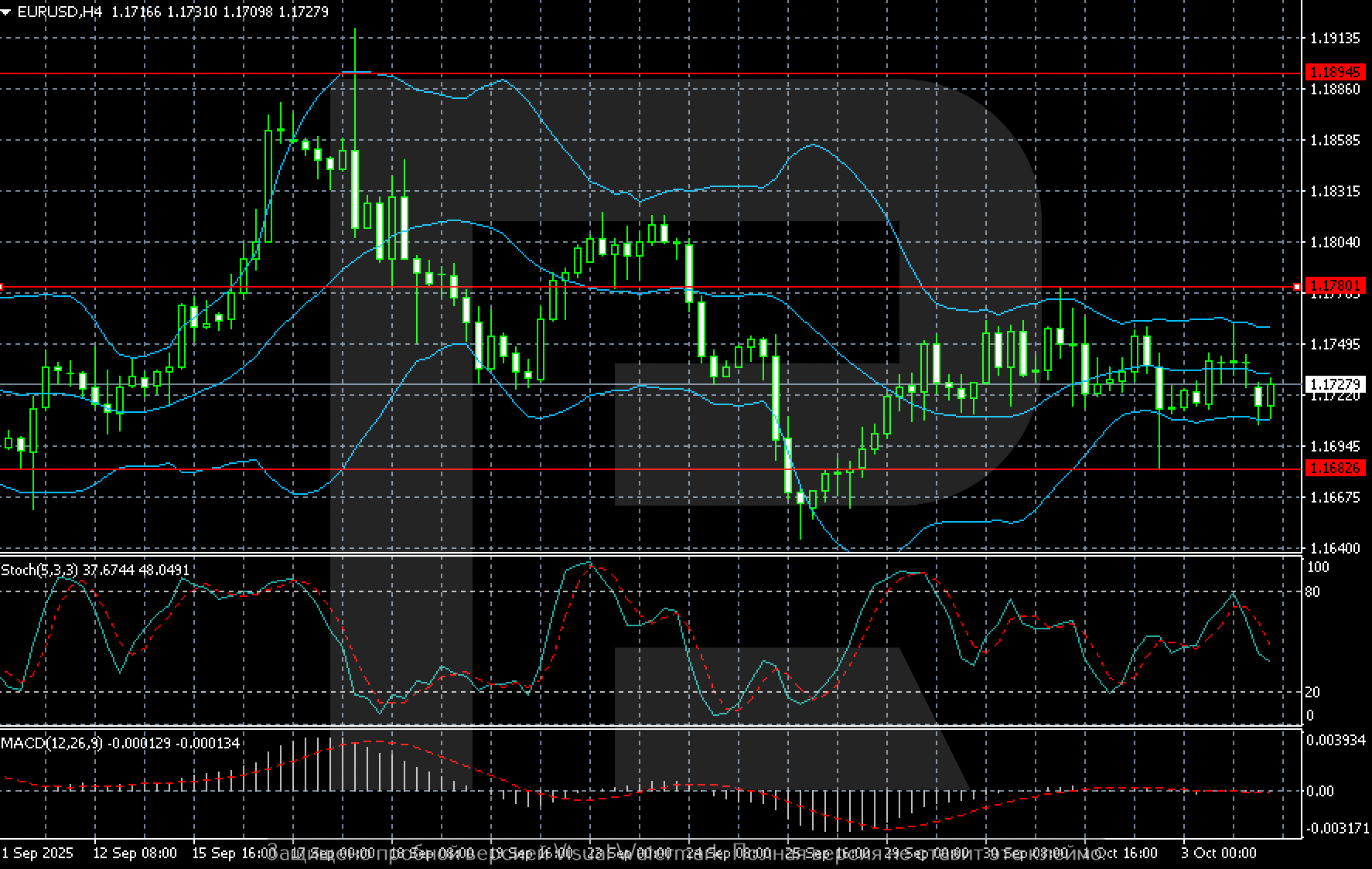

On the H4 chart, the EURUSD pair is trading in a sideways range after a corrective decline in late September.

Prices are fluctuating between the 1.1662 support level and the crucial resistance level at 1.1780. Attempts to break above the upper boundary have so far been unsuccessful, as the market remains in consolidation with declining volatility.

Bollinger Bands are gradually narrowing, indicating the potential for a new impulse in upcoming sessions. The Stochastic Oscillator is moving within the mid-range and is giving no clear signals, but retains upward potential when rebounding from the 30 zone. MACD remains in negative territory, although the histogram is stabilising – an early sign of weakening bearish momentum.

Overall, the technical picture for the EURUSD pair is neutral. Consolidation above 1.1780 is required for continued growth. A breakout below 1.1660 would open the way to a decline towards 1.1570–1.1500.

Summary

The EURUSD pair is holding within a narrow range as the market watches US news. The EURUSD forecast for today, 6 October 2025, does not rule out further consolidation between 1.1660 and 1.1780.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.