NFP approaches: EURUSD awaits a surge in volatility

EURUSD quotes have stalled around the 1.1715 support level while awaiting news from the US. Find more details in our analysis for 3 October 2025.

EURUSD forecast: key trading points

- US Nonfarm Payrolls: previously at 22 thousand, projected at 84 thousand

- US services PMI: previously at 54.5, projected at 53.9

- EURUSD forecast for 3 October 2025: 1.1800

Fundamental analysis

The EURUSD forecast takes into account that the US services PMI could decline to 53.9 from the previous 54.5. A drop to the forecast level or lower would signal a downturn in the US services sector. Stronger-than-expected data could support the USD, pushing the EURUSD pair lower.

The US Nonfarm Payrolls report for 3 October 2025 is expected to show an increase to 84 thousand from the previous 22 thousand. If actual data aligns with expectations, the market could see heightened volatility and temporary strengthening of the US dollar. The release of NFP almost always causes a stir in financial markets and can either support the US dollar or, conversely, strip it of its recent gains.

EURUSD technical analysis

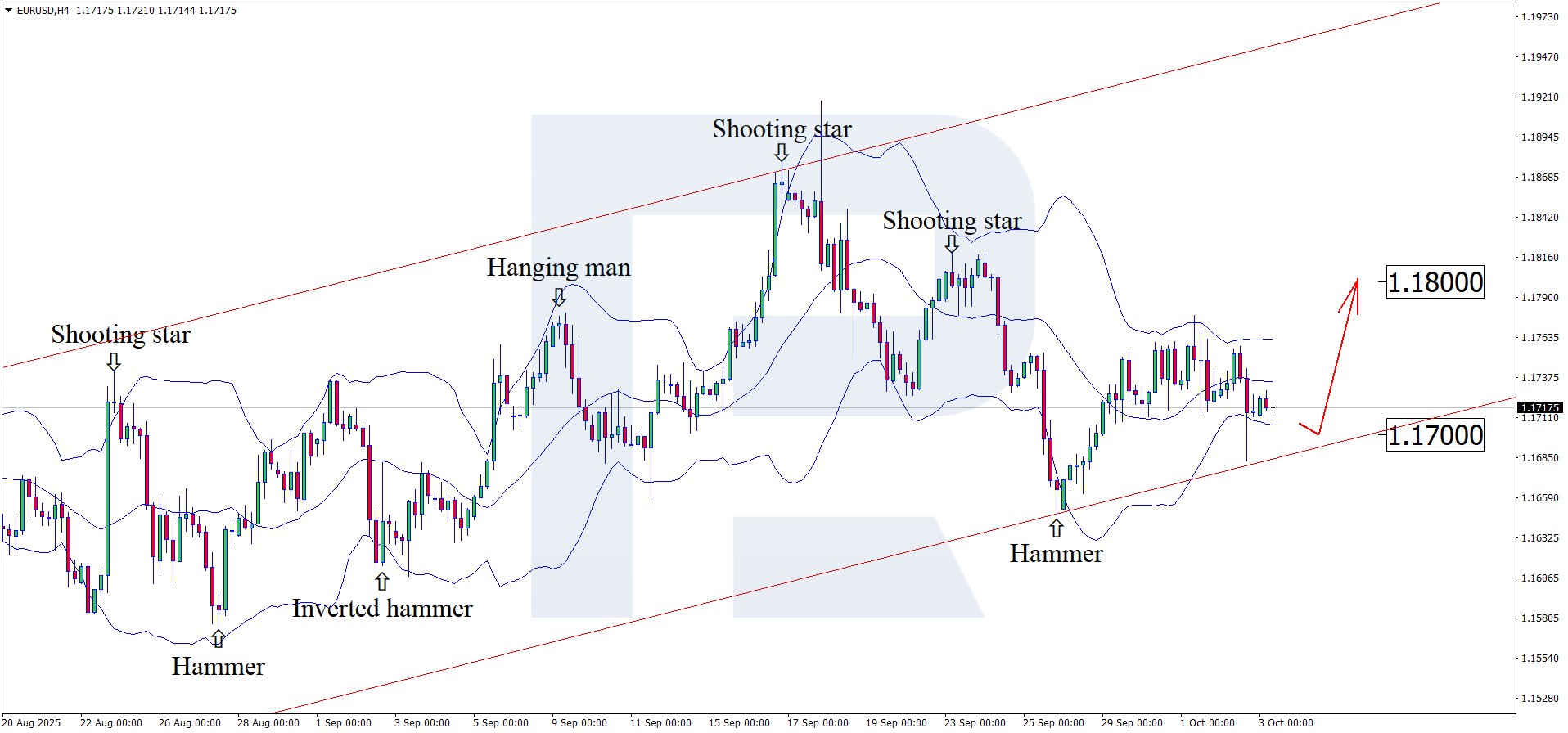

On the H4 chart, the EURUSD pair formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, it continues a bullish wave following the signal from the pattern. Since prices remain within the ascending channel, chances remain for a rise towards the nearest resistance level at 1.1800. A breakout above this level would open the door for continued upward movement.

At the same time, the forecast for 3 October 2025 does not rule out a correction in EURUSD towards 1.1700 before moving higher.

Summary

The EURUSD outlook for today may turn positive for the USD as growth in Nonfarm Payrolls will support the dollar. At the same time, EURUSD technical analysis suggests a rise to the 1.1800 USD resistance level after a correction.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.