EURUSD uncertain, but momentum exists

The EURUSD pair climbed to 1.1736. Market focus remains on the US government shutdown and the fate of economic data releases. Discover more in our analysis for 2 October 2025.

EURUSD forecast: key trading points

- The EURUSD pair continues to rise, but the market remains very cautious

- Investors are watching the US shutdown and upcoming statistics

- EURUSD forecast for 2 October 2025: 1.1780

Fundamental analysis

The EURUSD rate continues to edge slightly higher, reaching 1.1736 on Thursday. Some relief came after the US Supreme Court scheduled hearings for January on the case involving President Donald Trump’s attempt to remove Federal Reserve Board Governor Lisa Cook.

Concerns over the Fed’s independence intensified after Trump accused Cook of mortgage fraud and called on the Fed to accelerate rate cuts.

Additional pressure on the US dollar comes from the first government shutdown in nearly seven years, triggered by Congress’s failure to agree on temporary funding. The shutdown is expected to last at least three days and delay the release of key macroeconomic data, including the September jobs report.

ADP reported an unexpected decline of 32 thousand in private sector employment in September, compared to a forecast gain of 50 thousand. The figures were explained by adjustments linked to missing values in the quarterly census of employment and wages.

The EURUSD forecast is moderately positive.

EURUSD technical analysis

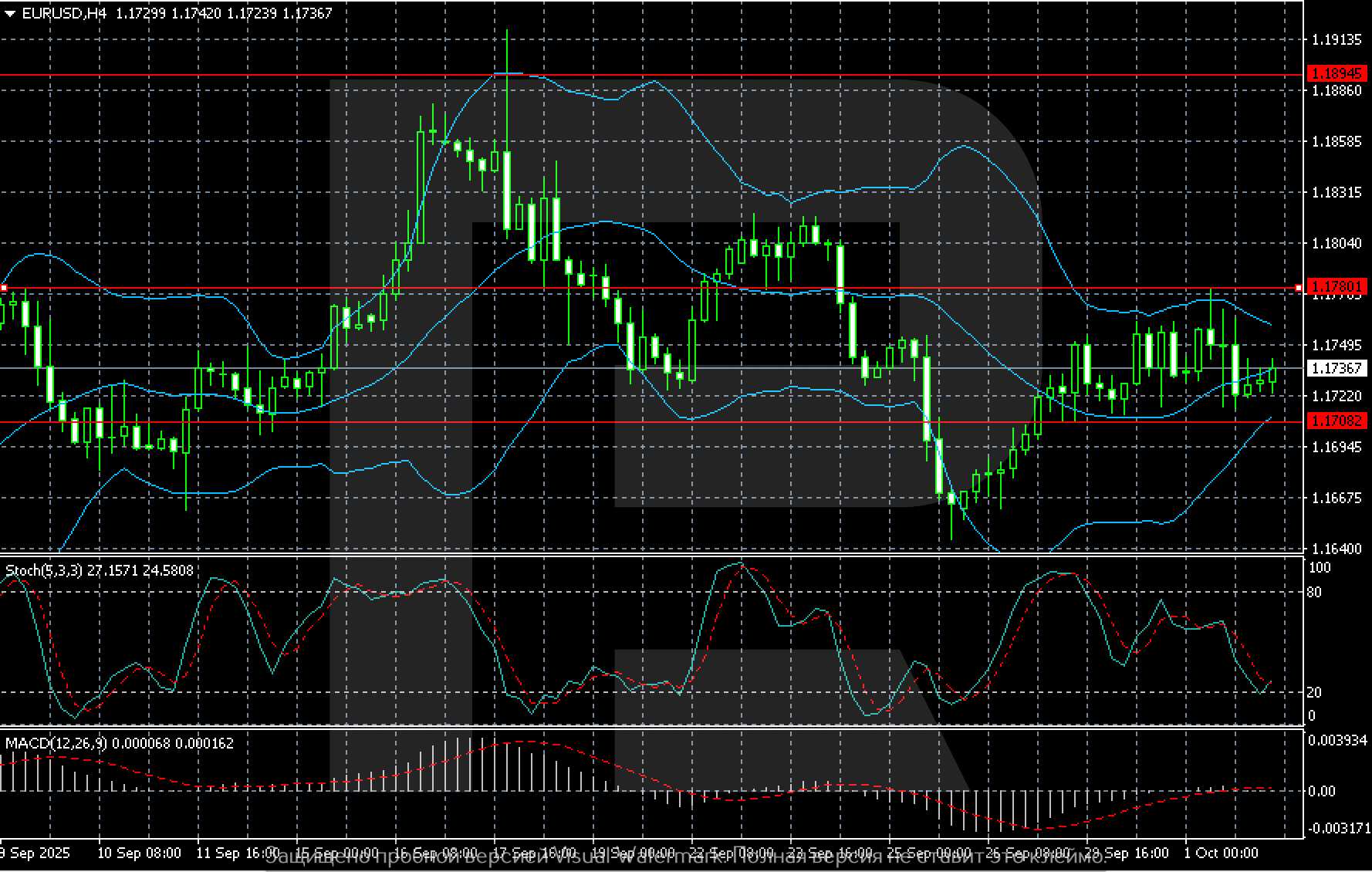

On the H4 chart, the EURUSD pair is consolidating within the 1.1708–1.1780 range after late September’s decline. The pair is hovering near 1.1735, while Bollinger Bands have contracted, indicating lower volatility.

The Stochastic Oscillator is near the oversold zone, signalling a potential local rebound, while MACD remains in negative territory, confirming an ongoing phase of uncertainty.

The nearest support level is at 1.1708, with resistance at 1.1780. A breakout of this range will define the next move, with a breakout above 1.1780 opening the path to 1.1830–1.1890, and a breakout below 1.1708 targeting 1.1650.

Summary

The EURUSD pair is cautiously advancing. The EURUSD forecast for today, 2 October 2025, suggests a rise towards 1.1780.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.