EURUSD dips below 1.1800

The EURUSD pair is correcting after recent gains, slipping below the 1.1800 level as the US dollar strengthens. Discover more in our analysis for 19 September 2025.

EURUSD forecast: key trading points

- Market focus: the Bank of Japan left its benchmark rate unchanged at 5%

- Current trend: correcting after recent growth

- EURUSD forecast for 19 September 2025: 1.1700 or 1.1900

Fundamental analysis

The EURUSD rate is undergoing a downward correction after the US Federal Reserve lowered its key rate by 25 basis points, as widely expected, and signalled a further reduction of 50 basis points by the end of the year. However, Federal Reserve Chairman Jerome Powell stressed that the move was a risk management measure rather than the start of a full-blown easing cycle.

In Europe, the ECB left rates unchanged for the second consecutive meeting last week, suggesting that the rate-cutting cycle may be nearing completion. The central bank is waiting to assess the effects of prior adjustments while weighing risks tied to tariffs, service-sector inflation, food prices, and fiscal policy.

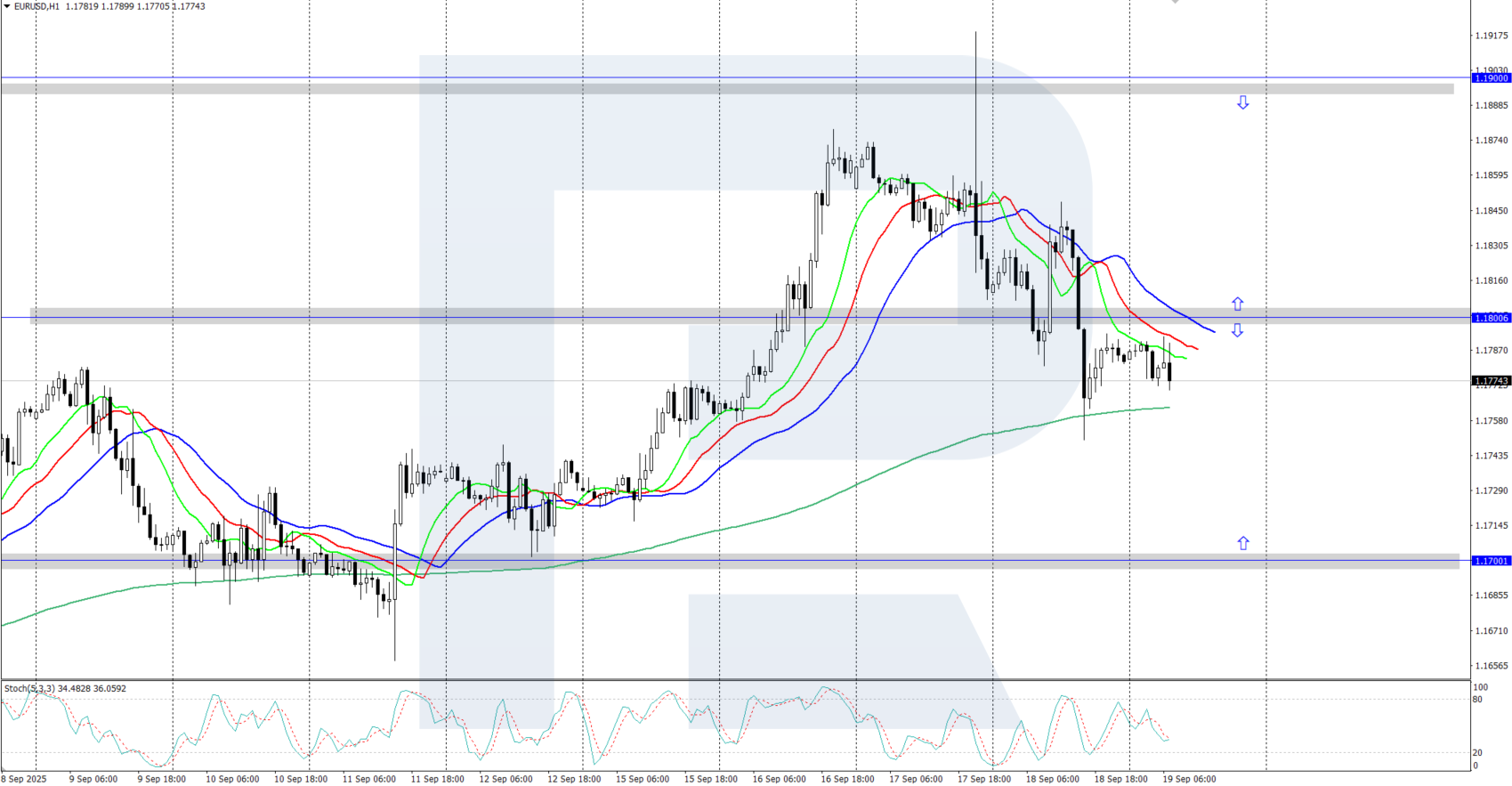

EURUSD technical analysis

On the H4 chart, the EURUSD pair turned lower after failing to break above the 1.1900 resistance level. The market is now in a local correction phase, with growth likely to continue once the correction is complete. The key support level is located at 1.1700.

The short-term EURUSD forecast suggests further growth towards 1.1900 if bulls push the price above 1.1800. Conversely, if bears gain a foothold below 1.1800, the pair could dip to the 1.1700 support area.

Summary

The EURUSD pair is moderately correcting, dropping below 1.1800 as markets are weighing the outlook for future policy moves by the Federal Reserve and the ECB.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.