EURUSD poised for breakout: thanks to Powell and rate-cut expectations

The EURUSD pair reached July highs near 1.1721, with market sentiment clearly risk-on. Find out more in our analysis for 25 August 2025.

EURUSD forecast: key trading points

- The EURUSD pair accelerated its rally after Powell’s Jackson Hole speech

- Markets now expect Fed monetary easing with more enthusiasm than before

- EURUSD forecast for 25 August 2025: 1.1800

Fundamental analysis

At the start of the last week of August, the US dollar came under pressure, while the euro strengthened. The EURUSD pair climbed to 1.1728, marking its highest level since late July.

Following Jerome Powell’s speech at the Jackson Hole Symposium, markets sharply revised their Fed rate expectations. The probability of a September cut now stands at 85%, compared with significantly lower odds earlier. By the end of the year, investors are pricing in 54 basis points of easing, up from 48 basis points a week ago.

Investors remain focused on the labour market, which, according to Powell, is showing an unusual balance, with both demand for and supply of workers slowing. Employment will serve as the key indicator for future Fed decisions.

An additional layer of uncertainty comes from politics: US President Donald Trump called for the resignation of Fed Governor Lisa Cook and suggested she could be dismissed. This fuelled debate over the Fed’s independence and added pressure on the dollar.

The EURUSD forecast is positive.

EURUSD technical analysis

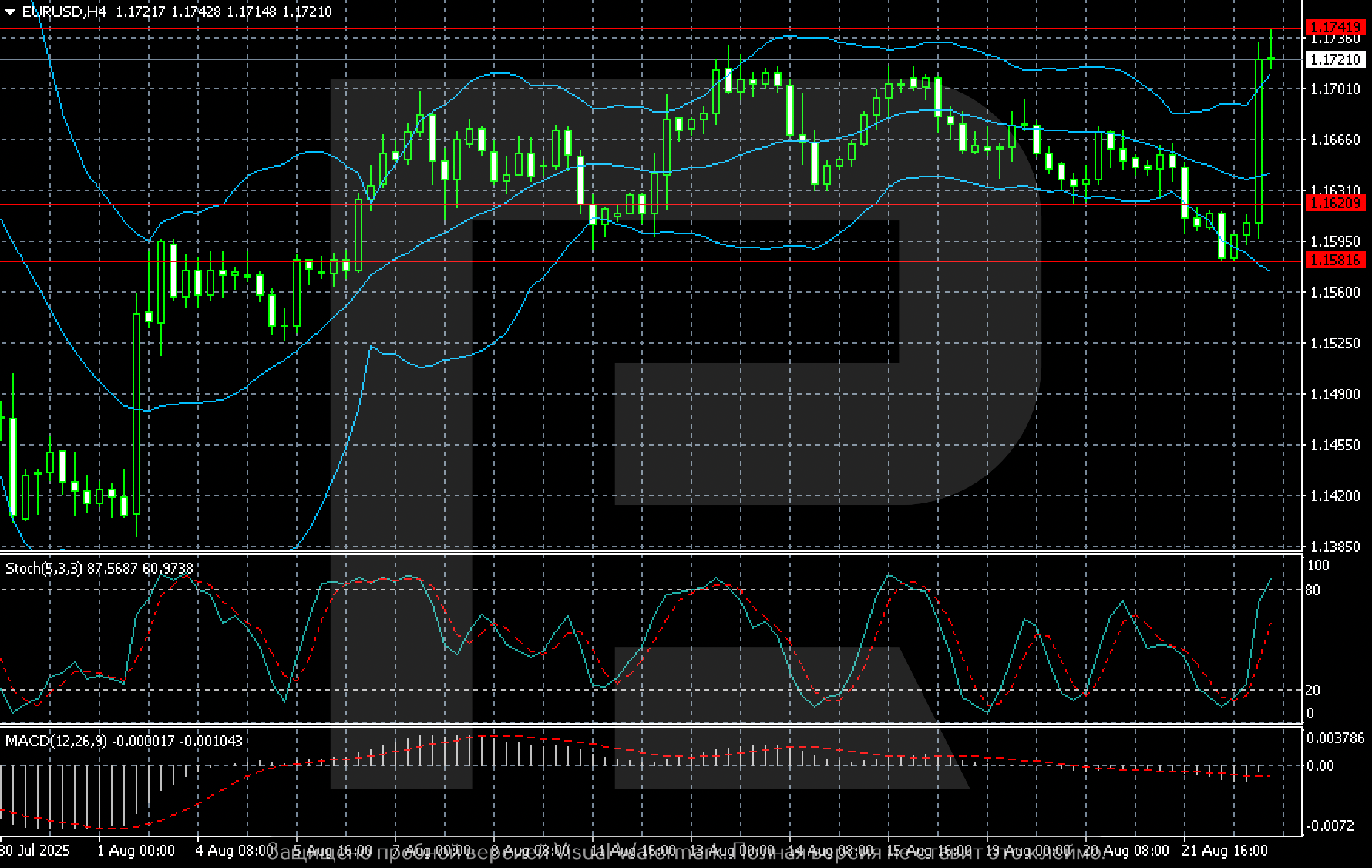

The EURUSD pair ended the week higher, consolidating around 1.1720-1.1740, matching late July highs. The move followed a breakout from the recent range of 1.1580-1.1740.

The support level remains in the 1.1580-1.1630 area, where the pair has rebounded several times.

The resistance level lies at 1.1740, now acting as the key directional marker. A breakout would open the way to 1.1800, while failure to secure gains above it could send the pair back into the range.

Indicators show growing pressure on the US dollar. The Stochastic has entered overbought territory, while Bollinger Bands are widening, pointing to increased volatility. MACD remains near zero, reflecting the consolidative nature of the prior move.

Summary

The EURUSD pair has reached the upper boundary of its fairly stagnant range. The EURUSD forecast for today, 25 August 2025, suggests the growth wave may stretch towards 1.1800.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.