EURUSD at a crossroads: Fed split and EU CPI data to decide the course

Amid expectations of fundamental data from the US and the EU, the EURUSD rate may rise towards 1.1715. Discover more in our analysis for 20 August 2025.

EURUSD forecast: key trading points

- Eurozone Consumer Price Index (CPI): previously at 2.0%, projected at 2.0%

- Publication of FOMC minutes

- EURUSD forecast for 20 August 2025: 1.1715

Fundamental analysis

The eurozone CPI reflects changes in the cost of goods and services for consumers, helping to assess purchasing trends and the level of stagnation in the economy. A stronger-than-expected indicator would support the euro.

The EURUSD forecast for 20 August 2025 suggests that the index may remain flat at 2.0%. However, if the actual figure exceeds the forecast, it could affect the EURUSD rate and strengthen the euro.

Today, the minutes of the Federal Open Market Committee (FOMC) meeting held on 29-30 July will be published.

Key expectations:

- A double split within the FOMC: for the first time since 1993, two governors – Michelle Bowman and Christopher J. Waller – voted to lower interest rates rather than keep them unchanged. This may signal growing support for monetary easing

- The minutes will likely reveal how other members view such proposals and how they assess risks tied to inflation, tariffs, and the labour market

The EURUSD outlook for today remains mixed. On the one hand, Fed monetary easing could support the USD and strengthen its position. On the other hand, stronger economic indicators from the eurozone could bolster the euro.

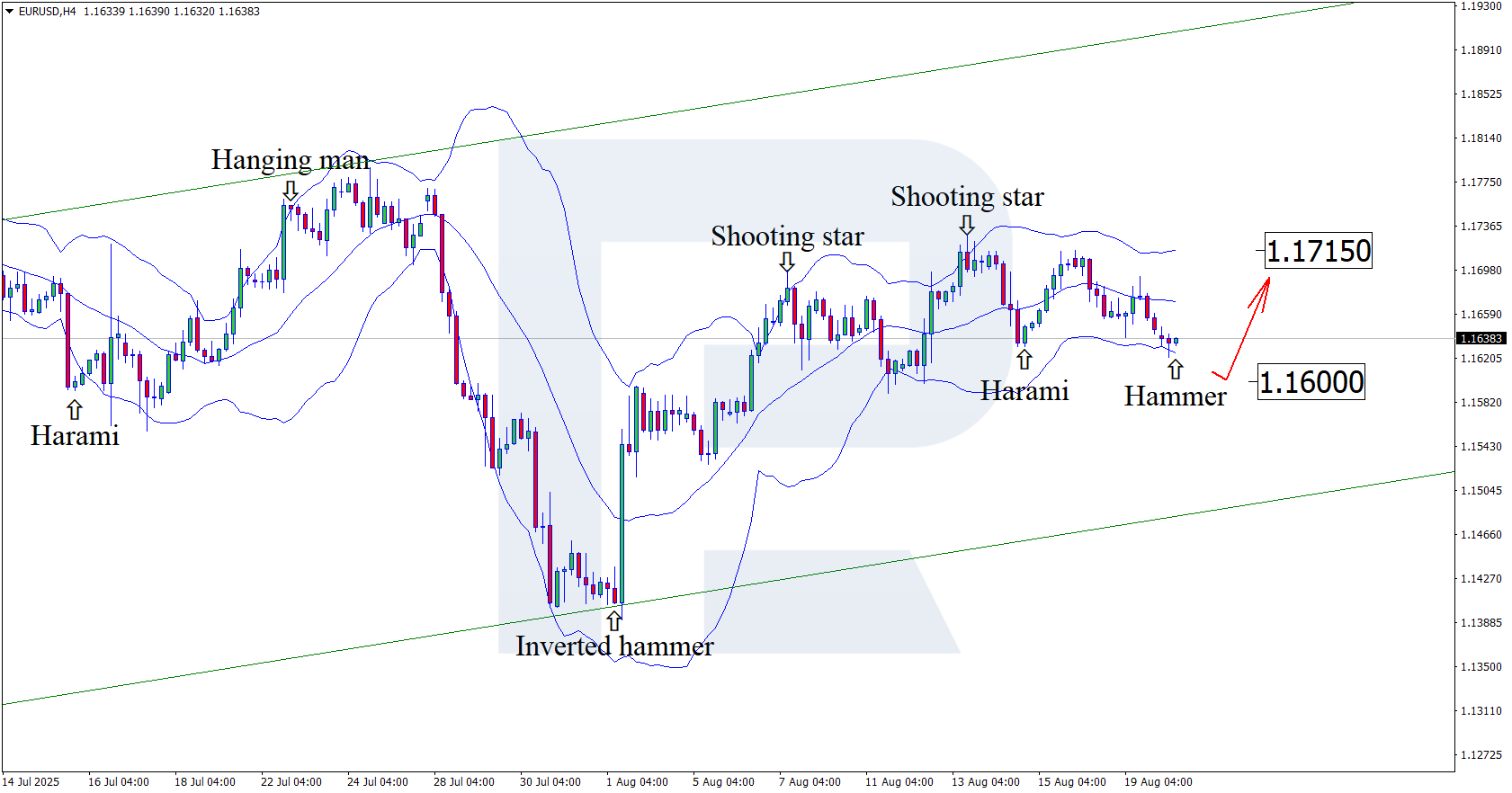

EURUSD technical analysis

On the H4 chart, the EURUSD pair formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, it may build an upward wave in line with the signal. Given the recent sharp decline, a correction towards the nearest resistance level at 1.1715 looks possible. A breakout above this resistance would open the way for a continuation of the uptrend.

However, the EURUSD rate could dip to 1.1600 before any upward move.

Summary

The anticipation of the FOMC minutes puts mixed pressure on the EURUSD rate, while technical analysis suggests the pair may rise towards the 1.1715 resistance level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.