EURUSD rises to the 1.1600 area amid rising EU inflation

The EURUSD rate is strengthening, reaching the 1.1600 area amid rising producer price inflation in the eurozone. Discover more in our analysis for 6 August 2025.

EURUSD forecast: key trading points

- Market focus: today, the market awaits eurozone retail sales data

- Current trend: moving upwards

- EURUSD forecast for 6 August 2025: 1.1700 or 1.1500

Fundamental analysis

Producer price inflation in the eurozone accelerated to 0.6% year-on-year in June 2025, up from 0.3% in May and slightly above market expectations of 0.5%. The price increase strengthened for both durable and non-durable consumer goods.

Today, investors are awaiting eurozone retail sales data for June to better assess trends in consumer demand. The indicator is expected to grow by 0.4% month-on-month and 2.6% year-on-year. A higher-than-expected reading would support the euro, while weaker data would push the EURUSD pair lower.

EURUSD technical analysis

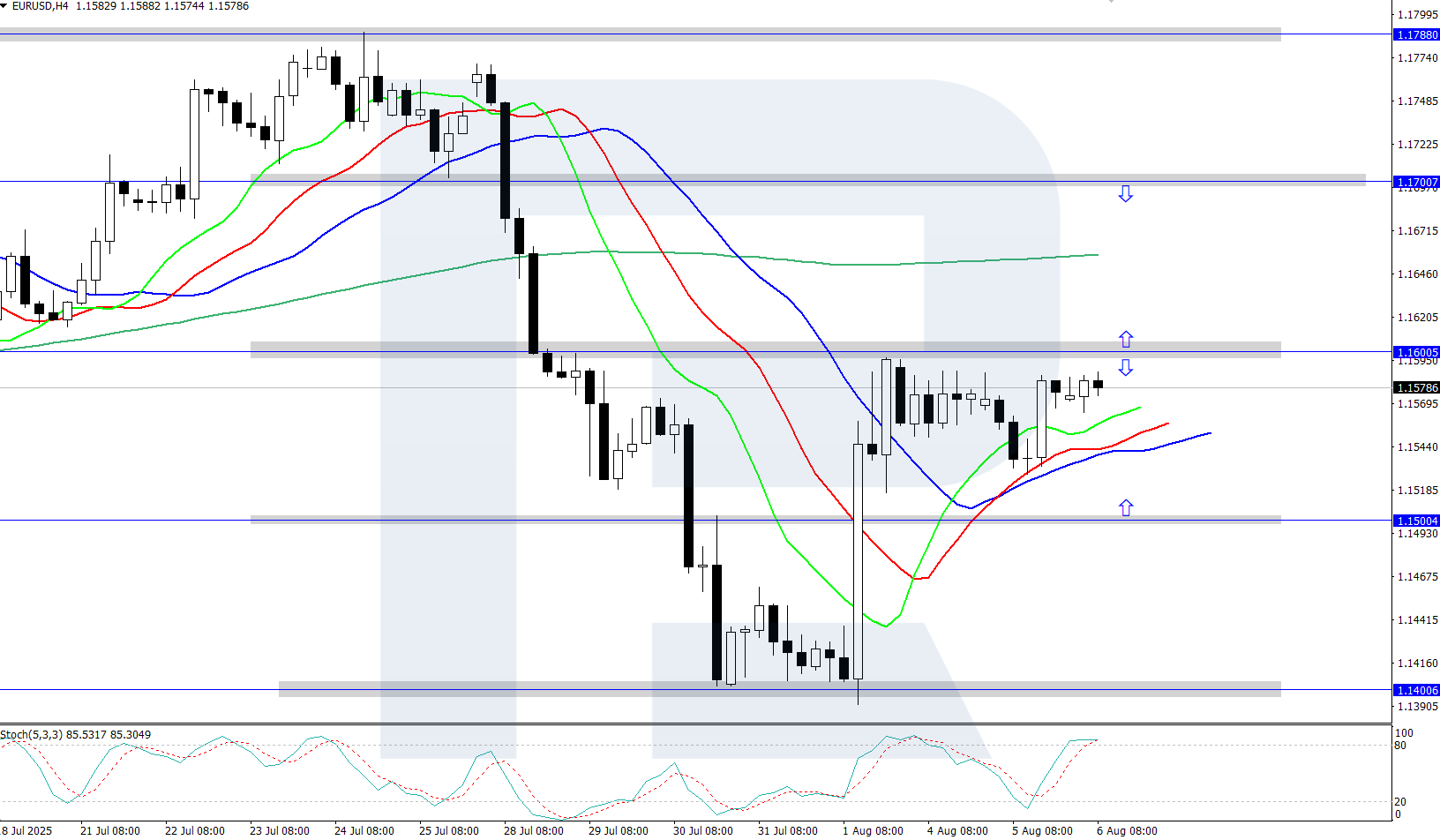

On the H4 chart, the EURUSD pair shows a local upward reversal, rising into the 1.1600 area. A local upward movement is underway, confirmed by a rising Alligator indicator. The pair may continue its upward move.

The short-term EURUSD forecast suggests a rise towards 1.1700 if the bulls push the price above 1.1600. However, if the bears reverse the quotes, the pair may decline towards the support area around 1.1500.

Summary

The EURUSD price rose to the 1.1600 area due to a weaker dollar and moderate growth in producer inflation in the eurozone. Today, the market focus is on eurozone retail sales data.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.