EURUSD takes a breather: news supports the US dollar

The EURUSD pair has paused around 1.1416 as the market continues to favour the US dollar. Discover more in our analysis for 1 August 2025.

EURUSD forecast: key trading points

- The EURUSD pair enters a consolidation phase

- US core PCE data reduced the odds of a Fed rate cut in September

- EURUSD forecast for 1 August 2025: 1.1415

Fundamental analysis

On Friday, the EURUSD rate remains in consolidation near 1.1416. The instrument hovers around local lows following new trade policy statements from Donald Trump. The US President confirmed a baseline global tariff of 10% and announced mirror tariffs of up to 41% against countries without trade agreements with the US.

Additionally, a 40% tariff was introduced on goods believed to have been rerouted through third countries to circumvent existing restrictions. This heightened trade tensions and boosted demand for the US dollar as a safe-haven asset.

Yesterday, the core PCE data – the Fed’s key inflation gauge – showed a 0.3% month-on-month and 2.8% year-on-year increase in June, reducing the likelihood of a rate cut in September.

Investors now remain cautious ahead of the July US employment report, which could serve as an important indicator for the Fed’s future monetary policy decisions.

The EURUSD forecast is moderate.

EURUSD technical analysis

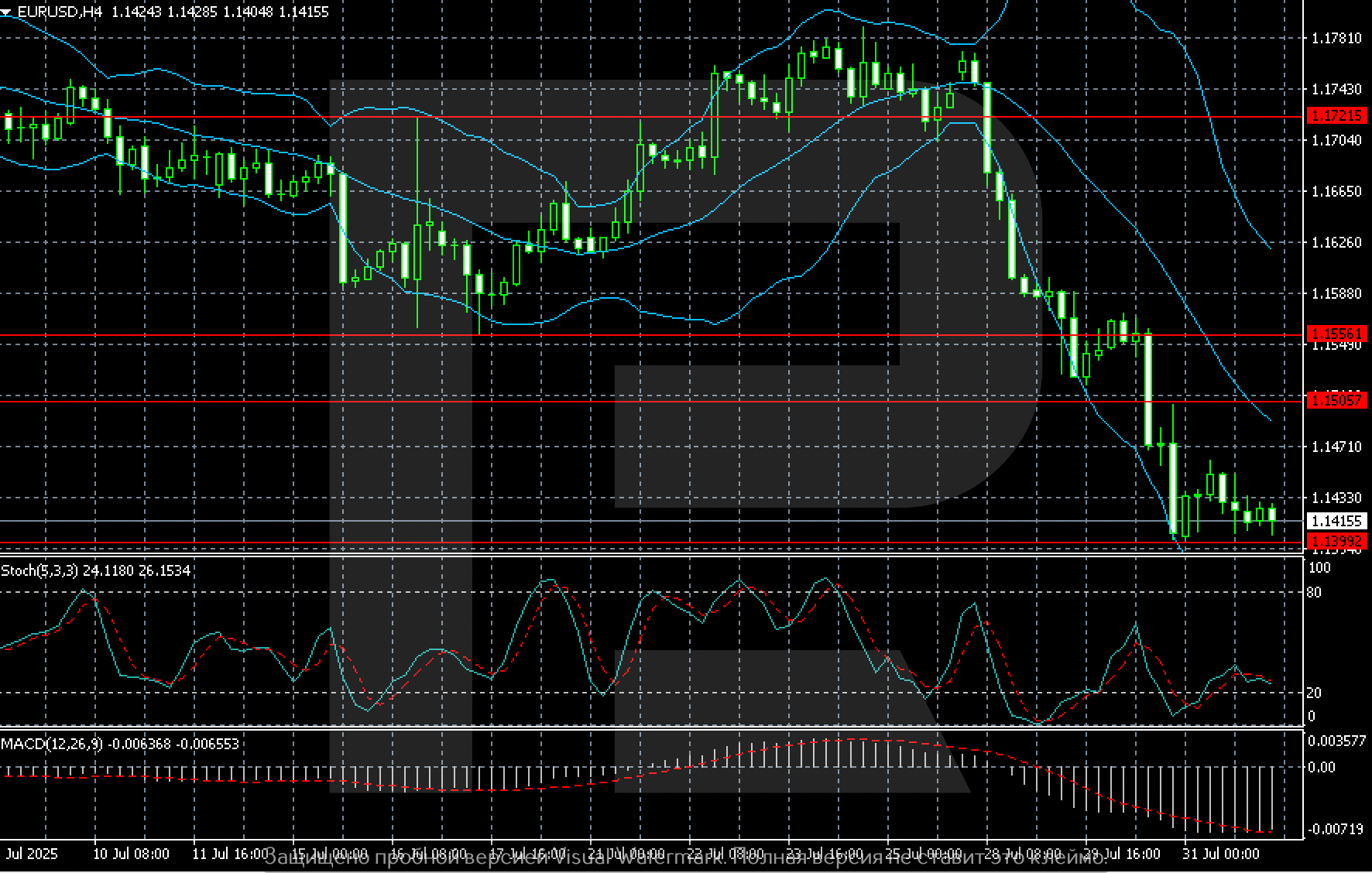

On the H4 chart, the EURUSD pair consolidates near 1.1415, holding the local support level at 1.1399. After breaking below the 1.1550-1.1505 area in late July, the downward move accelerated, with recovery attempts remaining weak.

Formally, the pair stays under pressure, also due to the strength of the US dollar, which gains support from the Fed’s hawkish tone and the White House’s trade rhetoric. Bollinger Bands have narrowed, signalling reduced volatility. MACD remains in negative territory, indicating sustained downward momentum. The Stochastic stays near the oversold zone with no clear reversal signals.

A breakout below 1.1399 would confirm the downtrend, targeting the 1.1350 area. A move back above 1.1505 would be the first sign of a recovery and a potential shift in the short-term trend. For now, the dynamics remain neutral-to-negative.

Summary

After a sharp drop, the EURUSD pair appears to have lost direction for the moment. The EURUSD forecast for today, 1 August 2025, suggested continued consolidation around 1.1415.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.