EURUSD dropped to the 1.1400 area after the Fed decision

The EURUSD rate corrected to the 1.1400 area after the Fed decided to keep rates unchanged and following a slowdown in eurozone GDP growth. Find more details in our analysis for 31 July 2025.

EURUSD forecast: key trading points

- Market focus: the Federal Reserve kept the key interest rate unchanged at 4.5%

- Current trend: downtrend continues

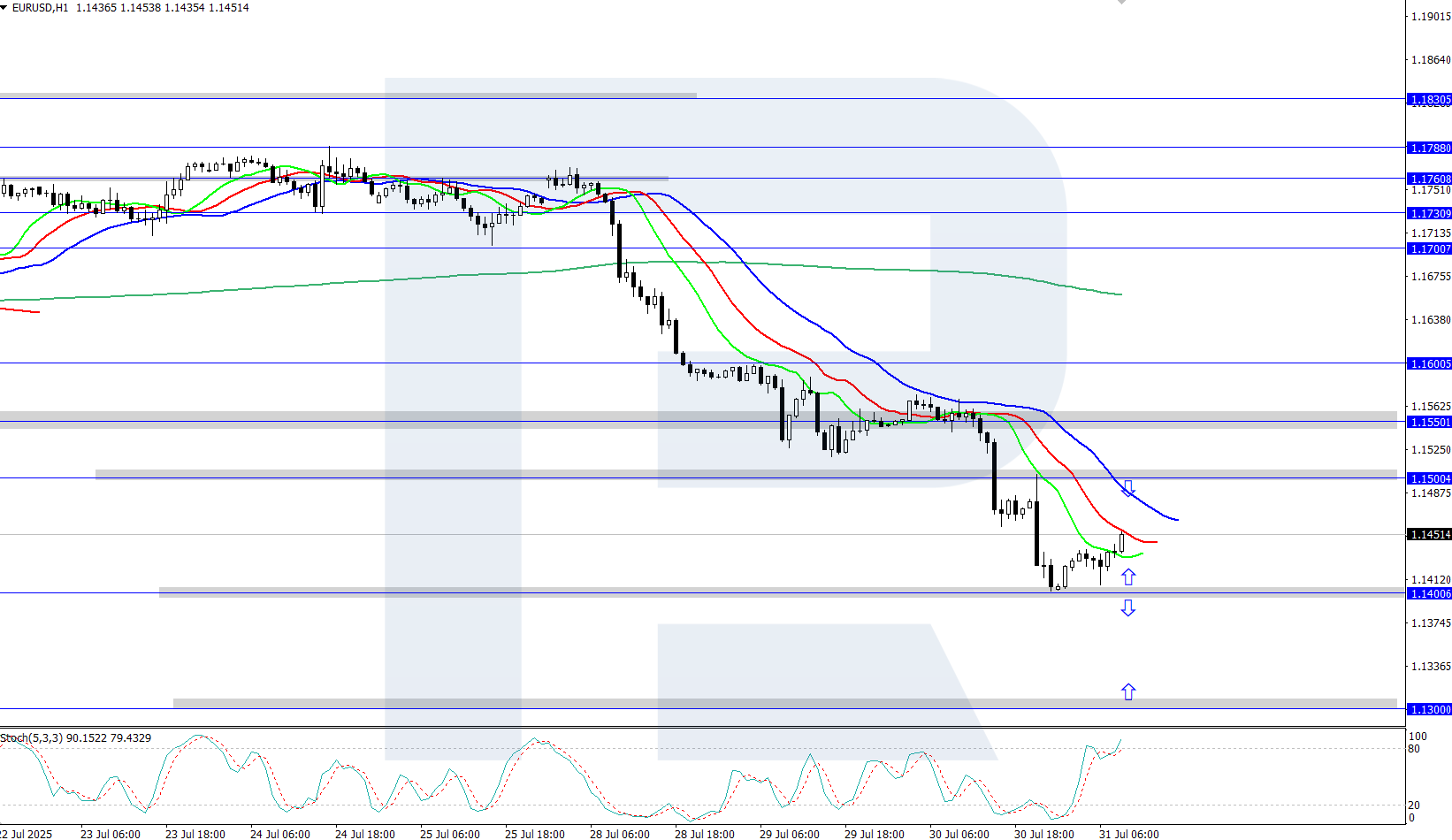

- EURUSD forecast for 31 July 2025: 1.1400 or 1.1500

Fundamental analysis

The euro continued its decline to 1.1400, its lowest level since mid-June, under pressure from a strengthening US dollar. Investors increased their dollar purchases in response to the Federal Reserve's latest monetary policy decision. The Fed left the benchmark interest rate unchanged at 4.5%, as expected.

Federal Reserve Chairman Jerome Powell noted that no decisions have yet been made for September, but markets continue to expect a rate cut. Meanwhile, fresh eurozone GDP figures revealed that the region’s economy grew by only 0.1% in Q2, sharply down from 0.6% in Q1.

EURUSD technical analysis

On the H4 chart, the EURUSD pair is moving downwards, falling to the 1.1400 area. The daily trend remains bearish, although a correction now appears due after the recent drop. After a brief pullback, the decline may resume.

The short-term EURUSD forecast suggests a renewed decline to 1.1400 if the bears keep the price below 1.1500. If the bulls push the pair back above 1.1500, a move higher towards the 1.1550 resistance level may follow.

Summary

The EURUSD price dipped to the 1.1400 area after the Federal Reserve held its rate steady and following weak eurozone GDP growth in Q2. On Friday, markets will focus on US labour market statistics.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.