EURUSD moves higher: EU secures trade deal with the US

The EURUSD pair rose to 1.1756, with the euro supported by positive trade news. Discover more in our analysis for 28 July 2025.

EURUSD forecast: key trading points

- The EURUSD pair gains ground amid the long-awaited US-EU trade deal

- Investors now shift focus to the Federal Reserve meeting and key US economic data

- The Fed interest rate to remain unchanged for now

- EURUSD forecast for 28 July 2025: 1.1789

Fundamental analysis

The EURUSD rate climbed on Monday to 1.1756, driven by euro strength after the weekend's trade agreement between the US and EU.

Under the deal, the US will impose a 15% tariff on most European exports instead of the previously expected 30%. This move significantly reduced transatlantic trade tensions and boosted demand for the euro.

Investors are now turning their attention to what promises to be a key week for US monetary policy and macroeconomic data. The Federal Reserve will hold its meeting on Wednesday. While the market widely expects the interest rate to remain unchanged, investor focus will be on the Fed’s rhetoric and any signals pointing to a potential rate cut in September.

This week will also see the release of the Personal Consumption Expenditures (PCE) report, the Fed’s preferred inflation gauge. It will shed light on how the new tariffs may impact consumer prices.

Additionally, traders will watch a batch of labour market data, including JOLTS, ADP, and the Non-Farm Payrolls (NFP) report.

The EURUSD forecast is positive.

EURUSD technical analysis

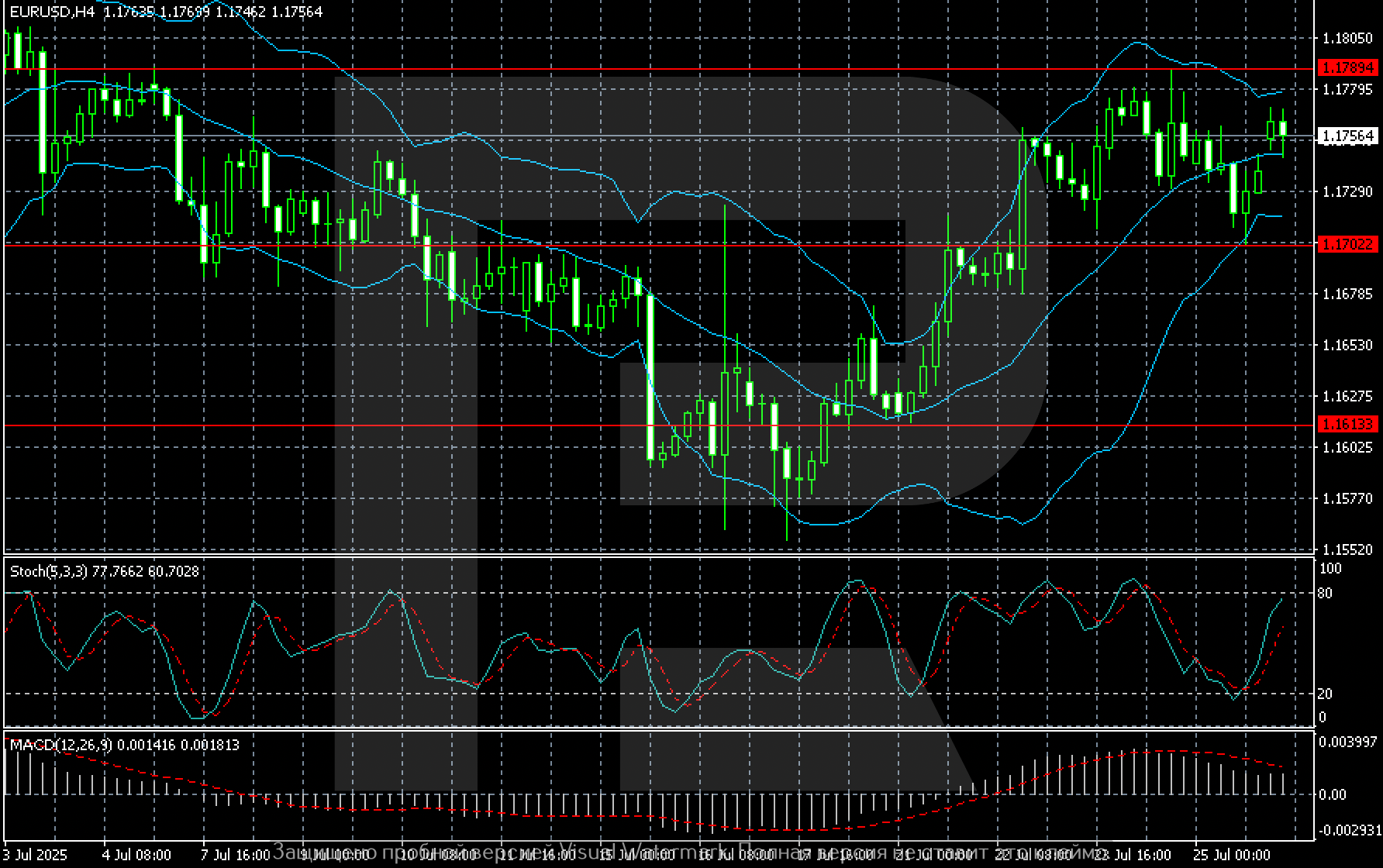

On the H4 chart, the EURUSD pair is hovering within an upward structure near 1.1756, trading confidently above the Bollinger Bands’ midline. This suggests the positive momentum continues after rebounding from the mid-July lows.

The nearest resistance level lies around 1.1789. An upward breakout could drive the pair towards the local high of 1.1835. The support levels are located at 1.1702 and 1.1613, both of which previously acted as reversal points.

Indicators confirm the trend’s strength: the MACD histogram continues to expand positively, signalling growing bullish momentum. Meanwhile, the Stochastic Oscillator has entered the overbought area, rising above 77, which may hint at a slowing impulse or short-term pullback.

Overall, the outlook remains favourable for buyers. However, current levels demand close attention. With key macroeconomic releases ahead, the market may see profit-taking at the highs and possible retracements.

Summary

The EURUSD pair is rising at the start of the new week. The EURUSD forecast for today, 28 July 2025, suggests a push towards 1.1789 and further movement towards 1.1835.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.