EURUSD attempts to rise: markets interested in risk

EURUSD is rising as the market regains interest in risk. The US dollar is reacting to the decline in Treasury yields. Details – in our analysis for 10 July 2025.

EURUSD forecast: key trading points

- The EURUSD pair begins to rise supported by market risk appetite

- Focus is on US trade agreements with partner countries

- EURUSD forecast for 10 July 2025: 1.1780

Fundamental analysis

The EURUSD rate on Thursday holds at 1.1733. Investors are shifting focus to risk assets amid significant growth in stock and commodity markets.

Pressure on the USD was caused by a sharp fall in US Treasury yields. This resulted from high demand at the ten-year bond auction held on Wednesday.

In monetary policy, market attention turned to the publication of the minutes of the last Fed meeting. Most committee members expressed readiness to consider a rate cut later this year.

Now market attention is shifting to possible trade agreements between the US, India, and the EU.

The forecast for EURUSD is positive.

EURUSD technical analysis

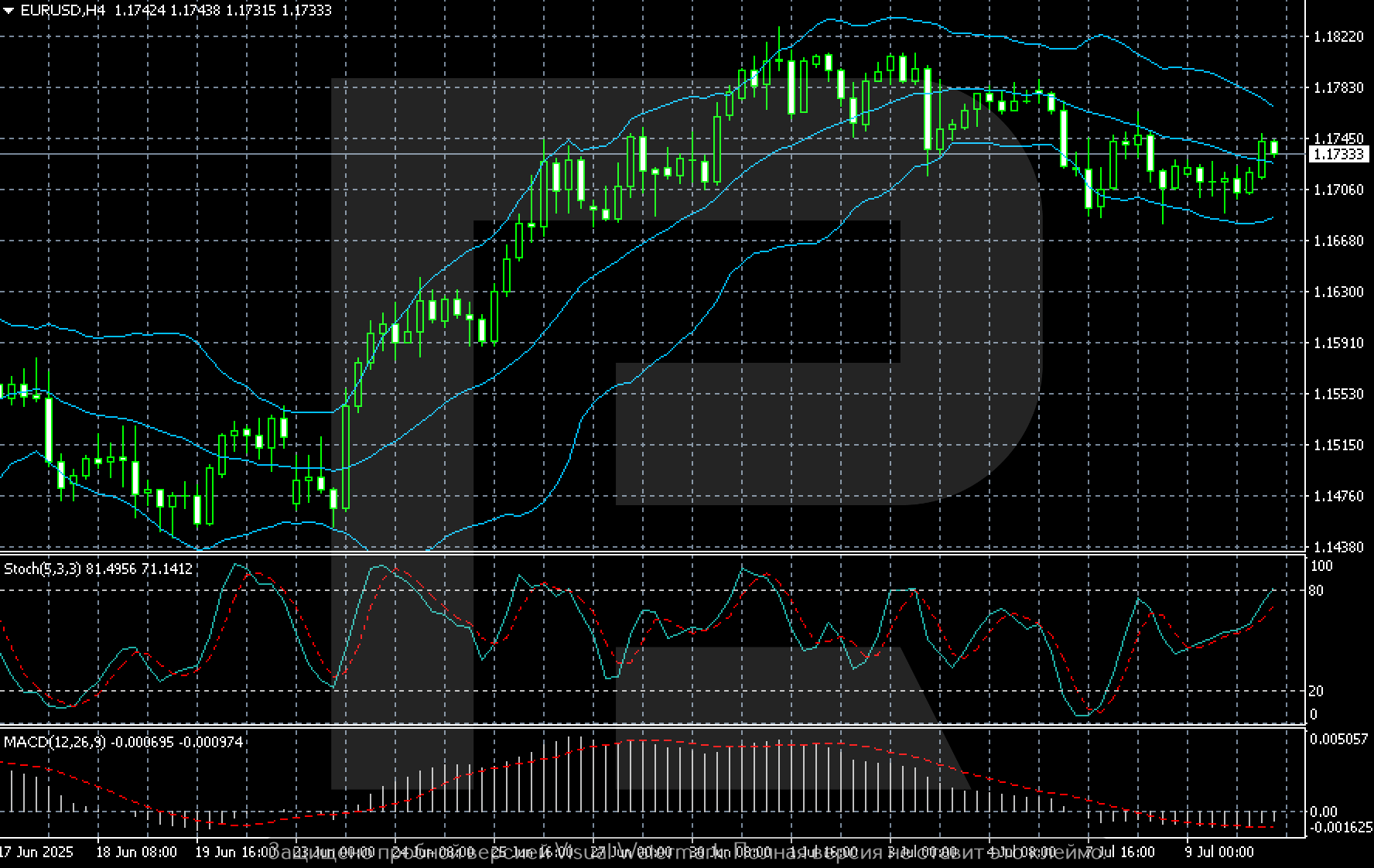

On the H4 chart for EURUSD, there is an attempt at recovery after a local decline following the test of the 1.1733 level. From 20 to 30 June, there was a steady upward trend. After this, the price entered a consolidation phase with a downward correction within the 1.1780–1.1700 range.

Technical indicators confirm the mixed situation. Bollinger Bands indicate movement from the lower boundary towards the middle line, which may suggest recovery within the sideways range. Stochastic has entered the overbought zone, increasing the probability of a correction. The MACD indicator shows a weak impulse.

Key levels remain the resistance zone near 1.1780–1.1820 and support at 1.1700. A breakout of the upper boundary will open the way for further growth, but current signals indicate limited upward potential. If selling resumes, market participants will monitor the reaction at the 1.1700 level.

Summary

The EURUSD pair rises slightly on Thursday, finding support in improved market sentiment. The forecast for EURUSD today, 10 July 2025, does not rule out a buying wave developing towards 1.1780 if a driver emerges.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.