July’s financial intrigue: will EURUSD growth continue

The euro continues to strengthen amid rising economic indicators in the European Union, and EURUSD quotes may test resistance around 1.1855 USD. Details – in our analysis for 1 July 2025.

EURUSD forecast: key trading points

- Eurozone Consumer Price Index (CPI): previous value – 1.9%, forecast – 2.0%

- US Job Openings and Labor Turnover Survey (JOLTS): previous value – 7.391 million, forecast – 7.450 million

- EURUSD forecast for 1 July 2025: 1.1855

Fundamental analysis

The fundamental analysis for 1 July 2025 suggests that the index may rise to 2.0%, up from the previous value of 1.9%. A significant discrepancy between the forecast and actual data could seriously impact the EURUSD exchange rate.

The US Job Openings and Labor Turnover Survey (JOLTS) is an economic indicator reflecting the number of unfilled job positions in the country at the end of the month.

The report is published by the US Bureau of Labor Statistics (BLS) and provides insight into labour demand, economic activity levels, and the balance between employers and job seekers.

JOLTS helps assess labour market dynamics: if there are many vacancies, it indicates economic activity and growing demand for staff; if few, it signals emerging business difficulties and an economic slowdown. Analysts, investors, and government officials consider this data when making decisions.

The forecast for 1 July 2025 suggests that the number of vacancies may increase to 7.450 million. If the actual figure falls short of expectations, it may negatively affect the US dollar.

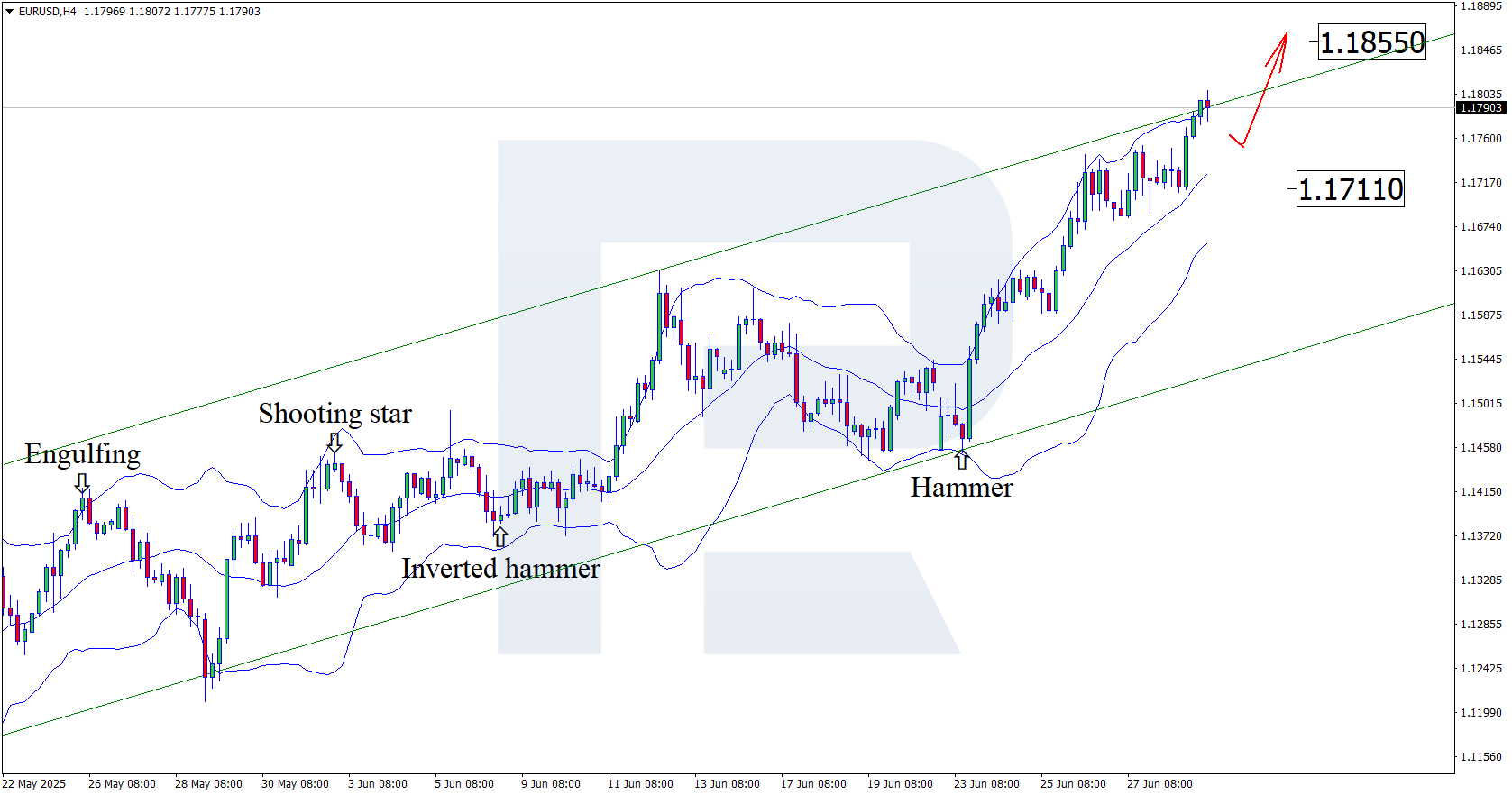

EURUSD technical analysis

On the H4 chart, EURUSD formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, it is forming an upward wave as it works out the signal. Considering that quotes remain within the upward channel, further growth towards the nearest resistance at 1.1855 can be expected. If the resistance level is broken, the upward trend may continue.

However, a correction of the EURUSD rate to 1.1711 should not be ruled out, with strengthening of the upward dynamics following a test of this support.

Summary

The forecast for 1 July 2025 is entirely in favour of the euro. An increase in US job openings, combined with EURUSD technical analysis, suggests a price rise towards the resistance at 1.1855 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.