EURUSD set for further growth: too much pressure on USD

The EURUSD pair on Monday is holding at 1.1719. Demand for the US dollar is declining while risks for it continue to rise. Details – in our analysis for 30 June 2025.

EURUSD forecast: key trading points

- The EURUSD pair starts the week calmly, retaining the possibility of further growth

- The market awaits employment sector statistics from the US and monitors trade policy details

- EURUSD forecast for 30 June 2025: 1.1754

Fundamental analysis

The EURUSD rate at the start of the new week remains stable around 1.1719. Market participants are assessing softer signals from the Fed and worrying about the state of US public finances. Additional pressure on the US dollar comes from uncertainty surrounding trade policy.

Investors await the release of key US labour market data, which could indicate a slowdown in business activity and strengthen expectations of a rate cut as early as July. Previously, Federal Reserve officials cited employment stability as an argument for a pause, but a weak labour market report for June could change their stance. The statistics will be released on Friday.

The market is also watching discussions in the Senate over the tax and budget package, which is estimated to increase US public debt by 3.3 trillion USD. This further complicates market sentiment.

The reduction in global tensions also lowers demand for the dollar as a safe-haven asset: the ceasefire between Israel and Iran remains in place, reducing geopolitical risks.

The forecast for EURUSD is positive.

EURUSD technical analysis

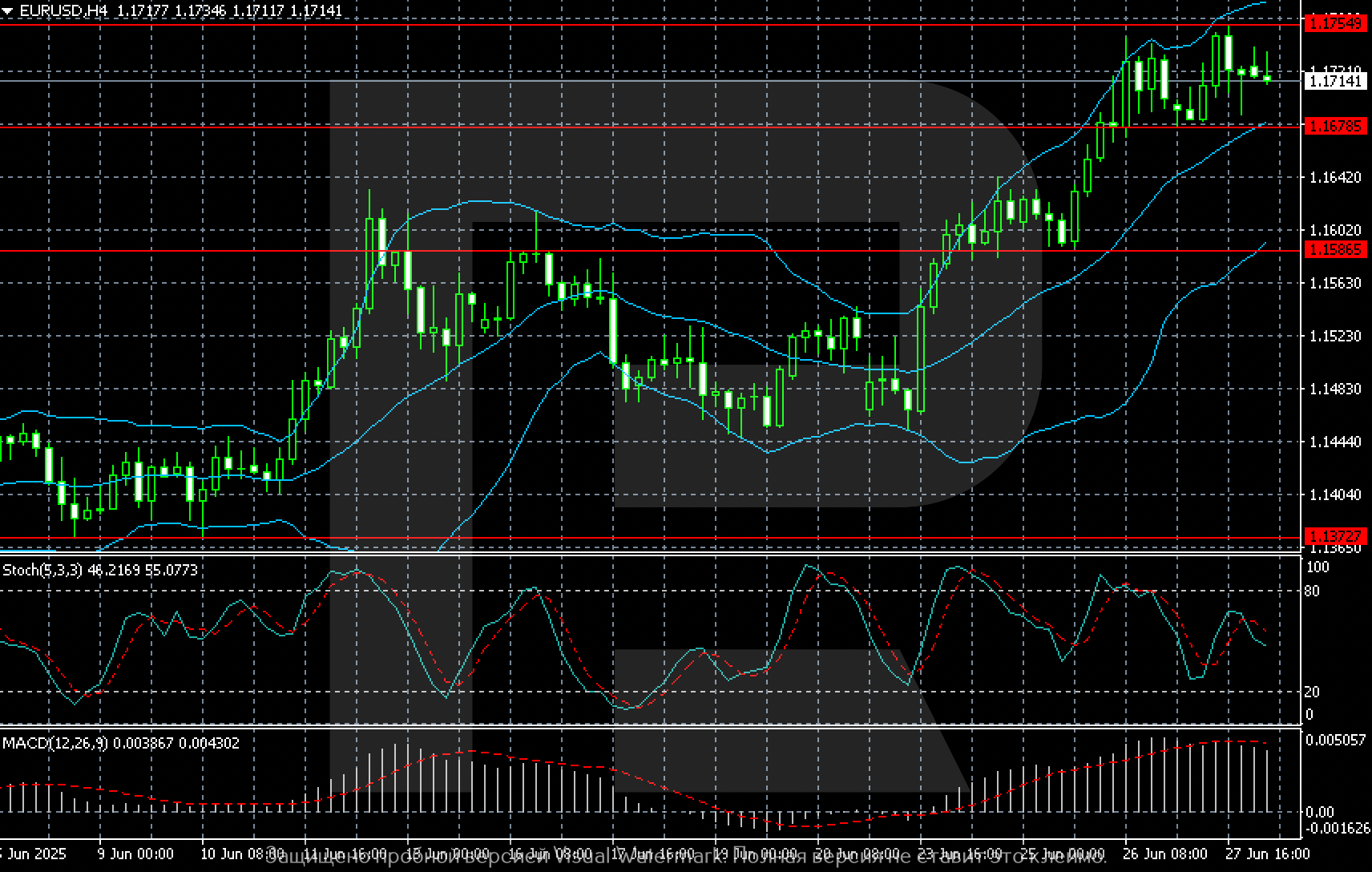

On the H4 chart, EURUSD continues to move in an uptrend visible since early June 2025. After consolidating in the 1.1480–1.1580 range in mid-month, the price confidently broke the key resistance at 1.1586 and consolidated above. The subsequent breakout of the 1.16785 level strengthened the impulse and pushed the pair towards the high of 1.1754, which currently remains the nearest target for the bulls.

At present, conditions are forming for a sideways movement within the boundaries of 1.16785–1.17549. A breakout upwards will drive the price to new highs, while a breakout downwards will see it retreat to 1.15865.

Volatility is above average, with overall sentiment remaining bullish.

Summary

The EURUSD pair is starting the week calmly but retains its bullish outlook. The forecast for EURUSD today, 30 June 2025, expects the development of an upward wave towards 1.1754.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.