EURUSD falls below 1.1500 after Fed decision

The EURUSD rate dropped to the 1.1450 area following the Fed’s decision to keep interest rates unchanged and accompanying remarks from Jerome Powell. Find more details in our analysis for 19 June 2025.

EURUSD forecast: key trading points

- Market focus: the Fed left the rate unchanged at 4.5%

- Current trend: correcting downwards

- EURUSD forecast for 19 June 2025: 1.1400 and 1.1500

Fundamental analysis

Following yesterday’s meeting, the Federal Reserve kept interest rates unchanged and reiterated its cautious stance. Federal Reserve Chairman Jerome Powell signalled that inflation could rise in the coming months, citing the negative effects of President Donald Trump’s new tariffs.

The US central bank also lowered its GDP growth forecasts and hinted at two possible rate cuts of 25 basis points each before the end of 2025. The first cut is expected in September.

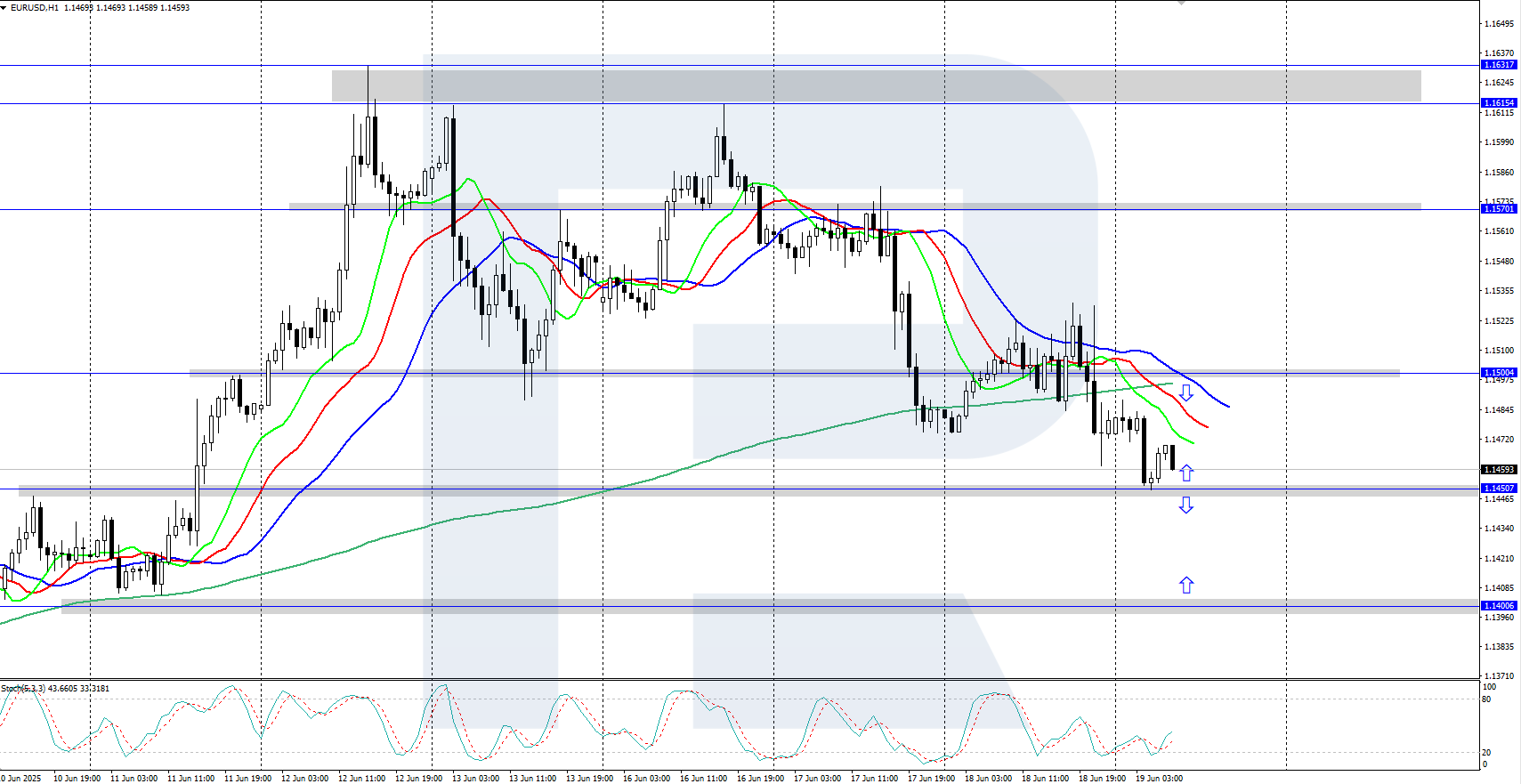

EURUSD technical analysis

On the H4 chart, the EURUSD pair is undergoing a downward correction, falling towards the support area near 1.1450. Bulls are now attempting to regain control and reverse the decline. The daily trend remains upward, with growth likely to continue after this correction.

The short-term EURUSD price forecast suggests that the pair could return to 1.1500 and higher if bulls hold the price above 1.1450. However, if bears push quotes below 1.1450, the downward correction may extend towards the 1.1400 support level.

Summary

The EURUSD pair dropped to the 1.1450 support level after the Fed decided to hold rates steady at 4.5%. In related comments, the central bank signalled the possibility of two 25-basis-point rate cuts by the end of 2025.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.