EURUSD holds near yearly high as market awaits Fed decision

The EURUSD rate is confidently hovering around its yearly peak at 1.1632, with the market awaiting economic data from the eurozone and the Federal Reserve’s rate decision. Discover more in our analysis for 17 June 2025.

EURUSD forecast: key trading points

- Market focus: wages in the eurozone rose by 3.4% year-on-year in Q1 2025

- Current trend: upward momentum persists

- EURUSD forecast for 17 June 2025: 1.1500 and 1.1632

Fundamental analysis

The EURUSD pair holds steady near its yearly highs. Today, investors will closely watch the release of the ZEW economic sentiment indices for both the eurozone and Germany for June, which may provide insights into the region’s growth prospects.

Tomorrow, the Federal Reserve is set to announce its interest rate decision. The market expects rates to remain unchanged, with the spotlight on any guidance regarding the timing and extent of future rate cuts. Currently, traders anticipate the Fed may resume monetary easing in September.

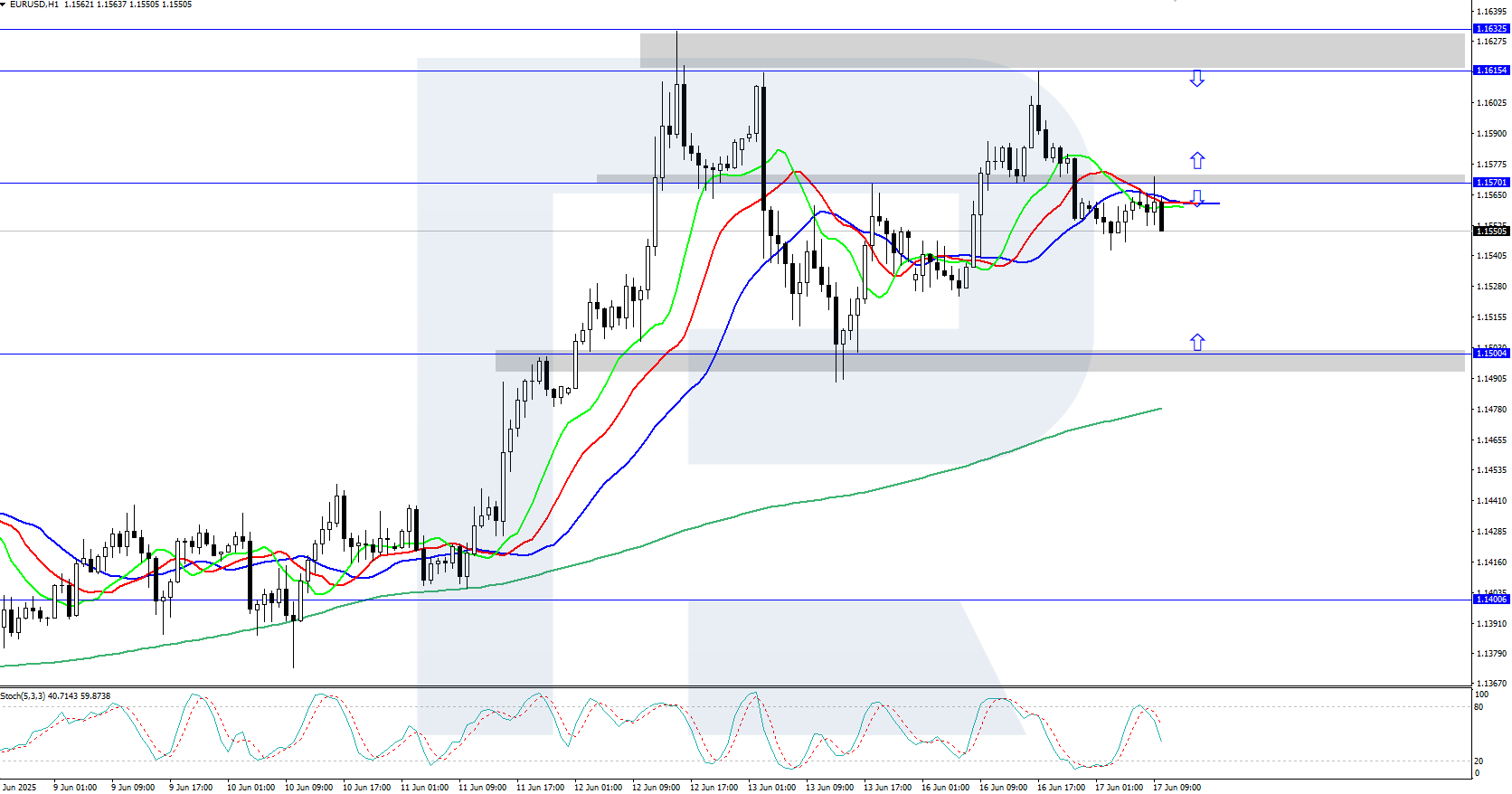

EURUSD technical analysis

On the H4 chart, the EURUSD pair is consolidating within a narrow range, with the support level at 1.1500 and resistance at the yearly high of 1.1632. The daily trend remains bullish, making an upward breakout more likely.

The short-term EURUSD forecast suggests growth to the yearly high of 1.1632 if bulls hold the price above 1.1500. However, if bears push the pair below 1.1500, a downward correction towards the 1.1400 support level may follow.

Summary

The EURUSD pair is consolidating within a narrow price range near its yearly high at 1.1632. Today, the market focuses on the ZEW sentiment data from Germany and the eurozone.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.