EURUSD trades sideways as markets await news from London

The EURUSD pair holds steady around 1.1402, with markets closely watching the ongoing US-China trade negotiations. Find out more in our analysis for 10 June 2025.

EURUSD forecast: key trading points

- The EURUSD pair moves within a narrow range, while the market awaits news on trade talks

- Without a deal between the US and China, the US dollar may come under renewed pressure

- EURUSD forecast for 10 June 2025: 1.1458

Fundamental analysis

The EURUSD rate is hovering around 1.1402 on Tuesday as investor attention centres on the ongoing US-China trade negotiations in London. On Monday, US Treasury Secretary Scott Bessent and other senior officials met with their Chinese counterparts to discuss rare earth supplies and potential easing of export restrictions. The talks are expected to continue today.

The market is pricing in a potential ceasefire in the trade war between the world's two largest economies. Such hopes have supported the US dollar, which has remained under pressure this year due to President Donald Trump’s trade policies. The White House’s actions have dampened investor confidence in US assets.

Market participants are closely watching the upcoming CPI and PPI reports later this week. These indicators will provide more insight into inflation trends and the economic fallout from the prolonged trade conflict.

The EURUSD forecast is neutral.

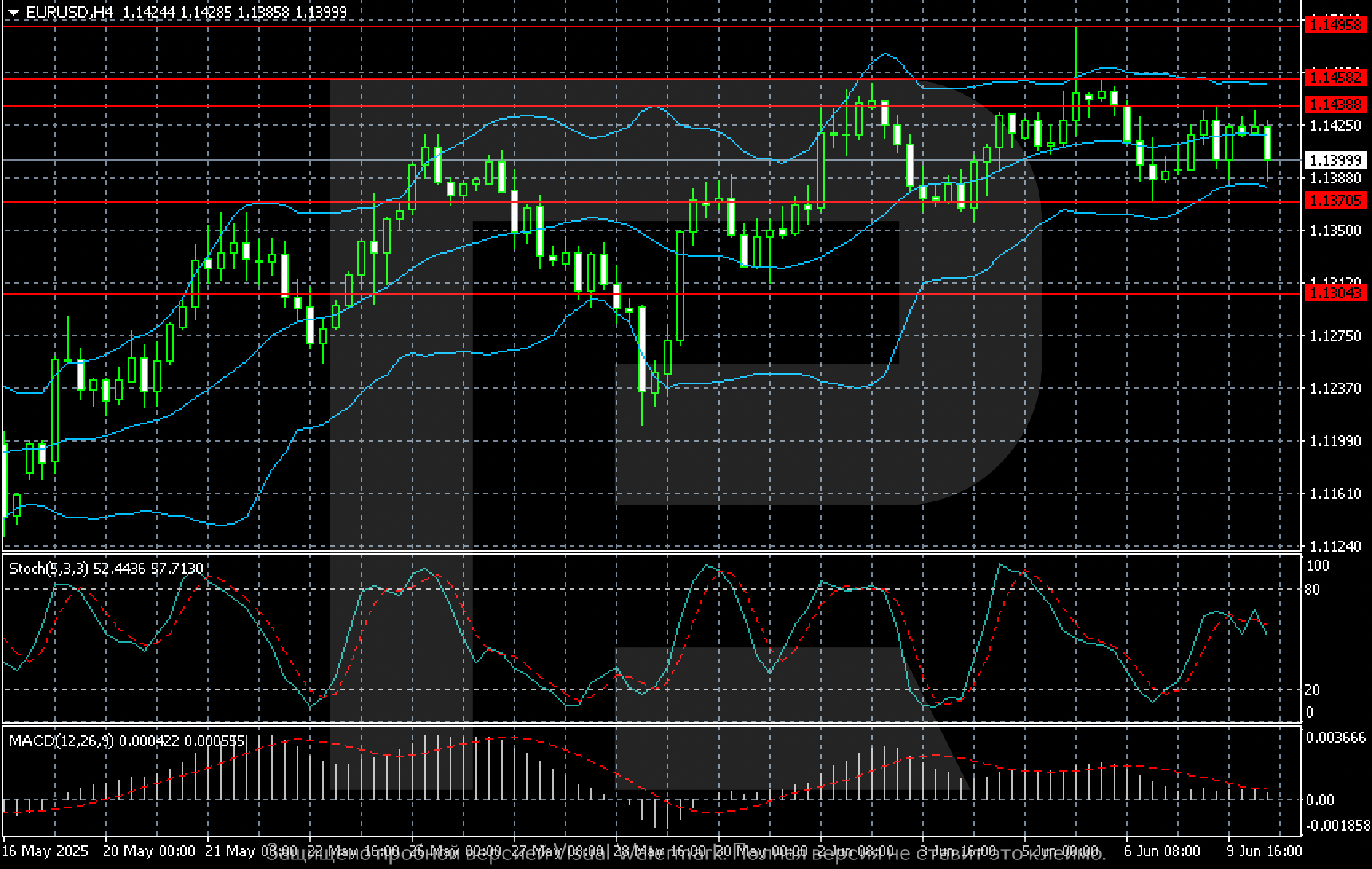

EURUSD technical analysis

On the H4 chart, the EURUSD pair has established a range between 1.1370 and 1.1438. A breakout above the upper boundary would open the path towards 1.1458. Conversely, if pressure drives the pair below the lower boundary, focus may shift to a move towards 1.1303.

Summary

The EURUSD pair is consolidating and saving its strength on Tuesday in anticipation of news from the US-China trade talks. The EURUSD forecast for today, 10 June 2025, suggests the pair may continue to trade within the 1.1370–1.1438 range until new drivers emerge.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.