EURUSD halts correction: key data ahead

The EURUSD pair is hovering around 1.1369 on Wednesday as markets await US labour market data. Find more details in our analysis for 4 June 2025.

EURUSD forecast: key trading points

- The EURUSD pair halted its decline on Wednesday, holding near 1.1369

- Investors await the US employment reports for May

- Preliminary figures suggest potential for employment growth in the US economy

- EURUSD forecast for 4 June 2025: 1.1455

Fundamental analysis

The EURUSD rate is trading around 1.1369 midweek as traders brace for a batch of US labour market reports that could influence the Federal Reserve's policy direction.

All eyes are on Wednesday’s ADP private sector employment data, Thursday’s weekly jobless claims, and Friday’s key nonfarm payrolls report for May.

On Tuesday, the JOLTS data showed an unexpected increase in job openings to 7.39 million in April from a revised 7.20 million in March, well above the forecast of 7.10 million. These figures highlight the continued resilience of the US labour market.

While Federal Reserve officials generally support holding interest rates steady, citing trade policy uncertainty, they remain under political pressure from President Donald Trump, who continues to push for monetary easing.

The EURUSD forecast is neutral.

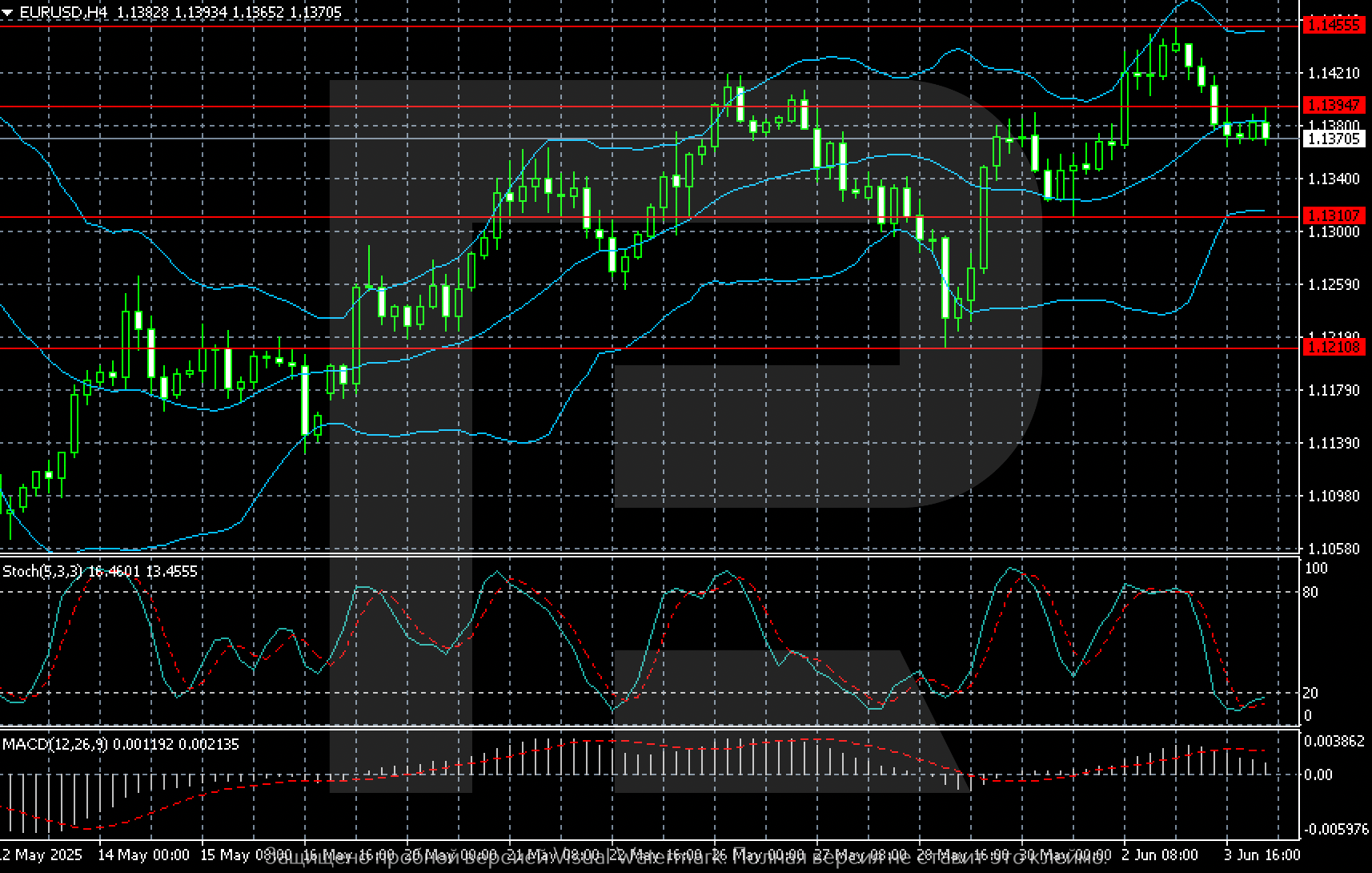

EURUSD technical analysis

On the H4 chart, the EURUSD pair is hovering around the key support level of 1.1370. If this level does not break, buyers could return with a target at 1.1455 and then 1.1500.

Summary

After a recent peak, the EURUSD pair declined, awaiting a catalyst from US labour market data. The EURUSD forecast for today, 4 June 2025, suggests a possible retest of the 1.1455 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.