Eurozone CPI drops – EURUSD braces for turbulence

A fall in the eurozone CPI may support the US dollar and push the EURUSD pair lower towards 1.1370. Discover more in our analysis for 3 June 2025.

EURUSD forecast: key trading points

- Eurozone Consumer Price Index (CPI): previously at 2.2%, projected at 2.0%

- US Job Openings and Labor Turnover Survey (JOLTS): previously at 7.192 million, projected at 7.110 million

- EURUSD forecast for 3 June 2025: 1.1370 and 1.1500

Fundamental analysis

The eurozone CPI tracks changes in consumer prices of goods and services, offering insight into consumer trends and the extent of economic stagnation. A higher-than-expected reading would support the euro.

Fundamental forecast for 3 June 2025 anticipates a drop in CPI to 2.0%, down from 2.2%. A wider gap between actual and forecast values could significantly impact the EURUSD rate.

The US JOLTS report – published by the Bureau of Labor Statistics – reveals how many jobs remain unfilled at the end of the month. It reflects labour demand, broader economic activity, and the balance between employers and job seekers.

A high number indicates robust business demand for personnel; a lower figure could suggest emerging challenges in the economy.

The JOLTS report helps assess the labour market dynamics. A high number indicates economic activity and increasing demand for personnel, while a lower figure points to emerging difficulties in business and an economic slowdown. This data is taken into account by analysts, investors, and the government in the decision-making process.

The forecast for 3 June 2025 suggests job openings may fall to 7.110 million. A weaker-than-expected actual figure may weigh on the US dollar.

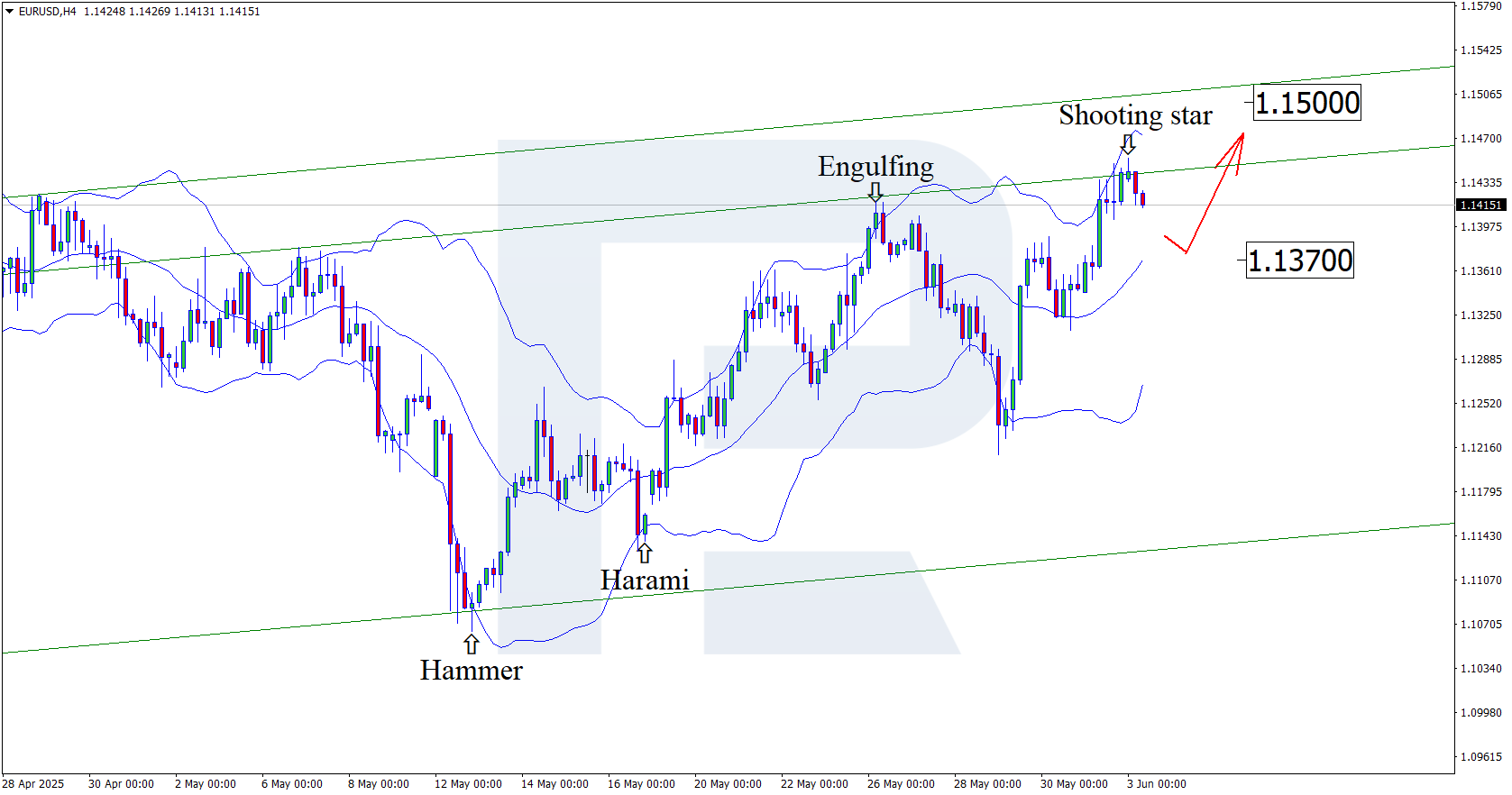

EURUSD technical analysis

On the H4 chart, the EURUSD pair has formed a Shooting Star reversal pattern near the upper Bollinger Band. It is currently forming a downward wave, following through on this signal. Since the price remains within an ascending channel, the pair could correct towards the nearest support level at 1.1370. A rebound from this level could pave the way for a continuation of the uptrend.

However, an alternative scenario is possible, where the EURUSD pair could climb to 1.1500 and gain upward momentum without testing the support level.

Summary

Today’s outlook for EURUSD appears favourable for the US dollar. The anticipated drop in the eurozone CPI, alongside EURUSD technical analysis, points to a possible correction towards the 1.1370 support level before growth.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.