EURUSD extends rally as US tax debate unsettles markets

The EURUSD pair remains near a five-week high around 1.1400. Investors await the outcome of Senate debates on US tax policy. Find more details in our analysis for 27 May 2025.

EURUSD forecast: key trading points

- The EURUSD pair has risen to 1.1400 and holds strong as pressure on the US dollar mounts

- Ongoing Senate debates over Trump’s tax-cut program could push the dollar even lower

- EURUSD forecast for 27 May 2025: 1.1424

Fundamental analysis

The EURUSD rate climbed to 1.1400 on Tuesday, approaching its highest level in five weeks. Market fears about US fiscal policy continue to weigh on the US dollar.

Investors are closely watching the upcoming Senate debate on President Donald Trump’s sweeping tax and budget cuts. These measures are expected to substantially increase the national debt. According to the Congressional Budget Office, the proposed reforms could add about 3.8 trillion USD to the federal debt, which already stands at 36.2 trillion USD, and this could unfold within the next decade.

Trump’s earlier decision to delay the 50% tariff on EU imports until 9 July has added further pressure on the US dollar.

Today, traders await key US economic data and comments from Federal Reserve officials Neel Kashkari and John Williams.

The EURUSD forecast is favourable.

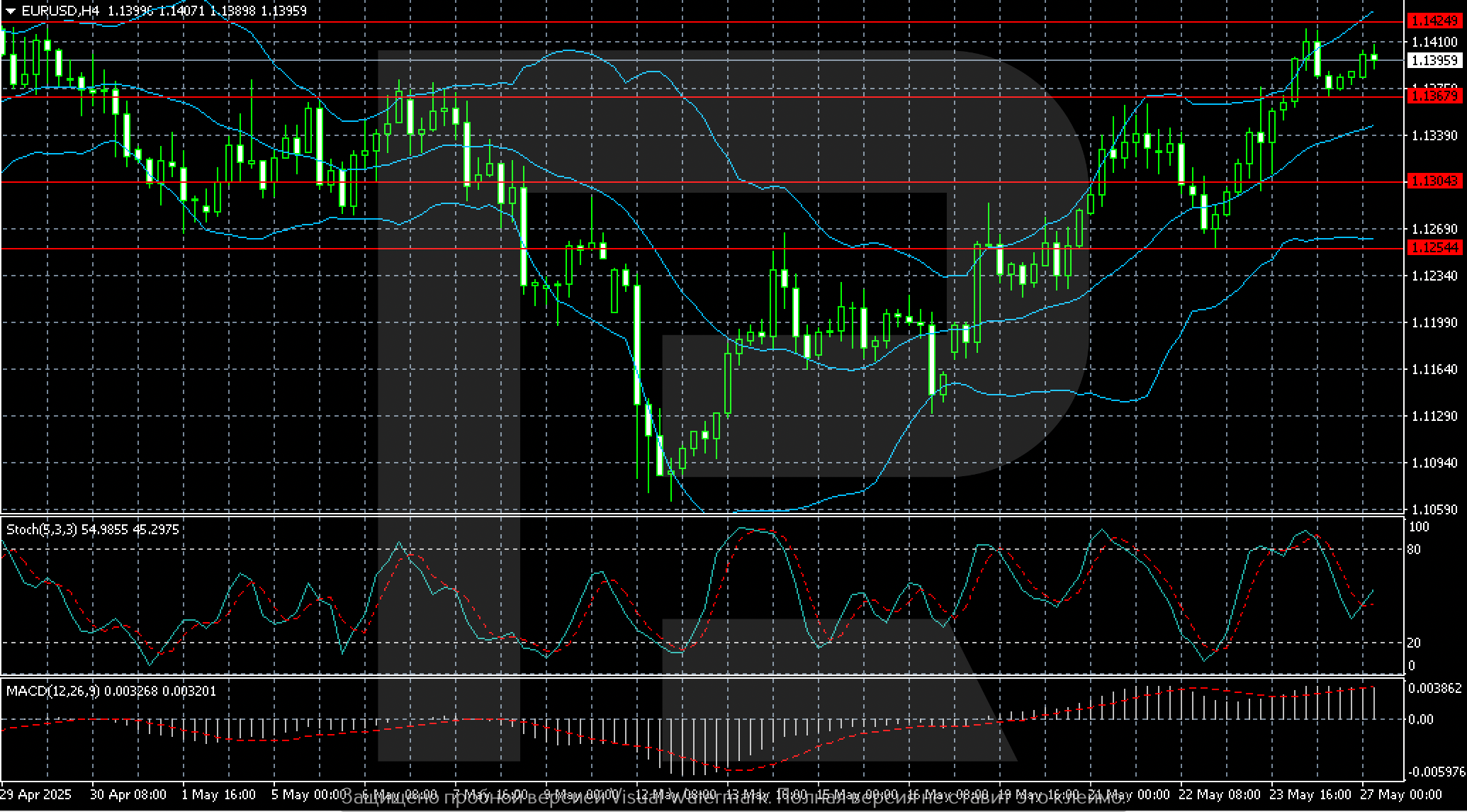

EURUSD technical analysis

On the H4 chart, the EURUSD pair is setting up for a potential continuation of its upward move through 1.1400 towards the previous local high at 1.1424.

If bullish momentum fades, the pair could return to a consolidation phase within the 1.1360-1.1385 range.

Summary

The EURUSD pair remains at five-week highs, supported by concerns over US fiscal policy and uncertainty surrounding tax reforms. The EURUSD forecast for today, 27 May 2025, expects the growth wave to continue 1.1424.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.