EURUSD rises as Trump delays tariffs – investors flee US dollar

The EURUSD rate strengthens as the US postpones a 50% tariff hike on the EU, with the price currently at 1.1405. Find out more in our analysis for 26 May 2025.

EURUSD forecast: key trading points

- The US dollar remains under pressure amid ongoing trade policy uncertainty

- US President Donald Trump postponed 50% tariffs on the EU

- US new home sales rose by 10.9% in April

- EURUSD forecast for 26 May 2025: 1.1255 and 1.1360

Fundamental analysis

The EURUSD rate shows strong upward momentum, having broken above the 1.1375 resistance level, indicating the dominance of buyers. The US dollar weakened following President Donald Trump’s announcement to postpone the planned 50% tariffs on the European Union until 9 July. This decision came after a phone call with European Commission President Ursula von der Leyen, who described the discussion as constructive, while acknowledging that a full agreement will require more time.

Meanwhile, recent data showed US new home sales jumped by 10.9% in April, reaching an annualised pace of 743 thousand. Analysts had expected a drop to 692 thousand. Despite this positive surprise, the US dollar remains under pressure due to heightened uncertainty around Trump’s erratic trade policy, which continues to diminish the appeal of dollar-based assets.

EURUSD technical analysis

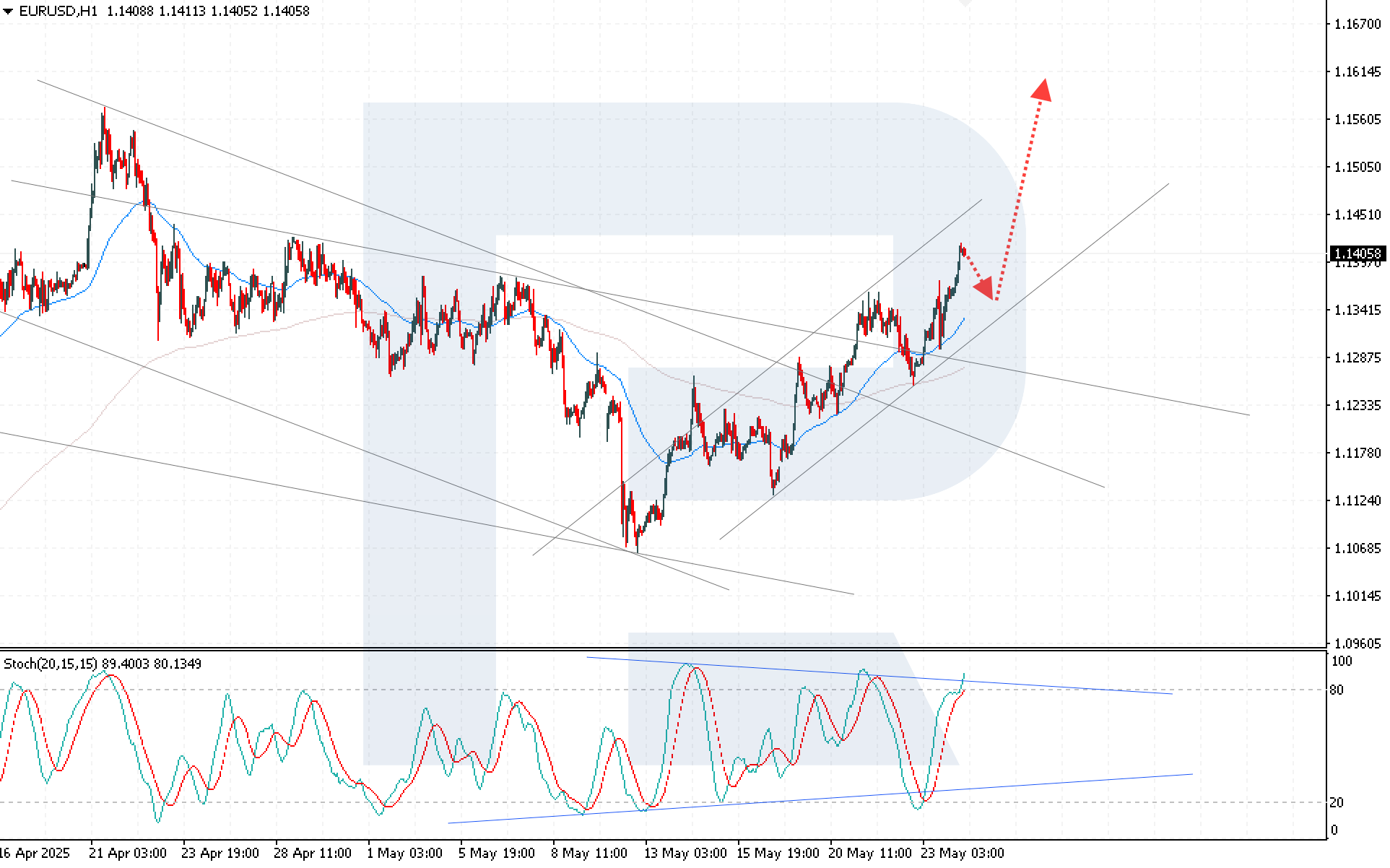

The EURUSD rate is rallying within an ascending channel, with bulls confidently breaking above the key resistance level at 1.1365. Today’s EURUSD forecast expects continued upward movement with a target at 1.1615.

Despite the strong bullish momentum confirmed by Moving Averages, a short-term bearish correction remains possible before the trend resumes. The Stochastic Oscillator is testing a resistance line, indicating that the price could decline towards 1.1365, where it will find strong support.

Summary

The EURUSD rate is rising amid US dollar weakness, driven by delayed tariffs on the EU and persistent trade uncertainty. EURUSD technical analysis suggests a continuation of the uptrend, with a potential short-term correction towards 1.1365 before further growth to 1.1615.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.