AUDUSD loses ground ahead of the regulator’s minutes release

The AUDUSD rate has resumed its decline amid investor uncertainty over the RBA’s next policy steps. The current quote is 0.6604. Details — in our analysis for 19 December 2025.

AUDUSD forecast: key takeaways

- The Australian dollar remains under pressure ahead of the release of the RBA’s December meeting minutes

- The market is looking for signals on the future direction of monetary policy

- AUDUSD forecast for 19 December 2025: 0.6515

Fundamental analysis

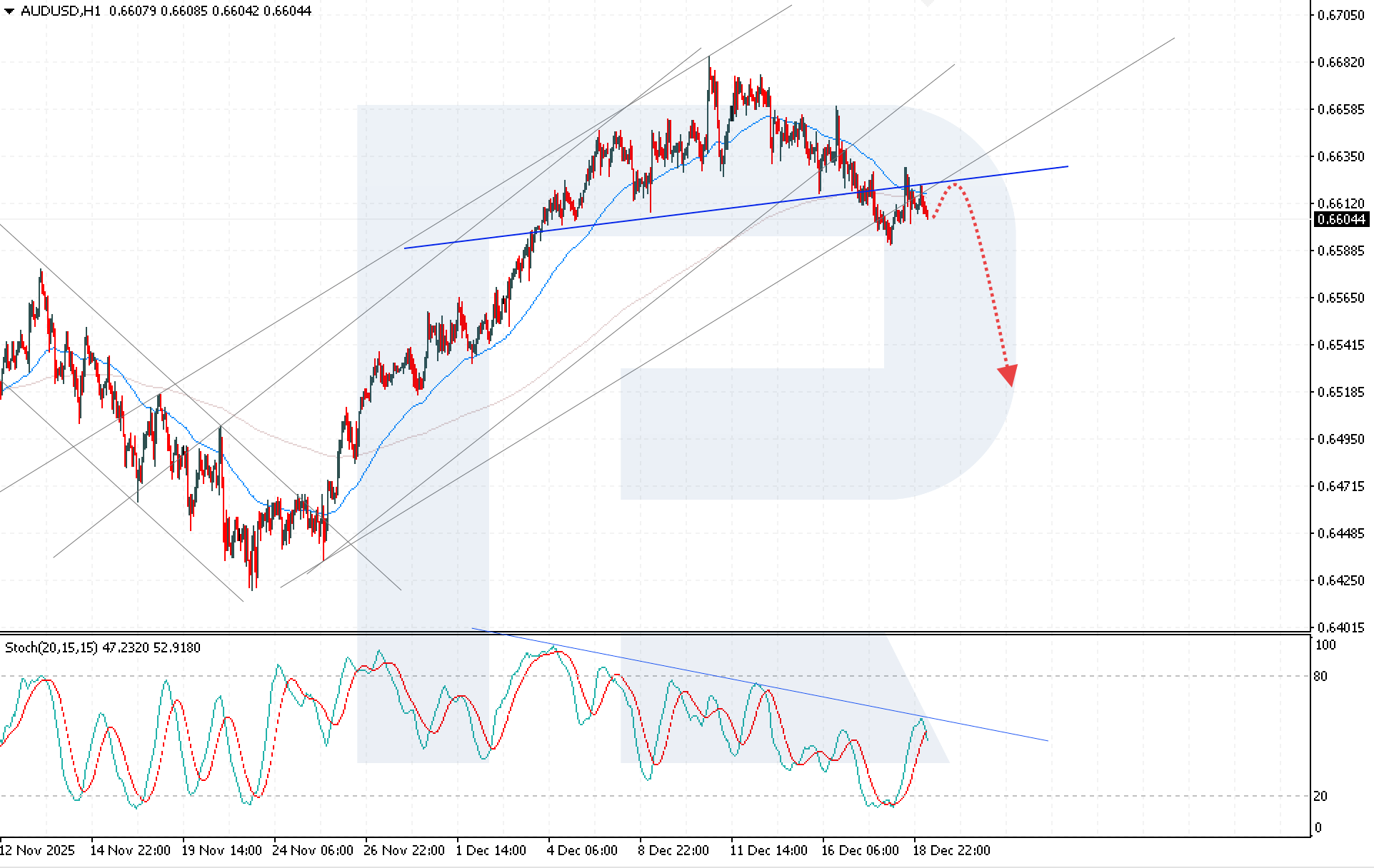

The AUDUSD rate resumed its decline after yesterday’s corrective rebound. The currency pair is moving lower as part of the implementation of a Head and Shoulders reversal pattern, with the nearest downside target located in the 0.6530 area.

The Australian dollar remains under pressure ahead of the publication of the minutes from the Reserve Bank of Australia’s December meeting. Market participants are hoping to obtain clearer signals regarding the future outlook for monetary policy. The document, due to be released next week, is expected to reveal the nature of the board’s discussions on the possibility of policy tightening, as well as the regulator’s level of concern about inflation risks.

Investor assessments remain divided. Some analysts allow for a rate hike as early as February, while others consider it more likely that current policy settings will be maintained unless short-term inflation data force the RBA to act sooner.

AUDUSD technical analysis

AUDUSD quotes have consolidated below the lower boundary of the bullish channel. Sellers have also confidently broken below the EMA-65 from above, indicating strengthening bearish pressure.

The AUDUSD forecast for today suggests a continuation of the decline toward the 0.6515 level. An additional signal in favor of further downside is generated by the Stochastic Oscillator: its signal lines have rebounded from the descending resistance line and formed a bearish crossover.

A sustained move below the 0.6585 level will confirm the realization of the bearish scenario.

Summary

The AUDUSD forecast for today indicates that the combination of an active Head and Shoulders reversal pattern and uncertainty surrounding the RBA’s next policy steps continues to pressure the currency pair and supports downside risks toward the 0.6515 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.