AUDUSD hits a five-week high: this is not the limit yet

The AUDUSD pair strengthened to 0.6624. Strong domestic data and upbeat projections are supporting the AUD. Discover more in our analysis for 5 December 2025.

AUDUSD forecast: key trading points

- Market focus: the AUDUSD pair is moving higher on positive Australian statistics

- Current trend: the market believes the RBA’s rate-cutting cycle is over

- AUDUSD forecast for 5 December 2025: 0.6630

Fundamental analysis

The AUDUSD rate climbed to a five-week high on Friday after unexpectedly strong domestic spending data pushed bond yields higher. At the same time, soft US labour market figures reduced pressure from the US dollar.

Household spending in Australia rose 1.3% in October, marking the strongest pace since early 2024 and providing a powerful start to the new quarter.

Markets quickly reassessed the monetary policy outlook. The probability that the RBA’s next rate move will be a hike has risen to 50%, with some traders even pricing in a possible increase as early as May.

The Reserve Bank of Australia meets next week. Consensus expectations are that the RBA will leave the cash rate at 3.60% after three consecutive cuts. However, there is a growing view that the easing cycle is over and the next step could be towards tightening.

RBA Governor Michele Bullock said this week that inflation should resume weakening after its recent spike, but she also noted that the economy is operating at full capacity. This strengthened expectations of a more hawkish shift in the RBA’s rhetoric.

The AUDUSD outlook is optimistic.

AUDUSD technical analysis

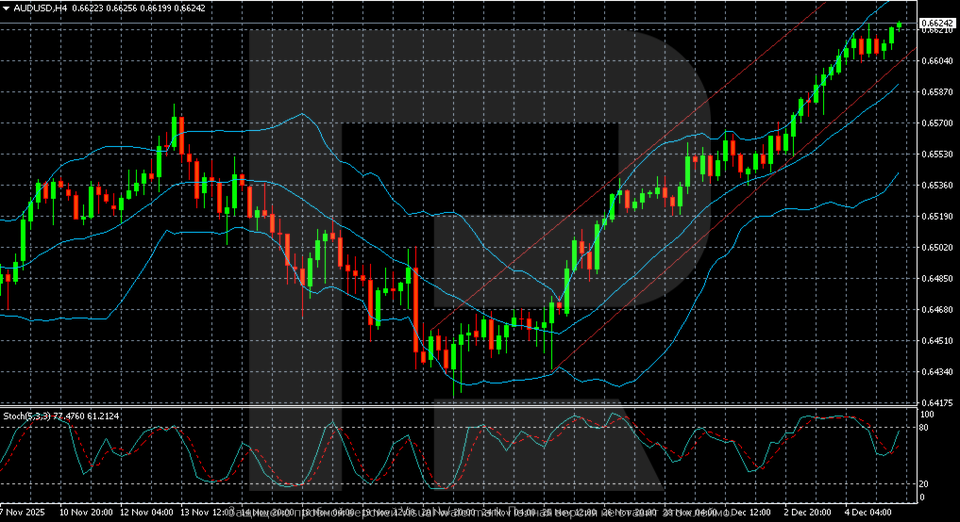

On the H4 chart, the AUDUSD pair shows a steady upward move within an ascending channel. The price is confidently holding in the upper half of the channel, reflecting strong bullish momentum. The structure is supported by the fact that the pair remains above the middle Bollinger Band, while the bands themselves are expanding, indicating rising volatility and trend acceleration.

The price is now trading near local highs around 0.6624, with the upper Bollinger Band pushing the movement higher. However, the Stochastic Oscillator is in or near overbought territory, signalling the possibility of a short-term pullback.

The nearest support level runs along the channel’s midline near 0.6570–0.6580. Its defence would keep the bullish scenario intact. Deeper support lies at the lower boundary of the channel near 0.6510–0.6520, an area the price may test if a correction expands.

To extend the rally, buyers need to gain a foothold above 0.6630, which would open the way towards new targets in the 0.6650–0.6680 range. A breakout below 0.6570 would be the first sign of weakening bullish momentum and a potential exit from the channel.

Summary

The AUDUSD pair is extending its upward movement and appears confident. The AUDUSD forecast for today, 5 December 2025, suggests a rise to 0.6630 and beyond.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisThis article offers a Gold (XAUUSD) price forecast for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.