AUDUSD climbed above 0.6500

The AUDUSD rate is moderately rising, having consolidated above the 0.6500 level. The Reserve Bank of Australia does not plan to cut rates in the near term. Discover more in our analysis for 28 November 2025.

AUDUSD forecast: key trading points

- Market focus: private sector credit in Australia rose by 0.7% month-on-month in October

- Current trend: upward momentum

- AUDUSD forecast for 28 November 2025: 0.6430 or 0.6550

Fundamental analysis

According to the published data, private sector credit in Australia grew by 0.7% month-on-month in October 2025, exceeding both last month’s figure and market expectations of 0.6% growth. On an annual basis, private sector credit increased by 7.3%.

The Australian dollar is rising, reaching a two-week high. Inflation growth in Q3 strengthens the hawkish stance of the Reserve Bank of Australia. Markets now estimate the likelihood of a rate cut in May next year at just 7%, down from 40% earlier, and even price in a 40% chance of a rate hike by the end of 2026.

AUDUSD technical analysis

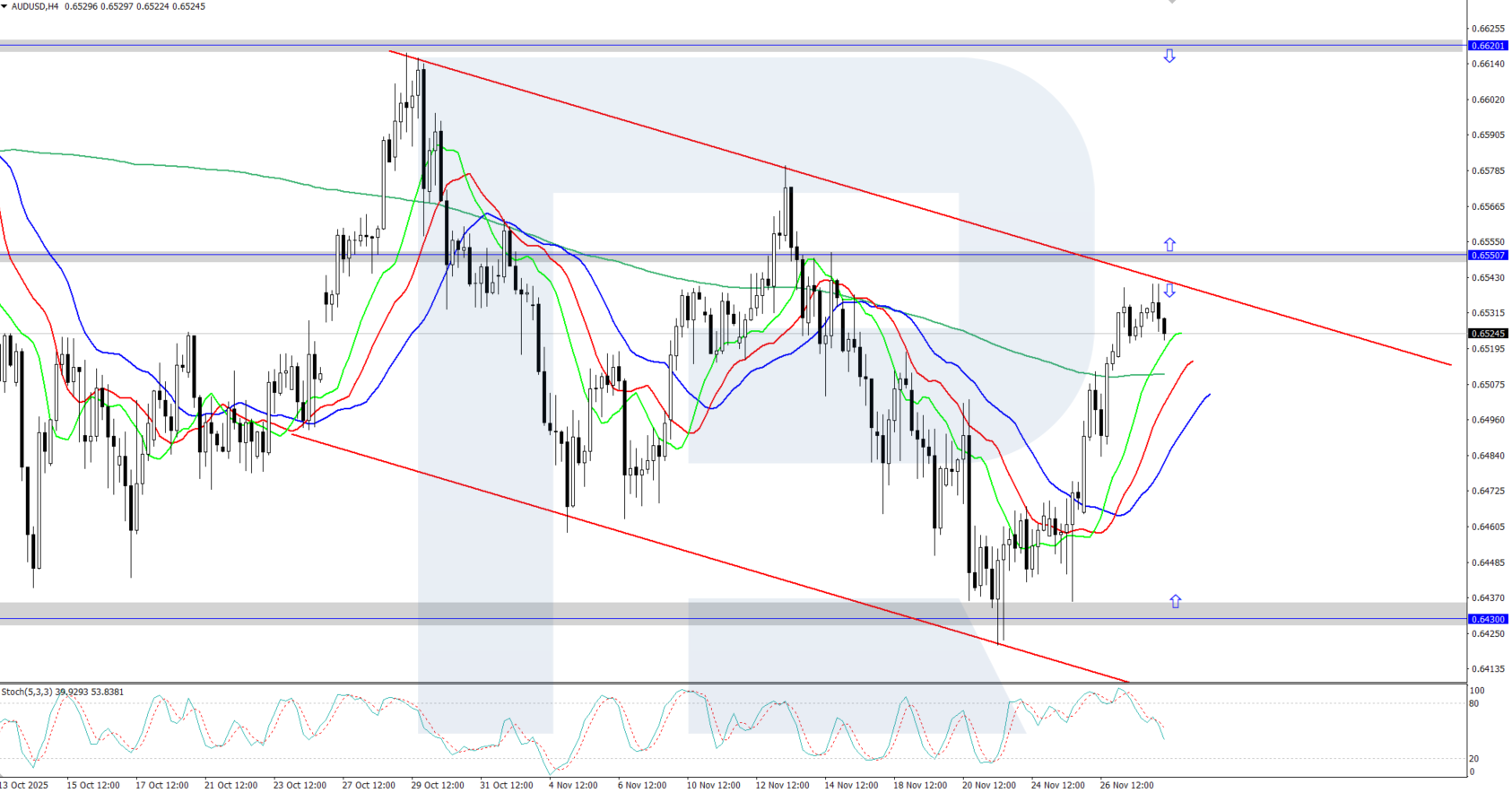

The AUDUSD pair is showing solid growth after reversing upwards from the daily support level at 0.6430. The Alligator indicator is pointing upwards, confirming bullish momentum. The key resistance level is 0.6550.

The short-term AUDUSD forecast suggests growth towards the 0.6550 resistance level and higher if the bulls maintain initiative. However, if bears reverse the price downwards, the pair could slip towards support near 0.6430.

Summary

The AUDUSD pair is rising moderately, consolidating above 0.6500. Unlike the Fed, the Reserve Bank of Australia does not intend to cut rates in the near term.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.