AUDUSD consolidates around 0.6600

The AUDUSD rate settled around the 0.6600 level amid ongoing uncertainty over US government funding. Discover more in our analysis for 3 October 2025.

AUDUSD forecast: key trading points

- Market focus: the US Department of Labor postponed the release of unemployment rate and Nonfarm Payrolls statistics

- Current trend: range-bound trading

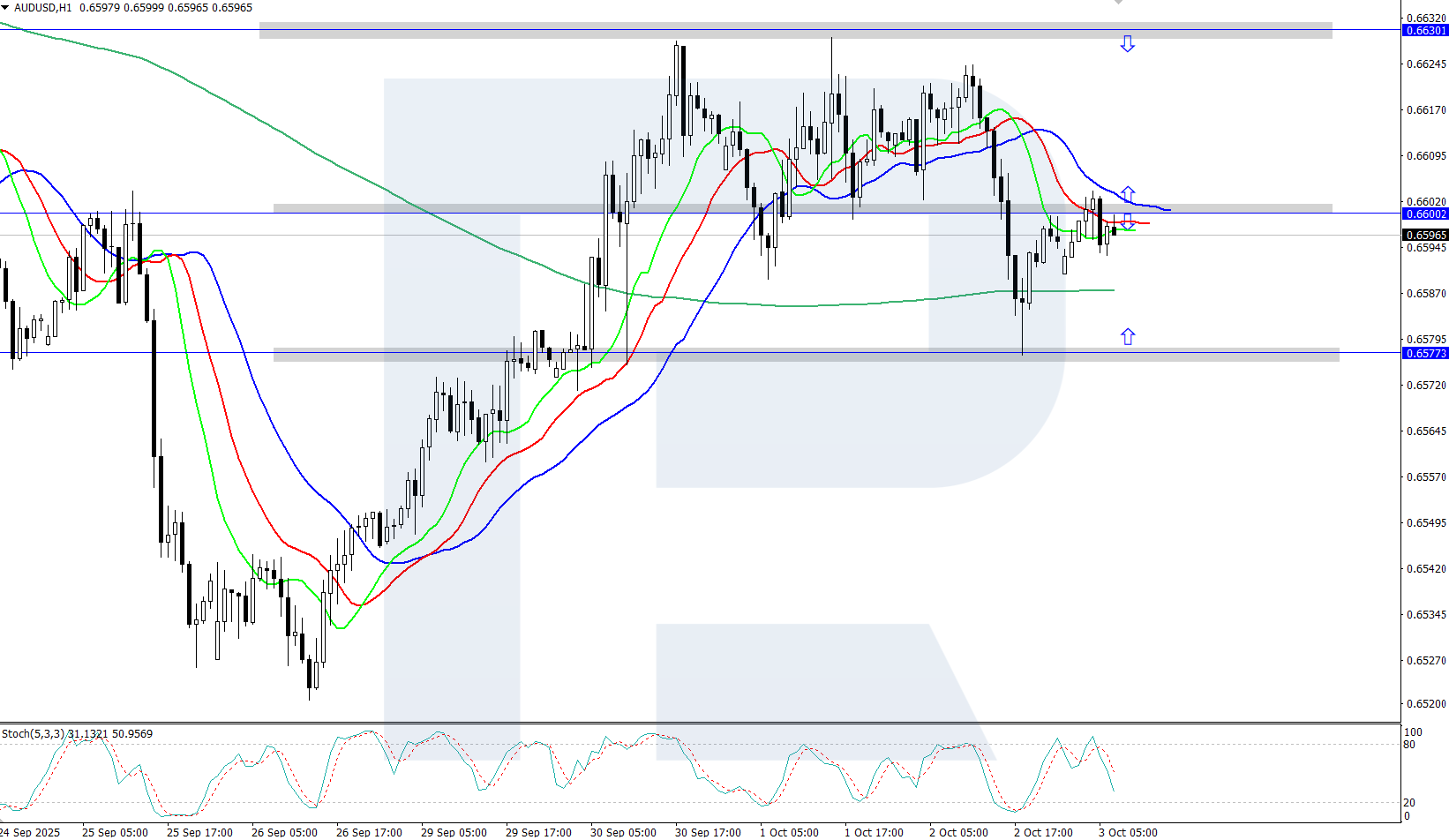

- AUDUSD forecast for 3 October 2025: 0.6577 or 0.6630

Fundamental analysis

Treasury Secretary Scott Bessent warned on Thursday that the government shutdown could negatively impact GDP growth, while President Donald Trump threatened mass federal worker layoffs to pressure Democrats.

The shutdown has also delayed key economic data as the Department of Labor postponed Friday’s release of the September Nonfarm Payrolls report.

The Australian dollar received support from the Reserve Bank of Australia after policymakers warned of higher-than-expected inflation. Markets are now pricing in only about a 45% chance of a rate cut at the 4 November meeting, compared to nearly 100% odds priced in a month ago.

AUDUSD technical analysis

The AUDUSD pair is trading within a narrow price range after a period of active growth. The Alligator indicator is pointing upwards, confirming the bullish momentum in price action. The key resistance level is the recent high at 0.6630.

The short-term AUDUSD forecast suggests growth towards the 0.6630 resistance level if bulls hold control. Conversely, if bears gain the upper hand and push the price below 0.6600, the pair could dip to the support level near 0.6577.

Summary

AUDUSD quotes are moderately rising, consolidating above the 0.6600 mark. The US government has partially shut down.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.