Stagnation or growth? US GDP will decide the fate of the AUDUSD rate

Amid expectations of US GDP data, AUDUSD quotes may continue to decline towards 0.6555. Find out more in our analysis for 25 September 2025.

AUDUSD forecast: key trading points

- US Q2 GDP: previously at 3.3%, projected at 3.3%

- US initial jobless claims: previously at 231 thousand, projected at 233 thousand

- AUDUSD forecast for 25 September 2025: 0.6555

Fundamental analysis

The AUDUSD forecast for today favours the US dollar, which continues to recover against the Australian dollar. At this stage, the pair is trading around 0.6590.

According to the forecast for 25 September 2025, US Q2 GDP may remain flat at 3.3%. This indicates some stagnation in the economy and may impact the USD, either strengthening or weakening it. Actual data may differ from expectations, and in the case of a significant upside surprise, the AUDUSD rate will continue to decline.

US initial jobless claims for last week are projected to rise slightly to 233 thousand. While the divergence is not significant, a worse-than-expected figure would put additional pressure on the US dollar.

AUDUSD technical analysis

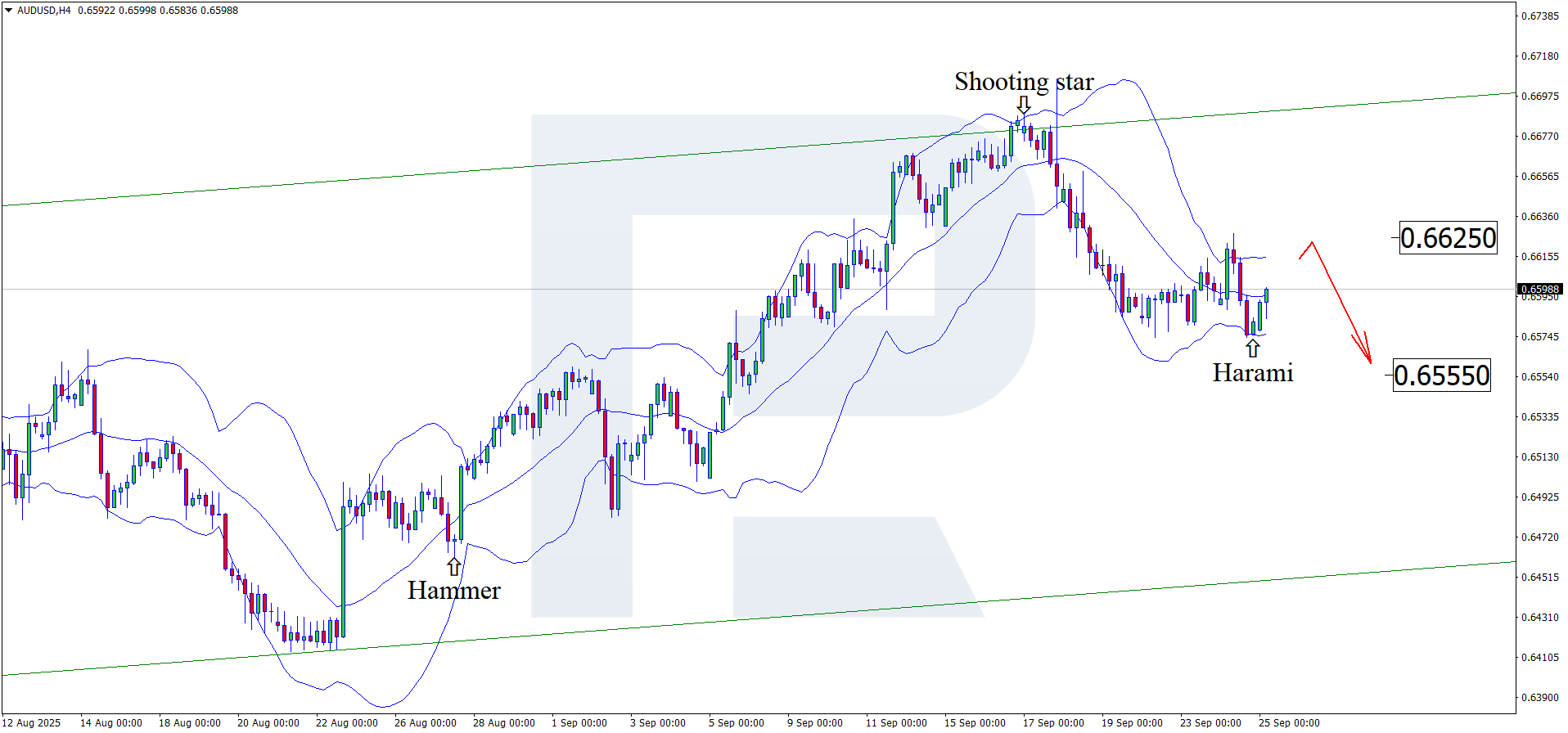

Having tested the lower Bollinger Band, the AUDUSD pair formed a Harami reversal pattern on the H4 chart. At this stage, it continues to develop a corrective wave following the signal received. The target for the pullback may be at the 0.6625 resistance level.

The AUDUSD forecast also considers an alternative scenario, with quotes falling further to the nearest support level at 0.6555 without a correction towards resistance.

Summary

The USD continues to pressure the Australian dollar ahead of key US economic data. Technical analysis of AUDUSD suggests further downside potential towards 0.6555.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.