AUDUSD: the pair has updated its yearly high.

AUDUSD is rising, setting a new yearly high today at 1.6595. Details – in our analysis for 11 July 2025.

AUDUSD forecast: key trading points

- AUDUSD quotes set a new yearly high at 1.6595

- Current trend: an upward trend is observed

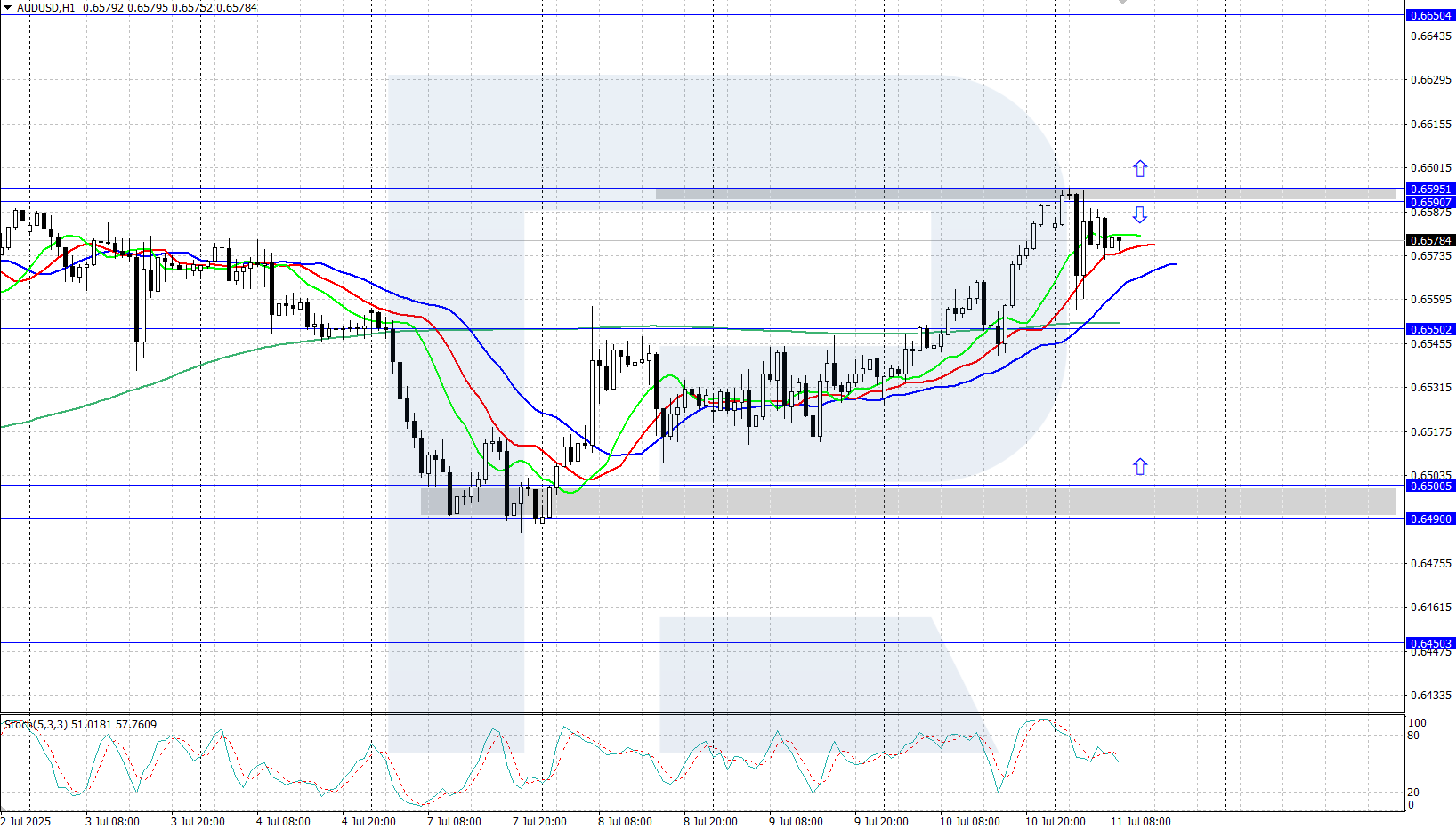

- AUDUSD forecast for 11 July 2025: 0.6595 or 0.6550

Fundamental analysis

The Australian dollar is strengthening after the RBA’s rate decision. This week, the Central Bank left the interest rate unchanged at 3.85%, surprising markets that expected a 25 basis points cut. The regulator wants additional evidence of slowing inflation.

Markets now anticipate further rate cuts of 75 basis points, compared to 100 basis points before the latest decision. Although a rate cut in August is still considered likely, much will depend on Q2 2025 inflation data to be published at the end of July.

AUDUSD technical analysis

AUDUSD is showing confident growth within its upward trend, currently trading near 0.6590. The Alligator indicator confirms the bullish price movement momentum. Key resistance is at the yearly high of 0.6595.

In the short-term forecast for AUDUSD price, if bulls manage to keep their initiative, an update of the yearly high and growth above 0.6600 may follow. However, if bears manage to reverse the quotes downwards, a correction towards the support area of 0.6490-0.6500 is possible.

Summary

AUDUSD set a new yearly high at 1.6595. The Reserve Bank of Australia paused rate cuts to assess inflation growth dynamics in the country.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.