HBM and Server DRAM drive Micron Technology to record revenue: is there growth potential for MU shares?

Growth in corporate spending on AI is supporting Micron Technology’s revenue. Amid this trend, the company has raised its guidance for the coming quarter.

Micron Technology, Inc. (NASDAQ: MU) published its Q4 FY2025 results, which came in ahead of analyst expectations. Revenue totalled 11.32 billion USD, while adjusted (non-GAAP) earnings per share reached 3.03 USD – both above market forecasts. The primary driver of growth was strong demand from data centres, particularly in AI-related solutions, including HBM memory and server DRAM.

The company also strengthened its cash flow position. Free cash flow after capital expenditure amounted to +803 million USD, with 4.93 billion USD invested in equipment and capacity expansion (CapEx). At quarter-end, Micron held 11.94 billion USD in cash and short-term investments – a solid liquidity buffer, especially given its extensive production expansion plans.

The key revenue growth driver in the quarter was the cloud segment. The Cloud Memory Business Unit generated 4.54 billion USD, accounting for around 40% of total quarterly revenue. The main contribution came from sales of HBM memory used in AI servers. By contrast, the NAND segment remained weaker relative to the DRAM segment.

Micron issued strong guidance for the next quarter: revenue of 12.5 billion USD (±300 million USD), non-GAAP gross margin of around 51.5% (±1 pp), and operating expenses of approximately 1.34 billion USD. This indicates that Micron continues to operate in a favourable market environment, with demand for AI memory staying robust and pricing dynamics supportive.

In the first 24 hours after the results were released, the market reacted cautiously. Despite revenue and profit exceeding expectations and strong guidance being issued, Micron shares fell by 2–3% on the first trading day. The decline reflected profit-taking after a sharp rally in the stock earlier in the year. In addition, some investors viewed the current valuation as excessive, given that the company is operating at the peak of memory demand.

However, sentiment shifted dramatically the very next day. Analysts raised their price targets for the stock, with media coverage emphasising that quarterly HBM revenue had approached 2 billion USD. Moreover, Micron’s revenue and margin outlook exceeded consensus forecasts. As a result, within a few trading sessions, the share price returned to its historical high. This reversal showed that investors had reassessed the report, betting on the long-term strength of HBM and server DRAM.

This article examines Micron Technology, Inc., outlines its revenue sources, reviews Micron’s performance in Q2, Q3 and Q4 FY2025, and sets out expectations for Q4 FY2025. It also provides a technical analysis of MU shares, forming the basis for a Micron stock forecast for calendar 2025.

About Micron Technology, Inc.

Founded in 1978, Micron Technology Inc. is a US-based company that develops and manufactures memory chips (DRAM, NAND) and provides technology solutions for data storage. Micron is one of the world’s largest producers of electronic memory, with its products used in cars, computers, mobile devices, servers, and other electronic equipment. The company was listed on the New York Stock Exchange in 1984 and trades under the ticker MU.

Today, Micron continues to develop and deploy advanced memory modules and data storage technologies for the artificial intelligence, 5G networks, autonomous vehicle, and cloud computing markets.

Image of the company name Micron Technology, Inc. for 2025Micron Technology, Inc.’s main revenue streams

Micron’s business model centres on developing, producing, and selling semiconductor memory modules and data storage solutions. The company’s segments are categorised by the product markets listed below:

- Personal computers and devices : this includes revenue from the sale of memory used in PCs, laptops, and workstations

- Mobile devices : memory chips for smartphones and tablets, where Micron competes against companies producing comparable products for high-performance devices

- Storage devices : products and solutions for NAND flash memory-based data storage

- Embedded systems : memory components and modules for integration into systems used in the automotive and healthcare sectors, as well as the manufacturing industry

The company provides detailed data for each segment and aggregates them into two major sectors in its report. The first sector is DRAM (Dynamic Random-Access Memory), which accounts for a substantial share of the company’s revenues (about 70%). DRAM is used in personal computers, servers, smartphones, graphics cards and other devices. The second sector, NAND (flash memory), accounts for about 25-30% of revenues. NAND products are used in SSDs (solid-state drives), mobile devices, data storage systems and other products requiring rapid and reliable access to information.

Micron Technology Inc. Q4 FY 2024 report

On 25 September 2024, Micron released its Q4 2024 report, which covered the period ending on 25 August. The company’s financial performance surprised investors and exceeded forecasts. Below is the reported data:

- Revenue : 7.75 billion USD (+93%)

- Net income : 1.34 billion USD compared to a loss of 1.17 billion USD

- Earnings per share : 1.18 USD compared to a loss of 1.07 USD

- Operating profit : 1.74 billion USD compared to a loss of 1.20 billion USD

Revenue by segment:

- DRAM : 5.33 billion USD (+69%)

- NAND : 2.36 billion USD (+31%)

- Compute and Networking : 3.01 billion USD (+152%)

- Mobile : 1.87 billion USD (+55%)

- Storage : 1.68 billion USD (+127%)

- Embedded : 1.17 billion USD (+36%)

After announcing the Q4 2024 financial results, Micron’s management underscored an impressive 93% revenue growth from the previous year, driven by strong demand for DRAM products for data centres and record NAND sales, which exceeded 1 billion USD per quarter for the first time.

Micron’s CEO, Sanjay Mehrotra, noted that Micron has the best competitive positioning in its entire history and forecasted record revenue and profitability figures in Q1 2025. He also emphasised the importance of demand for artificial intelligence solutions, which helps strengthen the company’s position in the market.

Micron expects record revenue in Q1 2025, forecasting income of 8.70 billion USD (plus or minus 200 million USD) and a gross margin of 39.5%. The anticipated earnings per share will amount to 1.74 USD. These figures are considerably higher than in previous quarters, indicating growth in demand for the company’s products, particularly in the artificial intelligence and cloud computing segments.

Micron also noted that it continues to benefit from rising prices in memory and data storage markets related to increased demand for AI servers.

Micron Technology Inc. Q1 FY 2025 report

On 18 December 2024, Micron published its Q1 fiscal 2025 report, covering the period ending on 28 November. Below are the report highlights:

- Revenue : 8.70 billion USD (+84%)

- Net income : 2.04 billion USD versus a loss of 1.05 billion USD

- Earnings per share : 1.79 USD versus a loss of 0.95 USD

- Operating profit : 2.39 billion USD versus a loss of 0.95 billion USD

Revenue by segment:

- DRAM : 6.40 billion USD (+73%)

- NAND : 2.32 billion USD (+26%)

- Compute and Networking : 4.40 billion USD (+153%)

- Mobile : 1.50 billion USD (+16%)

- Storage : 1.70 billion USD (+160%)

- Embedded : 1.10 billion USD (+6%)

Sanjay Mehrotra noted that data centres accounted for over 50% of revenue for the first time in the company’s history, driven by strong demand for AI memory chips. He also acknowledged the weakness in consumer segments such as PCs and smartphones but expressed confidence that growth would resume in the second half of the fiscal year.

For Q2 fiscal 2025, Micron issued guidance below Wall Street expectations, forecasting revenue of 7.90 billion USD (± 200 million USD) and EPS of 1.43 USD (± 0.10 USD). This forecast reflects the anticipated decline in DRAM and NAND revenue due to oversupply and sluggish consumer demand.

Investors reacted negatively to the outlook, with Micron’s stock falling by over 13% after the report was published.

Micron Technology Inc. Q2 FY 2025 report

On 20 March 2025, Micron released its Q2 fiscal 2025 report, covering the period ending on 27 February. Below are the report highlights:

- Revenue : 8.05 billion USD (+38%)

- Net income : 1.78 billion USD (+273%)

- Earnings per share : 1.56 USD (+323%)

- Operating profit : 2.01 (+800%)

Revenue by segment:

- DRAM : 6.12 billion USD (+47%)

- NAND : 1.85 billion USD (+18%)

- Compute and Networking : 4.60 billion USD (+153%)

- Mobile : 1.10 billion USD (+16%)

- Storage : 1.40 billion USD (+160%)

- Embedded : 1.00 billion USD (+6%)

Sanjay Mehrotra noted that revenue from DRAM for data centres reached a new record, while income from high-bandwidth memory (HBM) chips rose by more than 50% from the previous quarter, exceeding 1 billion USD. He emphasised Micron’s strong competitive position and the company’s success in high-margin product categories, attributing this to an effective strategy and growing demand for memory solutions used in artificial intelligence applications.

For Q3 fiscal 2025, Micron forecast revenue of between 8.6 and 9.0 billion USD with expected EPS of between 1.47 and 1.67 USD. The company also projected a decline in gross margin to 36.5%, a 1.5 percentage point decrease from the previous quarter. This decrease was attributed to a rise in sales of lower-margin consumer products and ongoing oversupply in the NAND market, which continues to put downward pressure on prices.

Investor reaction was mixed. Following the release of the earnings report, Micron’s shares initially rose by more than 5% in after-hours trading, reflecting optimism over the strong results. However, concerns regarding the level of gross profit and rising inventory levels later led to a drop of more than 8%, making Micron one of the worst-performing stocks in the S&P 500 following the earnings release.

Micron Technology, Inc. Q3 2025 financial report

On 25 June 2025, Micron released its financial results for Q3 of the 2025 fiscal year, covering the period ended 29 May. The key figures, compared with the same period of the previous fiscal year, are as follows:

- Revenue : 9.30 billion USD (+37%)

- Net income : 2.18 billion USD (+210%)

- Earnings per share : 1.91 USD (+208%)

- Operating profit : 2.49 billion (+164%)

Revenue by segment:

- DRAM : 7.07 billion USD (+50%)

- NAND : 2.15 billion USD (+4%)

- Compute and Networking : 5.06 billion USD (+97%)

- Mobile : 1.55 billion USD (-2%)

- Storage : 1.45 billion USD (+7%)

- Embedded : 1.22 billion USD (-5%)

Micron reported strong Q3 FY2025 results, significantly outperforming market expectations. Revenue reached 9.3 billion USD, up 37% year-on-year, while adjusted earnings per share rose to 1.91 USD, versus a consensus forecast of 1.60 USD. The main driver was steady growth in demand for memory used in AI systems. HBM shipments increased by approximately 50% quarter-on-quarter, and revenue from data centres more than doubled.

During the earnings call, CEO Sanjay Mehrotra noted the accelerated adoption of advanced technological solutions. Production of 1-gamma DRAM using EUV lithography began ahead of schedule, and mass shipments of HBM3E were expected as early as Q4. The company also reported the start of HBM4 testing, with plans to begin volume production in 2026. These initiatives, together with expanded manufacturing capacity in the US and government support under the CHIPS Act, were shaping Micron’s strategic advantage in the AI memory segment.

Profitability also improved, with gross margin reaching 39%, exceeding the upper end of guidance. A further increase to around 42% ±1% was expected in Q4. The company planned to allocate approximately 1.2 billion USD to operating expenses in the following quarter, with R&D in HBM and next-generation memory technologies remaining a key priority.

The Q4 outlook reflected management’s optimism. Expected revenue stood at 10.7 billion USD (+38% year-on-year), and earnings per share were projected at 2.50 USD (+111% year-on-year) – both well above analysts’ consensus estimates.

Micron Technology, Inc. Q4 FY2025 report

On 23 September 2025, Micron published its results for Q4 FY2025, covering the period ended 28 August. The key figures compared with the same period of the previous fiscal year are as follows:

- Revenue : 11.31 billion USD (+46%)

- Net income : 3.47 billion USD (+158%)

- Earnings per share (EPS) : 3.03 USD (+156%)

- Operating profit : 3.96 billion USD (+126%)

Revenue by segment:

- Cloud Memory Business Unit : 4.54 billion USD (+213%)

- Core Data Center Business Unit : 1.58 billion USD (–23%)

- Mobile and Client Business Unit : 3.76 billion USD (+24%)

- Automotive and Embedded Business Unit : 1.43 billion USD (+17%)

Micron’s Q4 FY2025 results came in ahead of market expectations. The company reported record revenue of 11.32 billion USD, while adjusted EPS stood at 3.03 USD – both figures exceeding the analyst consensus of 11.2 billion USD in revenue and 2.86 USD in EPS. Revenue growth was driven by exceptionally strong demand from AI-focused data centres, which became the primary source of expansion and are now the core of Micron’s business. For FY2025, data centres accounted for 56% of the company’s revenue at high gross margins, confirming a structural shift towards higher-value, higher-margin server memory and HBM modules.

The product mix also improved in the quarter, with a greater share of server DRAM and HBM for AI systems and fewer lower-cost configurations. This shift lifted average selling prices and supported profitability. The memory pricing cycle also showed signs of recovery: DRAM is experiencing supply shortages, while NAND prices are also rising.

In Q4, Micron generated a positive adjusted free cash flow of around 803 million USD despite significant capital expenditures. For FY2025 overall, FCF exceeded 3.7 billion USD. At the same time, management cautioned that CapEx will rise in FY2026 as the company expands DRAM and HBM capacity to capture growing AI-driven demand.

Micron issued strong guidance for the next quarter. Revenue is expected at around 12.5 billion USD (±300 million USD), adjusted EPS at approximately 3.75 USD (±0.15), and gross margin in the range of 50.5–52.5%. This guidance indicates that management anticipates continued strength in both pricing and product cycles, particularly in server DRAM and HBM, with further potential to increase profitability as AI memory accounts for an ever-larger share of total sales.

Fundamental analysis of Micron Technology, Inc.

Below is the fundamental analysis of MU following the Q4 FY2025 results:

- Liquidity and debt : as of 28 August 2025, the company held 12 billion USD in cash, and with an undrawn credit facility, had approximately 15.4 billion USD in available liquidity – a strong buffer against any short-term challenges. Total debt stood at 14.6 billion USD, of which approximately 900 million USD was repaid during the quarter. Net debt was roughly 2.7 billion USD, with the bulk of maturities not falling due until after 2033. This means Micron can comfortably service its debt and refinance it if required

- Cash flow and free cash : in the past quarter, operating cash flow reached 5.7 billion USD, with CapEx of 4.9 billion USD. Free cash flow was positive at 803 million USD. For the full FY2025, Micron generated 3.72 billion USD of free cash flow (~10% of revenue) and expects this figure to rise next year. However, it should be noted that the company will continue to invest heavily – around 4.5 billion USD per quarter – to expand DRAM and HBM production capacity. Part of these expenditures is offset by government support under the CHIPS Act

- Profitability and earnings : profitability continues to improve. Gross margin stood at 45.7%, operating margin was 35%, and non-GAAP EPS was 3.03 USD. This performance reflects higher sales of premium, higher-margin products such as HBM memory and server DRAM, combined with lower production costs. DRAM sales totalled 9 billion USD (79% of revenue), while NAND contributed 2.3 billion USD (20% of revenue). Data centres accounted for 56% of annual revenue, with a gross margin of 52%. This underscores the high quality of earnings, as the company generates profits primarily from its most lucrative solutions

- Balance sheet resilience : inventories totalled 8.4 billion USD, equivalent to 124 days. During the quarter, inventory days declined by 15, thanks to stronger DRAM sales, leaving inventories at a comfortable level. This reduces the risk of product obsolescence and forced discounting. Overall, Micron’s balance sheet looks solid, supported by low net debt and long maturities. However, given the industry’s capital intensity and cyclical nature, maintaining a large liquidity buffer is essential – a commitment the company continues to uphold

Conclusion of the fundamental analysis of MU:

Micron’s financial position at the start of FY2026 can be characterised as strong. The company is once again generating cash, increasing profitability, maintaining a stable balance sheet, and preserving a healthy liquidity buffer. Robust demand for HBM chips and server DRAM underpins strong near-term sales. The main risks remain the cyclical nature of the memory market, the relative weakness of NAND, heavy investment requirements, and potential tariff restrictions. Even so, in the current cycle, Micron appears financially stable and confident.

Expert forecasts for Micron Technology, Inc

- Barchart : 27 of 37 analysts rated Micron Technology shares as Strong Buy, 5 as Moderate Buy, 4 as Hold, and 1 as Strong Sell. The top-end forecast is 250 USD, with the lower-end forecast at 60 USD

- MarketBeat : 26 of 30 analysts assigned a Buy rating, 4 recommended Hold. The top-end forecast is 250 USD, with the lower-end forecast at 84 USD

- TipRanks : 24 of 27 analysts rated the stock as Buy, and 3 as Hold. The top-end forecast is 250 USD, with the lower-end forecast at 145 USD

- Stock Analysis : 10 of 30 experts rated Micron shares as Strong Buy, 16 as Buy, and 4 as Hold. The top-end forecast is 250 USD, with the lower-end forecast at 84 USD

Micron Technology, Inc. stock price forecast for 2025

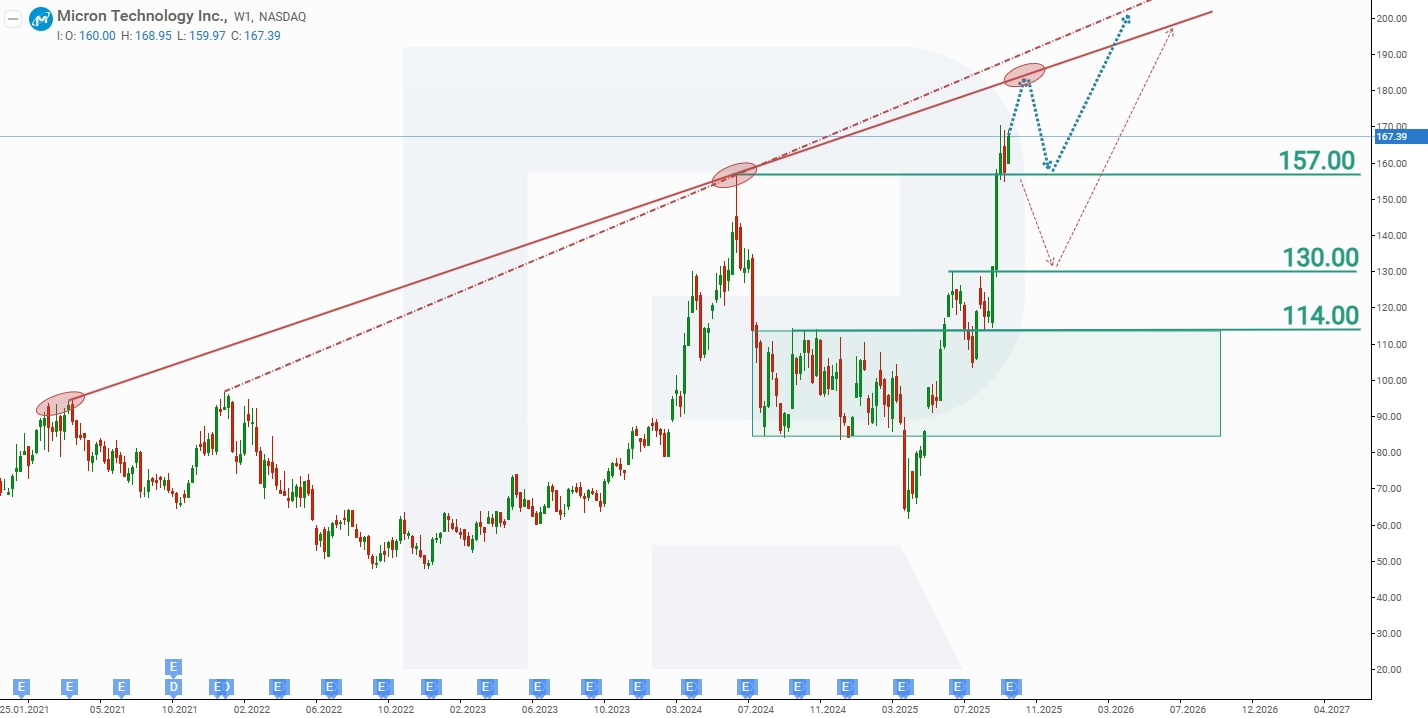

In April, following the announcement that Micron Technology had begun mass production of HBM3E chips for NVIDIA (NASDAQ: NVDA), MU shares surged sharply. From April to October 2025, the stock rose by 160%, breaking through its previous all-time high of 157 USD and is now approaching the resistance line near 185 USD. Based on the current performance of Micron shares, the two possible outcomes for 2025 are as follows:

Base case forecast for Micron shares: this assumes a test of resistance at around 185 USD, followed by a pullback towards support at 157 USD. Such a decline would be viewed as a correction. After rebounding from support at 157 USD, MU shares could resume their upward trend, with an upside target of around 200 USD.

Alternative outlook for Micron stock: this assumes a break below support at 157 USD. In this scenario, MU shares could fall towards 130 USD, after which a recovery in the share price towards the 200 USD target could follow.

Micron Technology, Inc. stock analysis and forecast for 2025Risks of investing in Micron Technology, Inc. stock

Investing in Micron Technology’s stock involves several risks that may adversely impact the company’s income and revenue:

- Memory market cyclicality : the semiconductor industry, particularly the memory segment, is highly cyclical, with fluctuations in demand and prices. A prolonged downturn in segments like NAND and DRAM could lead to overstock, falling prices, and reduced profitability

- Intense competition in the industry : Micron faces fierce competition from major players like Samsung Electronics and SK Hynix. Constant investment in technology and innovation is vital in such a highly competitive environment. If the company fails to keep pace with industry developments, it may lose market share, leading to lower profitability

- Geopolitical tensions and trade restrictions : Micron operates in the global market, generating significant revenue outside the US. Geopolitical tensions, trade disputes, and cybersecurity compliance checks may restrain sales and operations. For example, Micron’s products have been scrutinised in China, highlighting the risks tied to international markets

Investors must carefully consider these risks when evaluating an investment in Micron Technology, as they could significantly impact the company’s financial performance and stock price.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.