Fundamental analysis of Meta Platforms for Q3 2025 and META stock forecast

Meta Platforms reported strong results for Q3 2025, delivering revenue growth and maintaining a high operating margin, which underscores the resilience of the company’s core business. However, news of increased capital expenditure unsettled investors and led to a decline in META shares.

Meta Platforms, Inc. (NASDAQ: META) reported strong results for Q3 2025. Revenue rose by 26% to 51.24 billion USD, with ad impressions increasing by 14% and the average price per impression by 10%. The operating margin remained high at 40%, indicating stable profitability in Meta’s core business. Overall, the results aligned with market expectations.

The sharp 83% drop in GAAP net income was due to a one-time accounting tax charge of 16 billion USD, which temporarily reduced earnings per share to 1.05 USD. Excluding this effect, the adjusted figure would have been around 7.25 USD, indicating that the company’s underlying profitability remained effectively unchanged.

Management expects Q4 2025 revenue in the range of 56–59 billion USD, slightly above market expectations. At the same time, the company raised its capital expenditure plan for 2025 to 70–72 billion USD and warned that investment and operating expenses are expected to continue rising in 2026 due to the active development of artificial intelligence infrastructure.

The weakest area for Meta Platforms remains the Reality Labs division, which posted a quarterly loss of 4.43 billion USD.

Investor reaction to the report was negative. Immediately after publication, META shares fell by 11% – the largest one-day decline in three years. Although the revenue forecast for Q4 2025 at 56–59 billion USD was broadly in line with expectations, the increase in 2025 CapEx to 70–72 billion USD and management’s comments on further investment growth in 2026 deepened concerns that free cash flow would shrink.

As investors realised the scale of Meta’s future spending on AI infrastructure, the shares declined by around 19% over the month, reflecting a reassessment of free cash flow prospects and the capital intensity of the business.

Persistent losses at Reality Labs continued to weigh on META’s share price.

This article examines Meta Platforms’ business model and revenue structure, presents the company’s quarterly results, and provides a fundamental analysis of META. It also includes expert forecasts for Meta’s shares in 2025 and examines Meta’s stock performance, forming the basis for the Meta Platforms stock forecast for 2025.

About Meta Platforms, Inc.

Meta Platforms, formerly known as Facebook, was founded in 2004 by Mark Zuckerberg and his Harvard classmates Eduardo Saverin, Andrew McCollum, Dustin Moskovitz, and Chris Hughes. It was initially a social network created for Harvard students, but it soon expanded rapidly, becoming one of the world’s largest communication platforms. Meta’s core operations include the development of social networks such as Facebook, Instagram, and WhatsApp, as well as advancing virtual and augmented reality technologies through its Reality Labs division. The company focuses significantly on developing the metaverse, as reflected in its rebranding in 2021. Meta went public on 18 May 2012, and its IPO ranked among the most prominent tech IPOs in history.

Image of the company name Meta Platforms, Inc.Meta Platforms, Inc.’s main financial flows

Meta Platforms’ revenue mainly comes from the following sources:

- Advertising: this segment accounts for approximately 98.5% of the company’s total revenue. Meta generates advertising revenue through its platforms (Facebook, Instagram, Messenger, and WhatsApp), allowing advertisers to target audiences based on various criteria, including demographic data, user interests, and behaviour.

- Reality Labs: this division generates a smaller portion of the company’s revenue through hardware sales under the Meta Quest (previously Oculus VR) brand and related software products, including content.

- Other revenue: this comprises fees charged for using Meta’s payment systems (for example, on Marketplace platforms or apps), paid subscriptions for special features or products, and income from other services. While these sources are less significant than advertising, they still contribute to the company’s financial performance.

Thus, Meta Platforms’ primary source of revenue is advertising on its social platforms, followed by income from virtual reality sales and services and additional proceeds from other sources.

Meta Platforms, Inc. Q2 2024 results

Meta announced solid financial Q2 2024 results. Below are the figures compared with the same period in 2023:

- Revenue: 39.74 billion USD (+22%)

- Net income: 13.46 billion USD (+73%)

- Earnings per share: 5.16 USD (+73%)

- Operating margin: 38% (+900 basis points)

- Advertising revenue: 38.20 billion USD (+21%)

- Revenue from Reality Labs: 353 million USD (+27%)

- Loss from Reality Labs: 4.50 billion USD (+21%)

- Number of daily active users: 3.27 billion (+7%)

- Costs and expenses: 24.22 billion USD (+7%)

Advertising remains the primary revenue stream, contributing 96% of the company’s total revenue. The Reality Labs division, which specialises in developing virtual and augmented reality (VR and AR) technologies, has only generated losses so far. By the end of Q2 2024 results, Reality Labs’ loss reached 4.50 billion USD, a 21% increase.

Meta Platforms, Inc. Q3 2024 results

On 30 October, Meta released its Q3 2023 report. Below are the key figures compared with the same period in 2023:

- Revenue: 40.58 billion USD (+19%)

- Net income: 15.68 billion USD (+35%)

- Earnings per share: 6.03 USD (+37%)

- Operating margin: 43% (+300 basis points)

- Advertising revenue: 39.88 billion USD (+18%)

- Reality Labs revenue: 270 million USD (+28%)

- Reality Labs loss: 4.40 billion USD (+20%)

- Number of daily active users: 3.279 billion (+5%)

- Costs and expenses: 23.24 billion USD (+14%)

CEO Mark Zuckerberg explained that revenue growth was driven by advancements in artificial intelligence (AI), which are actively integrated into the company’s applications and business processes. He highlighted the notable success of Meta AI, the rollout of the Llama AI model, and the development of AI-powered smart glasses.

CFO Susan Li shared the company’s forecast, expecting Q4 2024 revenue to range between 45.00 billion and 48.00 billion USD. She also revised the company’s total expense forecast for 2024, lowering it to the 96.00-98.00 billion USD range, down from the previous estimate of 96.00-99.00 billion USD. Li emphasised that the operating losses of the Reality Labs division, which focuses on virtual and augmented reality (VR and AR), would significantly increase year-over-year due to ongoing development and investments aimed at scaling the ecosystem. Additionally, Li mentioned that Meta expects substantial growth in capital expenditures in 2025, including increased spending on infrastructure.

Both Zuckerberg and Li also noted the growing number of legal and regulatory challenges, particularly in the European Union and the US, which could significantly affect Meta’s business and financial results.

Overall, Meta’s management expressed optimism about the company’s current performance, which is driven by progress in AI technologies and strategic investments. However, they also pointed out that external factors could influence future results.

Meta Platforms, Inc. Q4 2024 earnings results

On 29 January 2025, Meta published its earnings report for Q4 2024. Below are the key figures compared with the same period in 2023:

- Revenue: 48.38 billion USD (+21%)

- Net income: 20.83 billion USD (+49%)

- Earnings per share: 8.02 USD (+50%)

- Operating margin: 48% (+700 basis points)

- Advertising revenue: 46.78 billion USD (+20%)

- Reality Labs revenue: 1.08 billion USD (+1%)

- Reality Labs loss: 4.96 billion USD (+6%)

- Number of daily active users: 3.35 billion (+5%)

- Costs and expenses: 25.02 billion USD (+5%)

In his comments on the report, Zuckerberg highlighted advancements in Artificial Intelligence (AI) and expressed optimism about scaling these technologies in 2025, including the introduction of personalised AI assistants. He emphasised the company’s commitment to building an “extensive computing infrastructure,” which implies significant investments in AI. His vision includes creating AI that can write and deploy code, unlocking new opportunities for business and the market.

Zuckerberg also pointed to progress in the development of computerised smart glasses, suggesting that 2025 could be a key year for understanding the market potential of AI-powered glasses.

Regarding DeepSeek, he acknowledged the “groundbreaking” developments that Meta is still trying to comprehend, with plans to integrate some of these innovations into its products. Despite DeepSeek’s achievements, Zuckerberg stated that “it is too early to form a definitive opinion” on how these developments may impact Meta’s infrastructure and capital investment plans. He emphasised that the company’s commitment to large-scale AI infrastructure investment will remain unchanged, viewing it as a long-term strategic advantage.

Zuckerberg noted that DeepSeek is a new competitor in this market. At the same time, the decline in demand for computing resources (GPUs) is by no means certain, as running AI models still requires substantial computing power, especially given the scale of Meta’s operations.

Meta Platforms, Inc. Q1 2025 earnings results

On 30 April, Meta published its Q1 2025 report for the period ended 31 March. Key figures compared with the same period in 2024 are as follows:

- Revenue: 42.31 billion USD (+16%)

- Net income: 16.64 billion USD (+35%)

- Earnings per share: 6.43 USD (+37%)

- Operating margin: 41% (+300 basis points)

- Advertising revenue: 41.39 billion USD (+16%)

- Reality Labs revenue: 0.41 billion USD (-9%)

- Reality Labs loss: 4.21 billion USD (+16%)

- Family daily active people (DAP): 3.43 billion (+6%)

- Costs and expenses: 24.76 billion USD (+9%)

Meta made a confident start to 2025, delivering strong results and beating analysts’ expectations. Revenue rose by 16%, while earnings per share increased by 35%, well ahead of market forecasts. Advertising remains the primary growth driver/ Ad revenue increased by 16.2%, driven by higher prices and an increase in impressions. Meanwhile, the user base for Meta’s products continues to expand – daily active users reached 3.43 billion, up 6% year-on-year.

The company also placed a major focus on artificial intelligence. Meta raised its capital expenditure forecast for 2025 to a range of 64-72 billion USD (up from a previous estimate of 60-65 billion USD), allocating investment towards developing data centres and acquiring infrastructure to support its AI initiatives.

For Q2 2025, Meta expected revenue in the range of 42.5 to 45.5 billion USD, which was in line with analysts’ expectations. However, management highlighted potential short-term risks, including a decline in advertising activity from Asian companies and broader economic uncertainty.

For investors, Meta remains one of the most promising companies in the technology sector. Its strong operational base, growing user base and significant investments in AI make the stock an attractive option for those seeking exposure to innovation and long-term growth.

Meta Platforms, Inc. Q2 2025 earnings results

On 30 July, Meta released its results for Q2 2025, which ended 30 June. Below are the key figures compared with the same period in 2024:

- Revenue: 47.52 billion USD (+22%)

- Net income: 18.34 billion USD (+36%)

- Earnings per share: 7.14 USD (+38%)

- Operating margin: 43% (+500 basis points)

- Advertising revenue: 46.56 billion USD (+16%)

- Revenue from Reality Labs: 0.37 billion USD (+5%)

- Loss from Reality Labs: 4.53 billion USD (–1%)

- Family daily active people (DAP): 3.48 billion (+6%)

- Costs and expenses: 27.07 billion USD (+12%)

Meta Platforms reported revenue of 47.52 billion USD in Q2 2025, up 22% year-on-year, while adjusted earnings per share came in at 7.14 USD – 38% higher than the same period last year and well above analyst expectations of 5.85–5.89 USD. Operating profit rose to 20.44 billion USD, with an operating margin of approximately 43%, up five percentage points from 38% a year earlier.

Meta issued revenue guidance for Q3 2025 in the range of 47.5–50.5 billion USD, anticipating a slowdown in growth in Q4 due to a high base of comparison. At the same time, it raised its full-year capital expenditure forecast to 66–72 billion USD and hinted at even higher investment in 2026 to support the expansion of its AI infrastructure and the hiring of specialised talent.

Meta Platforms, Inc. Q3 2025 results

On 29 October 2025, Meta published its financial report for Q3 2025, which ended on 30 September. The key figures, compared with the same period in 2024, are as follows:

- Revenue: 51.24 billion USD (+26%)

- Net income: 2.71 billion USD (–83%)

- Earnings per share: 1.05 USD (–83%)

- Operating margin: 40% (–300 basis points)

- Advertising revenue: 50.08 billion USD (+26%)

- Reality Labs revenue: 0.47 billion USD (+74%)

- Reality Labs loss: 4.43 billion USD (0%)

- Family daily active people (DAP): 3.54 billion (+8%)

- Costs and expenses: 30.71 billion USD (+32%)

Meta reported record Q3 2025 revenue of 51.2 billion USD (+26% y/y), exceeding market expectations. Operating profit rose by 18%, and the operating margin remained high at 40%. GAAP net income declined due to a one-off tax charge of nearly 16 billion USD. Excluding this effect, the underlying net profit would have been 18.6 billion USD, and earnings per share 7.25 USD. Thus, the decline in profit was a technical adjustment resulting from changes in tax legislation, while operationally, Meta delivered one of the strongest quarters in its history.

Meta’s core business – its Family of Apps (Facebook, Instagram, WhatsApp, Messenger) – achieved excellent results with total revenue and advertising income increasing by 26%. The number of ad impressions grew by 14%, and the average price per ad by 10%. The daily active user base across its apps reached 3.54 billion (+8%), setting a new record. AI-powered recommendations (Reels and content algorithms) continue to boost user engagement, particularly in video.

The Reality Labs division (AR/VR and AI devices) also increased revenue by 74% to 470 million USD but remains loss-making. This segment continues to be funded through profits from the advertising business.

Meta raised its full-year expense forecast to 116–118 billion USD and its capital expenditure plan to 70–72 billion USD, which became the main source of investor concern. The company is actively investing in the development of AI infrastructure and data centres, making its operations more capital-intensive.

These expenditures are temporarily reducing profitability and free cash flow, but could pay off in the future if AI enhances advertising efficiency, user engagement, and creates new revenue streams.

Meta Platforms, Inc. forecast for Q4 2025

Meta’s management issued a confident outlook for Q4 2025, indicating continued strong business momentum. The company expects revenue in the range of 56–59 billion USD, representing year-on-year growth of 18–22%. This pace signals the ongoing recovery of the advertising market and steady demand from both major brands and small businesses.

The primary source of growth is expected to remain advertising, particularly across the Facebook and Instagram ecosystems. Management noted that AI-driven tools enabling advertisers to target audiences more precisely and optimise budgets are already delivering a tangible impact – the number of campaigns created with AI support is growing at double-digit rates. As a result, Meta anticipates further improvements in ad efficiency and an increase in the average price per impression.

The Family of Apps segment will remain the primary revenue driver, supported by rising user engagement and the expanding short-form video format Reels, which now generates revenue comparable to the traditional feed. WhatsApp is also becoming increasingly monetised through business tools and payment solutions.

Meanwhile, the Reality Labs division is expected to post a slight decline in revenue in Q4 compared with the previous quarter. This reflects the fact that the peak of Quest headset sales occurred in Q3, during channel stocking and the launch of new models. Meta expects sales to stabilise in Q4 but not to act as a growth driver.

In terms of profitability, the company forecasts operating margins will remain strong, although slightly below historical peaks due to substantial investments in AI infrastructure and data centres. The gross margin of the advertising business remains stable, while the negative impact of capital expenditure on profit is currently being offset by revenue growth and business scale.

Management also emphasised that the tax rate will normalise in Q4, returning to a range of 12–15%, meaning the one-off tax charge from Q3 will be fully eliminated. This will enable net profit to return to levels that reflect the company’s underlying operating performance.

Overall, Meta expects revenue growth to remain solid in the coming quarter, at around 15–20% year-on-year, while profitability remains high, despite ongoing increases in spending on artificial intelligence and Reality Labs. The company effectively guides investors to expect another strong quarter in Q4 2025, with record revenue and stable cash flows.

Fundamental analysis of Meta Platforms, Inc.

Below is the fundamental analysis of Meta Platforms, Inc. (META) based on the Q3 2025 results:

- Operating trends: Meta ended Q3 2025 with very strong financial results. Revenue grew by 26% year-on-year, reaching 51.24 billion USD – a new record. The main growth driver was advertising: the number of ad impressions rose by 14%, and the average price per impression increased by 10%, meaning the company is earning more both through volume and improved monetisation.

The user base also continued to expand – the number of daily active users across Meta’s Family of Apps (Facebook, Instagram, WhatsApp and Messenger) reached 3.54 billion, up 8% year-on-year. This demonstrates a steady inflow of new users and strong engagement among existing ones.

Operating profit totalled 20.54 billion USD, with the operating margin holding steady at around 40% – still among the highest in the large-cap tech sector. The Family of Apps segment, Meta’s core advertising business, accounted for nearly all the profit, while Reality Labs (AR/VR and AI devices) remained loss-making, posting a quarterly loss of 4.43 billion USD.

- Liquidity and access to financing: as of 30 September 2025, Meta held 44.45 billion USD in cash and marketable securities, ensuring a strong liquidity position. The company generated 30 billion USD in operating cash flow during the quarter, further strengthening its cash reserves.

Meta also retains broad access to debt markets. Following the earnings release, reports emerged of plans to issue up to 30 billion USD in bonds with maturities ranging from five to forty years. This would mark the largest bond placement in Meta’s history, demonstrating the company’s ability to secure long-term financing for major investment projects, including AI infrastructure development and data centre expansion.

- Debt and leverage: the company’s debt consists mainly of senior unsecured notes totalling 28.83 billion USD, with maturities ranging from 2027 to 2064. According to its 10-Q filing, interest-bearing liabilities amount to approximately 1.38 billion USD short-term and 26.94 billion USD long-term.

Meta’s net cash position remains positive: taking into account 44.45 billion USD in cash and securities, the company holds about 15.6 billion USD in net cash, which provides low refinancing risk and a strong buffer against volatility in the advertising market.

- Cash flow and dividends: in Q3 2025, Meta generated 30 billion USD in operating cash flow, while capital expenditure, including lease obligations, totalled around 19.37 billion USD. Free cash flow (FCF) for the quarter stood at 10.6 billion USD, and 29.5 billion USD year-to-date.

Returning capital to shareholders remains a top priority for the company. During the quarter, Meta allocated 3.16 billion USD to share buybacks and 1.33 billion USD to dividend payments. Over the first nine months of the year, total shareholder returns amounted to about 30 billion USD – almost entirely covered by internal cash generation. This indicates that the company’s shareholder distributions are fully supported by underlying cash flow.

Management raised its annual investment forecast to 70–72 billion USD and cautioned that capital and operating expenses will continue to rise in 2026, driven by the rapid expansion of data centres and AI infrastructure.

Conclusion – fundamental analysis of META:

Meta remains a financially robust company. Its core advertising business continues to grow at double-digit rates, and an operating margin of around 40% underscores the efficiency of its main revenue engine – the Family of Apps.

The company has substantial liquidity and a positive net cash position, allowing it to finance large-scale AI infrastructure investments without resorting to short-term borrowing. The decline in net income reported for Q3 2025 reflects a one-off accounting adjustment; excluding this, both profitability and cash flows remain strong.

The main risks include increasing capital expenditure through 2025–2026, rising lease and long-term cloud commitments, and continued losses at Reality Labs. Nevertheless, if management maintains cost discipline and successfully translates AI investments into higher advertising revenue and new products, Meta should be able to continue paying dividends and conducting share buybacks using internally generated cash flow without weakening its balance sheet.

Expert forecasts for Meta Platforms, Inc. stock for 2025

- Barchart: 45 out of 57 analysts rated Meta Platforms shares as a Strong Buy, 3 as a Buy, 8 as Hold, and 1 as Strong Sell. The highest price target is 1,117 USD, and the lowest is 560 USD.

- MarketBeat: 41 out of 48 specialists rated the stock as a Buy, and 7 as Hold. The highest price target is 1,120 USD, and the lowest is 605 USD.

- TipRanks: 34 out of 46 analysts rated the shares as a Buy, 7 as Hold, and 1 as Sell. The highest price target is 1,120 USD, and the lowest is 655 USD.

- Stock Analysis: 19 out of 45 experts rated the stock as a Strong Buy, 22 as a Buy, and 4 as Hold. The highest price target is 1,117 USD, and the lowest is 645 USD.

Meta Platforms, Inc. stock price forecast for 2025

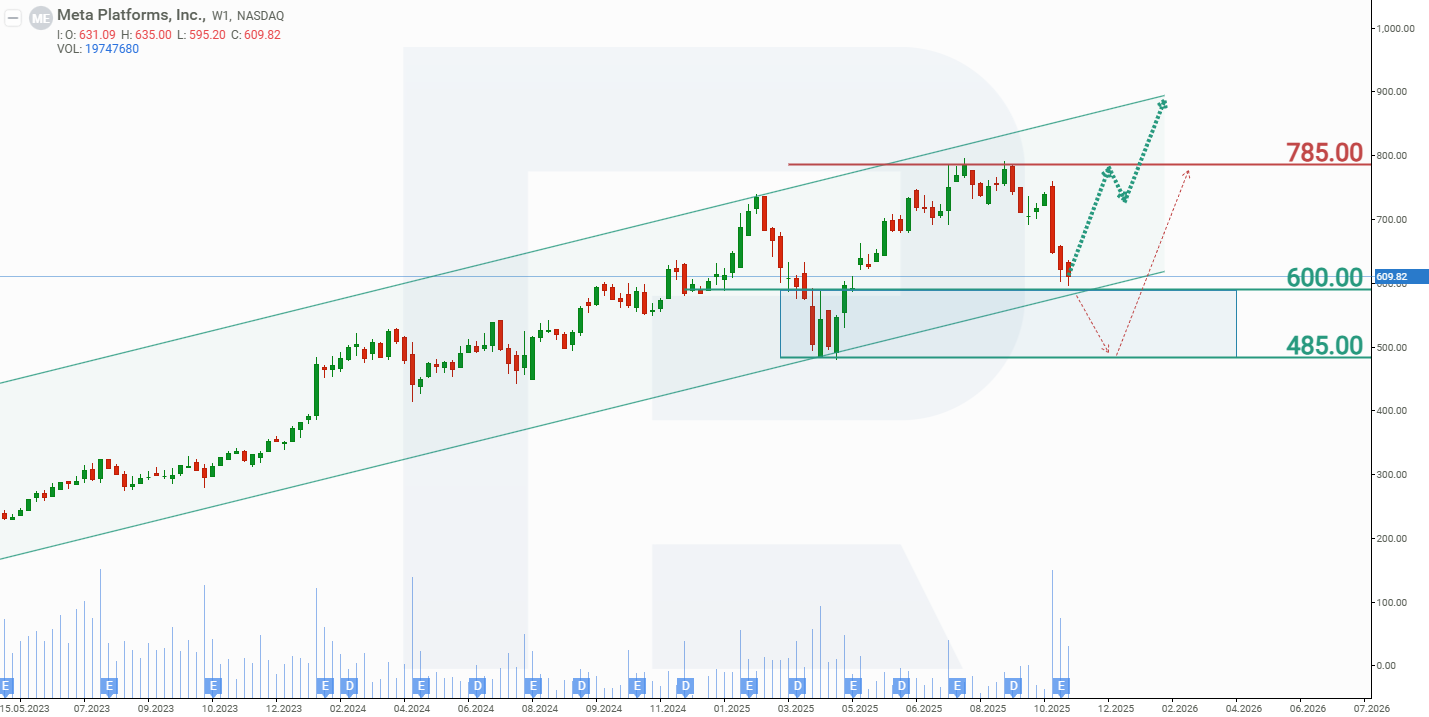

On the weekly chart, Meta Platforms shares are trading within an upward channel. The negative investor reaction to the earnings report led to a sharp decline in META’s share price, bringing it down to the trendline around 600 USD, which serves as a key support level. Based on the current performance of Meta Platforms shares, the potential scenarios for 2025 are as follows:

The base-case forecast for Meta Platforms shares anticipates a rebound from support at 600 USD, signalling the end of the correction and the resumption of META’s uptrend. The next upside target is resistance at 785 USD, and if this level is breached, the share price could advance towards the upper boundary of the channel near 900 USD.

The alternative forecast for Meta Platforms stock projects a breakdown of support at 600 USD. In this scenario, the price could decline towards 485 USD, where demand for META shares is expected to increase, given the company’s strong financial position and its ability to invest in AI without significantly increasing its debt load. A rebound from support at 485 USD would then signal a potential rise towards 785 USD.

Meta Platforms, Inc. stock analysis and forecast for 2025Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.