FedEx Corporation: strong Q2 2026 report, stock valuation and forecast for 2026

FedEx Corporation reported better-than-expected results for Q2 2026 of the fiscal year and raised its full-year forecast, confirming business resilience amid a strong Express segment.

FedEx Corporation (NYSE: FDX) posted strong results for Q2 2026 of the fiscal year. Non-GAAP revenue reached 23.5 billion USD, operating income – 1.61 billion USD, operating margin – 6.9%, net profit – 1.14 billion USD, earnings per share – 4.82 USD. All key indicators rose significantly year-over-year. The report outperformed market expectations. Analysts expected around 22.8 billion USD in revenue and just over 4 USD in EPS, but the actual results were significantly higher.

The overall business improved due to the Express segment. Higher shipment yields and package volumes supported revenue and margins. The Freight segment appeared weaker. Volumes declined and profitability worsened due to one-time costs of 152 million USD related to the spin-off preparation.

Amid the strong quarter, FedEx Corporation raised its forecast for the entire 2026 fiscal year. The company expects revenue growth of 5–6% and non-GAAP EPS in the range of 17.80–19.00 USD. Plans to complete the FedEx Freight spin-off on 1 June 2026 remain confirmed.

At the same time, FedEx warns that the next quarter may be weaker. Profit will come under pressure due to additional costs of up to 175 million USD. These relate to the temporary replacement of air capacity following the grounding of part of the MD-11 fleet and ongoing Freight spin-off expenses.

This article covers FedEx Corporation, lists the sources of its revenue, summarises FedEx’s recent quarterly performance, and outlines expectations for the 2026 fiscal year. Additionally, it includes technical analysis of FDX and builds a stock forecast for the 2026 calendar year.

About FedEx Corporation

FedEx Corporation is an American logistics company founded in 1971 by Frederick Smith. The company provides global express delivery, freight transportation, logistics, and e-commerce services. In 1978, it went public through an IPO on the NYSE, where its stock trades under the ticker FDX.

FedEx holds a leading position in the global logistics and delivery market, though its market share varies by region and delivery segment. Major competitors include Amazon Logistics, DHL, and United Parcel Service, Inc. (NYSE: UPS).

Image of the company FedEx CorporationFedEx Corporation’s business model

FedEx’s business model is centred around providing logistics and transportation services, primarily express delivery and freight transportation. The company generates revenue from various business segments, each catering to different client categories: individuals, small and medium-sized enterprises, and large corporations. The main sources of the company’s income are as follows:

- FedEx Express : one of the key segments responsible for the fast delivery of parcels and documents worldwide. Revenue is generated through tariffs based on weight, distance, and delivery speed

- FedEx Ground : ground delivery of freight and parcels, which is typically slower but more cost-effective than air transportation. This segment is popular among small and medium-sized enterprises, as well as in the e-commerce sector

- FedEx Freight : this segment transports freight across the US and international routes, focusing on large and heavy cargo.

- FedEx Services : provides logistics and business solutions, including supply chain management, IT services, and e-commerce support for corporations

- FedEx Office : offers retail and business services, including document printing, mailbox rentals, and package handling and shipping at service points

The company reports on two segments – FedEx Express and FedEx Freight – with other divisions categorised under ‘Other Income’.

FedEx Corporation Q1 FY2025 report

On 19 September 2024, FedEx posted disappointing results for the Q1 fiscal year 2025, which ended on 31 August 2024. Below are the key figures compared to last year’s corresponding period:

- Revenue : 21.60 billion USD (-0.5%)

- Net income : 890 million USD (-26.0%)

- Earnings per share : 3.60 USD (-21.0%)

- Operating margin : 5.20% (-190 basis points)

Revenue by segment:

- FedEx Express : 18.30 billion USD (-1.0%)

- FedEx Freight : 2.32 billion USD (-2.0%)

- Other and eliminations : 945 million USD (+9.0%)

The fundamental analysis of FedEx’s report indicated stagnant revenue despite increased expenses. Transportation costs rose by 5% to 5.27 billion USD, and business optimisation costs increased by 22% to 128 million USD. As a result, net income declined from 1.16 billion to 0.89 billion USD. Analysts’ forecasts were not met: revenue was expected to be 360 million USD higher (21.96 billion USD), and earnings per share were projected at 4.86 USD, above the actual 3.60 USD. Following the report’s release, FedEx stock plunged by over 15%.

If the logistics company shows no revenue growth, this may indicate a slowdown in the US economy. Additional pressure came from a 0.50% Federal Reserve interest rate cut, which may suggest the peak of economic growth.

FedEx’s outlook for the fiscal year 2025 was cautious, with revenue expected to rise moderately and the EPS forecast lowered from 18.25-20.25 USD to 17.90-18.90 USD.

FedEx CEO Rajesh Subramaniam noted that the weak results were due to reduced demand for express deliveries, higher operating costs, and a downturn in industrial production. Despite cautious optimism about the second half of 2024, the company maintained a moderate outlook due to economic uncertainty.

FedEx Corporation Q2 FY2025 report

On 19 December 2024, FedEx posted disappointing results for the Q2 fiscal year 2025, discouraging investors again. Below are the main highlights:

- Revenue : 22.00 billion USD (-1.0%)

- Net income : 0.99 billion USD (-1.9%)

- Earnings per share : 4.05 USD (+1.5%)

- Operating margin : 5.60% (+10 basis points)

Revenue by segment:

- FedEx Express : 18.84 billion USD (+0.3%)

- FedEx Freight : 2.18 billion USD (-11.2%)

- Other and eliminations : 949 million USD (+0.9%)

FedEx’s management, commenting on the 1% revenue decline, attributed it to a challenging economic environment, particularly the weakness in the US industrial economy and the expiration of its air freight contract with the US Postal Service (USPS), which ended on 29 September 2024 and had previously generated approximately 2 billion USD in annual revenue. However, there were also positive developments, including a 9% increase in international export parcel volume and cost-saving benefits from the DRIVE program, which resulted in savings of 540 million USD in the last quarter.

The company also highlighted the completion of a one billion USD share buyback and announced plans to spin off FedEx Freight into a separate publicly traded company within the next 18 months to increase stockholder value.

For Q3 of the fiscal year 2025, management expects positive effects from increased DRIVE savings and higher revenue due to the Cyber Week event dedicated to cybersecurity, digital technology, and the IT industry. However, these benefits may be offset by the loss of the USPS contract.

The fiscal 2025 outlook expects revenue to remain approximately the same as last year. The EPS forecast has been adjusted to a range between 19.00 USD and 20.00 USD, down from 20.00 USD to 21.00 USD.

FedEx Corporation Q3 FY2025 report

On 20 March 2025, FedEx reported disappointing results for Q3 of the fiscal year 2025, discouraging investors again. Below are the key figures:

- Revenue : 22.20 billion USD (+0.9%)

- Net income : 1.09 billion USD (+12.3%)

- Earnings per share : 4.51 USD (+16.8%)

- Operating margin : 6.70% (+40 basis points)

Revenue by segment:

- FedEx Express : 19.81 billion USD (+2.7%)

- FedEx Freight : 2.08 billion USD (+27.2%)

- Other and eliminations : 890 million USD (+3.3%)

In his commentary on the report, Rajesh Subramaniam noted revenue growth in Q3 compared to the same period last year, marking the first such increase in fiscal year 2025. He stated that FedEx improved profitability despite a particularly challenging operating environment, which included a busy festive season and severe weather conditions. Management also emphasised the success of the DRIVE program, which helped save 600 million USD in costs during the quarter, contributing to a 12% rise in adjusted operating income, which increased to 1.8 billion USD from the previous year.

FedEx’s management expressed cautious optimism regarding its Q4 fiscal year 2025 outlook. The company is expected to continue pursuing its revenue quality strategy and increase cost savings from the DRIVE program. Specifically, it projects closing Q4 FY2025 with annual cost savings exceeding 2.2 billion USD, in line with its target for the full fiscal year 2025.

However, management also anticipates ongoing challenges in the FedEx Freight segment, though these are expected to ease somewhat compared to previous quarters. Revenue in the FedEx Express segment is forecast to remain nearly unchanged, while the FedEx Freight segment is expected to experience a decline in revenue compared to the prior year.

FedEx revised its full fiscal year 2025 forecast downward, now expecting EPS to range from 18.00 USD to 18.60 USD, down from 19.00-20.00 USD. This revision reflects ongoing economic challenges and uncertainty regarding global trade policies under the Donald Trump administration.

FedEx Corporation Q4 FY2025 report

On 24 June 2025, FedEx released its Q4 FY2025 results, which this time exceeded investor expectations. Key performance indicators are as follows:

- Revenue : 22.21 billion USD (+1%)

- Net profit : 1.46 billion USD (+9%)

- Earnings per share (EPS) : 6.07 USD (+12%)

- Operating margin : 8.4% (+150 basis points)

Revenue by Segment:

- FedEx Express : 18.98 billion USD (+1%)

- FedEx Freight : 2.30 billion USD (−4%)

- Other and eliminations : 946 million USD (+2%)

FedEx delivered a solid performance in Q4 FY2025, with adjusted EPS of 6.07 USD on revenue of 22.2 billion USD – both metrics exceeding expectations, despite only modest year-on-year revenue growth.

Instead of issuing full-year guidance, FedEx provided a limited outlook for Q1 FY2026, forecasting revenue growth between 0% and 2% and adjusted EPS in the range of 3.40–4.00 USD. This forecast was below analyst expectations.

There are, however, encouraging signals. The company has already achieved 2.20 billion USD in cost savings through the DRIVE program and expects a further 1.00 billion USD in FY2026, supported by both DRIVE and the Network 2.0 initiative. According to CEO Raj Subramaniam, around 200 million USD of these savings will be realised in the first quarter, with the main impact expected mid-year.

FedEx also continues to return capital generously to shareholders. The annual dividend was increased by 5% to 5.80 USD, and 2.10 billion USD remains under its share buyback program. Cash flow remains strong, with a conversion rate of nearly 90% over the past year.

A potential weakness is management’s decision not to provide full-year guidance, which underlines the ongoing external uncertainty – particularly concerning trade tariffs between the US, China, and Europe. Additional pressure comes from reduced freight volumes from Asia to the US, the expiration of the USPS contract, and continued weakness in the B2B segment. However, FedEx is actively shifting its focus to higher-margin, oversized shipments. It has signed a new rural delivery agreement with Amazon, which may help offset some of the pressure on revenue.

The Q4 FY2025 report demonstrated the company’s resilience in an unstable global environment, with effective cost control adding to investor confidence. In addition, shareholders continue to receive generous payouts. However, the cautious outlook and global risks offer little room for short-term optimism.

For long-term investors, the key question remains whether FedEx can successfully translate its structural reforms and network improvements into profit growth by mid-FY2026. If so, the current share price may represent an attractive entry point.

FedEx Corporation Q1 FY2026 report

On 18 September 2025, FedEx published its results for Q1 FY2026, which ended on 31 August 2025. The key figures are as follows:

- Revenue : 22.24 billion USD (+3% year-on-year)

- Net profit : 0.91 billion USD (+2% year-on-year)

- Earnings per share : 3.83 USD (+6% year-on-year)

- Operating margin : 5.8% (+20 basis points)

Revenue by segment:

- FedEx Express : 19.12 billion USD (+4% year-on-year)

- FedEx Freight : 2.26 billion USD (–3% year-on-year)

- Other and eliminations : 871 million USD (+60% year-on-year)

FedEx delivered Q1 FY2026 results ahead of expectations. Revenue reached 22.2 billion USD (+3% year-on-year), adjusted EPS was 3.83 USD (+6% year-on-year), and the non-GAAP operating margin expanded to 5.8% (+20 bps). Consensus had forecast around 21.66 billion USD in revenue and 3.68 USD in EPS.

Among the negative factors in the quarter were trade barriers and tariffs: the removal of the de minimis regime (duty-free import of low-value goods) reduced quarterly revenue by 150 million USD and, according to FedEx, could cost up to around 1 billion USD for the full year. International export volumes fell 3%, while rising wages and transport costs, the expiry of the USPS contract, and a one-off tax expense of 16 million USD further weighed on performance. The FedEx Freight segment also posted weaker operating results.

On the positive side, the domestic US market remained resilient, with average daily parcel volume rising 4% and revenue per parcel increasing 2%. The effects of the ongoing cost-saving program (target: 1 billion USD) supported margins. The company also repurchased 0.5 billion USD worth of shares and ended the quarter with 6.2 billion USD in cash. Additionally, it announced an average tariff increase of 5.9% effective from 5 January 2026 and confirmed the planned spin-off of FedEx Freight into a standalone public company by June 2026.

Management forecasts FY2026 revenue growth of 4–6% and adjusted EPS in the range of 17.20–19.00 USD. Planned targets include capital expenditure of approximately 4.5 billion USD, an effective tax rate of around 25%, and delivery of 1 billion USD in structural cost savings. No quarterly guidance was issued for Q2, but the company expects a moderately strong peak season, characterised by a slight increase in average daily peak volumes and growth in total peak traffic, implying a sequential improvement in Q2 compared to Q1, while risks from international trade remain.

FedEx Corporation Q2 2026 earnings report

On 18 December 2025 calendar year, FedEx presented results for Q2 2026 of the fiscal year, which ended on 30 November 2025. Below are the key figures:

- *Revenue* : 22.47 billion USD (+3%)

- *Net profit* : 1.14 billion USD (+15%)

- *Earnings per share* : 4.82 USD (+19%)

- *Operating margin* : 6.9% (+60 basis points)

Revenue by Segment:

- *FedEx Express* : 20.43 billion USD (+8%)

- *FedEx Freight* : 2.14 billion USD (-2%)

- *Other and eliminations* : 897 million USD (-5%)

In Q2 2026 of the fiscal year (ended 30 November 2025), FedEx delivered strong non-GAAP results: revenue amounted to 23.5 billion USD (+7% y/y), net profit – 1.14 billion USD (+15% y/y), earnings per share – 4.82 USD (+19% y/y), and the operating margin rose to 6.9% from 6.3% a year earlier. The company exceeded analysts’ expectations: the market expected EPS around 4.12 USD and revenue of 22.8 billion USD.

The main growth came from FedEx Express, where both volumes and tariffs increased – average daily parcel volume rose by 5%, and revenue per delivery also improved. As a result, the segment’s operating profit grew significantly, and the margin rose to 7.6% versus 5.6% a year earlier.

The weak spot in the quarter was FedEx Freight, where revenue slightly declined and the margin dropped to 4.2% (compared to 14.3% a year ago) due to one-off expenses related to spin-off preparation (around 152 million USD). Without these costs, the Freight results would have looked stronger.

Management upgraded the full-year 2026 fiscal forecast. The company now expects revenue growth of 5–6% and EPS of 17.80–19.00 USD. FedEx also reaffirmed its cost reduction plan of 1 billion USD and capital expenditures of 4.5 billion USD. However, the next quarter may see temporary costs of about 175 million USD due to the suspension of part of the MD-11 aircraft fleet, which could slightly reduce profitability.

Fundamental analysis of FedEx Corporation

Below is the fundamental analysis of FDX as of Q2 2026 of the fiscal year:

- *Liquidity and balance sheet* : At the end of Q2 2026 of the fiscal year, FedEx held 6.57 billion USD in cash, 20.65 billion USD in current assets, and 16.21 billion USD in short-term liabilities. The current ratio stands at around 1.27, and working capital amounts to 4.44 billion USD. This indicates that the company can cover its near-term obligations without needing to sell long-term assets. Compared to the end of the 2025 fiscal year (ended 31 May 2025), liquidity improved – cash increased by 1.07 billion USD, and working capital by 1.46 billion USD. An important nuance is that a significant part of current assets is accounts receivable (12.16 billion USD), so liquidity depends on how quickly corporate clients make payments.

- *Cash flows* : The trajectory of cash flows shows improvement. For the 12 months ending 30 November 2025, operating cash flow was 8.20 billion USD, capital expenditures amounted to 3.85 billion USD, and free cash flow stood at 4.35 billion USD. Compared to the 2025 fiscal year, free cash flow is higher (4.35 billion USD vs. 2.98 billion USD) – a direct positive for financial stability, as it allows simultaneous funding for investments, dividends, and debt reduction. That said, FedEx is a capital-intensive business, so even a good free cash flow often appears modest relative to revenue – not critical for the industry, but it means a demand downturn quickly impacts free cash generation.

- *Debt burden* : As of 30 November 2025, total debt including leases stood at 37.77 billion USD, and net debt at 31.20 billion USD. This is a notable burden: net debt is about 1.1 times equity. On the other hand, with the current cash generation, the debt load looks manageable. Net debt is about 3.8 times operating cash flow over the past 12 months, and operating cash flow covers interest payments nearly 10 times. What is critical is that a significant part of the debt consists of leases (lease obligations), which reduce flexibility in a market downturn since these payments are harder to quickly remove from costs.

Conclusion on the fundamental analysis of FDX:

In Q2 2026 of the fiscal year, FedEx’s financial position improved – liquidity and working capital increased, and free cash flow strengthened significantly. This enhanced the company’s resilience and allowed it to weather periods of weak demand while simultaneously financing network upgrades. The main risks remain high fixed obligations in the form of debt and leases, and dependency on shipping volumes, which means that in the event of an economic slowdown, profit and cash flow may decline quickly. Operationally, the quarter exceeded expectations, with EPS of 4.82 USD, and management raised the full-year earnings forecast to the 17.80–19.00 USD range, while warning of potential additional costs in the next quarter due to the temporary grounding of part of the fleet and expenses related to the Freight spin-off.

Analysis of key FedEx Corporation valuation multiples

Below are the key FedEx Corporation valuation multiples as of Q2 2026 of the fiscal year, calculated based on a share price of 290 USD.

| Multiple | What it indicates | Value | Comment |

|---|---|---|---|

| P/E (TTM) | Price paid for 1 USD of earnings over the past 12 months | 15 | ⬤ Normal level. The price already reflects the effect of cost-saving programmes and margin improvementsия маржи |

| P/S (TTM) | Price paid for 1 USD of annual revenue | 0.7 | ⬤ Cheap based on revenue: the market pays less than one year of revenue for a global logistics network |

| EV/Sales (TTM) | Enterprise value to sales, accounting for debt | 0.9 | ⬤ Even with debt included, the business is valued below one year of revenue – for this scale, it’s a comfortable level |

| P/FCF (TTM) | Price paid for 1 USD of free cash flow | 18 | ⬤ Valuation close to average: the market needs confirmation of sustainable FCF after network optimisation |

| FCF Yield (TTM) | Free cash flow yield to shareholders | 6% | ⬤ Strong free cash flow yield: attractive for long-term investment compared to many defensive stocks |

| EV/EBITDA (TTM) | Enterprise value to operating profit before depreciation and amortisation | 8.5 | ⬤ Market gives a moderate premium for cost-cutting progress and margin improvement |

| EV/EBIT (TTM) | Enterprise value to operating profit | 12.5 | ⬤ Based on pure operating profit, FedEx is valued with a small premium relative to the norm for cyclical businesses |

| P/B | Price to book value | 2.6 | ⬤ Premium to book value is notable, but not extreme. The market pays for brand, network, and transformation programme benefits |

| Net Debt/EBITDA | Debt burden relative to EBITDA | 1.3 | ⬤ Moderate debt burden: at current EBITDA levels, the company could repay net debt relatively quickly |

| Interest Coverage (TTM) | Ability to cover interest expenses with operating profit | 7 | ⬤ Interest on debt is covered with a solid margin. Even if profit falls, there should be no issue servicing debt |

Conclusion on FDX valuation multiples:

Based on revenue and overall enterprise value, FedEx currently appears moderately undervalued. The company is not expensive relative to sales and has a degree of buffer if volumes decline. Based on earnings and free cash flow, valuation is closer to average: shares are trading at about 15 times annual profit, and the free cash flow yield is around 6%. The balance sheet is overall healthy – debt does not overburden the company, and interest is comfortably covered.

In conclusion, at current levels, FedEx stock has a fair valuation. This is a resilient but cyclical business. There is growth potential, but it will only materialise if the company maintains improved margins and avoids a sharp drop in volumes due to economic slowdown and the FedEx Freight spin-off.

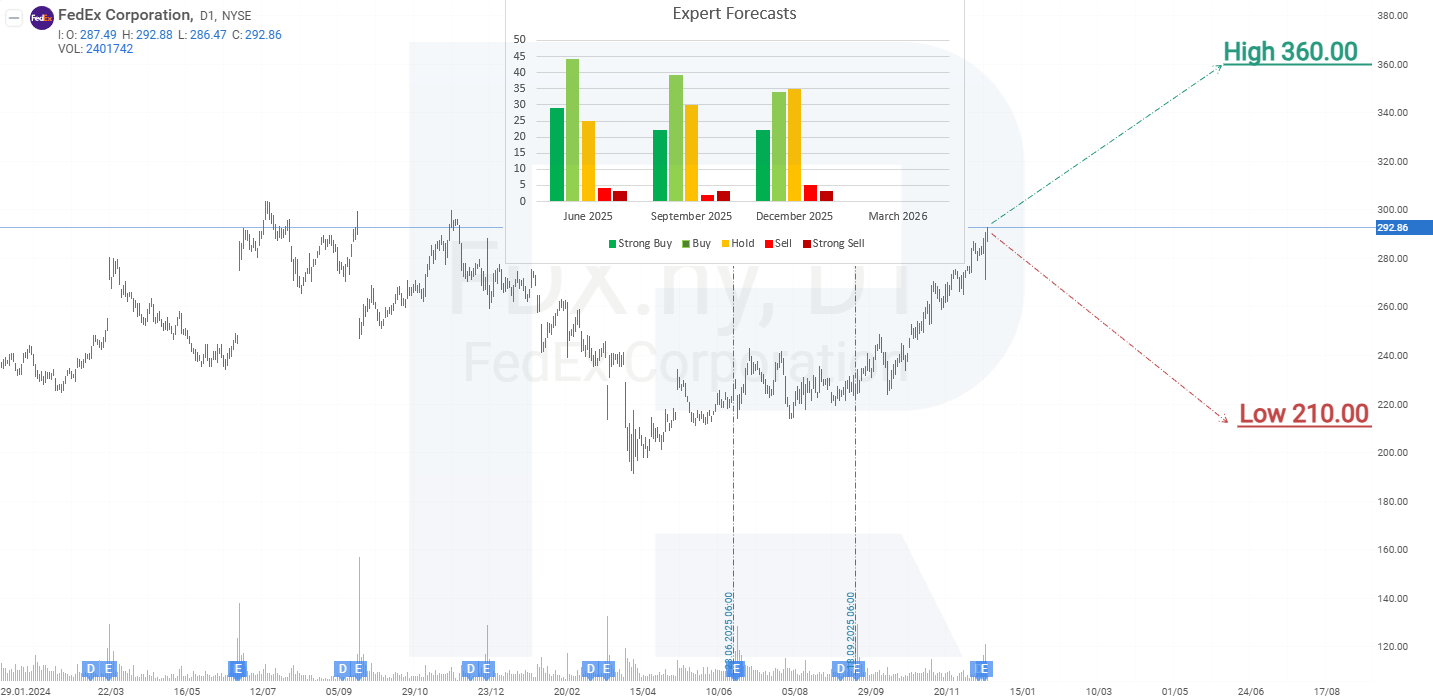

Expert forecasts for FedEx Corporation stock

- Barchart : 16 out of 28 analysts rated FedEx shares as Strong Buy, 2 as Moderate Buy, 9 as Hold, and 1 as Sell. The maximum target price for upside potential is 360 USD, and the lowest target for downside is 200 USD.

- MarketBeat : 16 out of 31 analysts rated the stock as Buy, 13 gave a Hold recommendation, and 2 rated it as Sell. The maximum target price for growth is 360 USD, and the lowest is 210 USD.

- TipRanks : 11 out of 19 respondents rated the stock as Buy, 7 gave a Hold recommendation, and 1 as Sell. The maximum target price for growth is 360 USD, and the minimum is 210 USD.

- Stock Analysis : 6 out of 19 experts rated the stock as Strong Buy, 5 as Buy, 6 as Hold, 1 as Sell, and 1 as Strong Sell. The maximum target price is 360 USD, and the minimum is 210 USD.

FedEx Corporation stock price forecast for 2026

FedEx shares are trading within an ascending channel. In November 2024, after reaching a peak at the 300 USD level, FDX quotes began to decline within a correction that lasted until April 2025. During this period, the stock price fell by approximately 35% – down to 190 USD. After the publication of the Q3 2025 fiscal year report, the situation with FedEx shares began to improve, and the quotes reversed upwards. Subsequently, driven by quarterly reports, FDX shares continued to rise and by December 2025 had once again approached resistance at 300 USD, fully recovering the drop that began in November 2024.

Based on the current trend in FedEx shares, the forecast for the company’s stock movement in the 2026 calendar year assumes a breakout above the 300 USD resistance with further growth towards the resistance line at 370 USD. The company has sufficient financial strength, and its valuation based on key multiples does not appear overheated, which lowers investor risk. An additional factor supporting this scenario is the macroeconomic background: the Federal Reserve is not in a rush to lower the key interest rate, indicating no signs of recession in the US economy. Under such conditions, demand for logistics and courier services, including freight and parcel deliveries, is likely to remain stable.

FedEx Corporation stock analysis and forecast for 2026Risks of investing in FedEx Corp stock

When investing in FedEx, it is essential to consider the risks the company may face. Below are the key factors that could negatively impact FedEx’s revenue:

- Economic sensitivity : FedEx’s financial performance is closely tied to the global economy. Economic downturns may lead to reduced demand for shipping services as businesses and consumers cut back on spending

- Intense competition : the logistics sector is highly competitive. FedEx faces significant pressure from major players such as UPS (NYSE: UPS) and DHL, as well as emerging competitors like Amazon (NASDAQ: AMZN), which is developing its own logistics network

- Fuel price volatility : as a logistics company, FedEx is heavily dependent on fuel prices. While fuel surcharges help offset costs, continuous price increases can raise shipment costs and lead to customer dissatisfaction due to higher tariffs, ultimately impacting revenue

- Dependence on the US market : a substantial portion of FedEx’s revenue is derived from the US. Economic challenges or market saturation within the US may limit growth opportunities and reduce overall revenue

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.