Broadcom delivers record results amid strong demand for AI infrastructure

Broadcom Inc. released strong results for Q4 2025, reporting revenue growth and a record EBITDA margin. The company remains one of the key beneficiaries of rising demand for AI infrastructure, maintaining high profitability and stable dividend payments.

Broadcom Inc. (NASDAQ: AVGO) delivered results for Q4 of the 2025 financial year that exceeded market expectations. Revenue reached 18.02 billion USD (+28% y/y), while earnings per share came in at 1.95 USD, above analysts’ forecasts. The main growth driver was AI chips and networking infrastructure: the semiconductor business expanded by 35% to 11 billion USD, while software revenue increased by 19% to 7 billion USD. The company continues to demonstrate strong profitability, with EBITDA of around 12.2 billion USD (68% of revenue) and free cash flow of 7.5 billion USD (41% of revenue). Broadcom also raised its quarterly dividend to 0.65 USD per share.

Management expects revenue to rise to 19 billion USD in Q1 of the 2026 financial year, while EBITDA margin is projected to remain at around 67%. Revenue from AI semiconductors is expected to increase to 8.2 billion USD, with the order backlog for AI solutions estimated at 73 billion USD over the next 18 months.

Overall, the company continues to grow rapidly on the back of strong demand for AI infrastructure and remains one of the most profitable players in the sector. However, high dependence on a small number of large customers and potential margin pressure in AI chips pose risks to the future valuation of the shares.

This article examines Broadcom Inc., outlines the sources of its revenue, summarises Broadcom’s quarterly performance, and presents expectations for 2026. It also includes a technical analysis for AVGO shares, on the basis of which a forecast for Broadcom shares for 2026 is developed.

About Broadcom Inc.

Broadcom Inc. is a US-based technology company specialising in developing chips for networking equipment, servers, data centres, wireless communications, and software for cloud and enterprise solutions. Founded in 1961 as a division of HP, it was spun off as Avago Technologies in 1991. In 2009, Avago Technologies went public on NASDAQ, and its shares have been traded under the ticker AVGO ever since. In 2016, Avago Technologies acquired Broadcom Corporation for 37.0 billion USD and adopted its name.

Image of the company name Broadcom Inc.Broadcom Inc.’s main revenue streams

Broadcom’s revenue is divided into two main segments:

- Semiconductor business : approximately 75% of revenue is derived from the sale of chips for data centres, cloud computing, AI accelerators, network processors, and chips for servers, storage, networking equipment, and wireless modules for smartphones and Wi-Fi.

- Infrastructure software : the remaining 25% of revenue comes from enterprise software for cloud computing, cybersecurity and networking solutions, VMware products, automation components, and DevOps platforms.

Broadcom Inc. Q1 2025 financial results

On 6 March, Broadcom released its Q1 2025 financial results for the period ended 2 February 2025. The key figures are as follows:

- Revenue : 14.9 billion USD (+25%)

- Net profit : 7.8 billion USD (+67%)

- Earnings per share (EPS) : 1.60 USD (+307%)

- Operating profit (non-GAAP) : 9.82 billion USD (+44%)

Net revenue by segment:

- Semiconductor solutions : 8.2 billion USD (+55%)

- Infrastructure software : 6.7 billion USD (+47%)

Broadcom reported strong financial results for Q1 of the 2025 financial year, with revenue rising by 25% year-on-year. This growth was primarily driven by a 77% increase in AI-related revenue, which reached 4.1 billion USD, and a 47% rise in infrastructure software revenue, totalling 6.7 billion USD. The successful integration of VMware, acquired in 2023, also played a significant role in this expansion, strengthening Broadcom’s position in the enterprise software market.

CEO Hock Tan highlighted the strong demand for custom AI chips from cloud computing giants, which heavily invest in AI-driven data centres.

Looking ahead to Q2 2025, Broadcom expects revenue to reach 14.9 billion USD, slightly above analysts’ estimates. The company anticipates further growth in the AI semiconductor segment, with AI-related revenue projected to increase to 4.4 billion USD in the next quarter.

Broadcom Inc. Q2 2025 financial results

On 5 June, Broadcom published its earnings report for Q2 of the 2025 financial year, which ended on 4 May 2025. Below are its key figures:

- Revenue : 15.0 billion USD (+20%)

- Net income : 7.8 billion USD (+44%)

- Earnings per share (EPS) : 1.58 USD (+43%)

- Operating profit (non-GAAP) : 9.79 billion USD (+37%)

Net revenue by segment:

- Semiconductor solutions : 8.4 billion USD (+17%)

- Infrastructure software : 6.6 billion USD (+25%)

Broadcom’s Q2 report for the 2025 financial year painted a strong picture for investors, highlighting the company’s solid position in the AI and semiconductor sectors. Revenue rose by 20% from last year, largely driven by a rapid 46% increase in AI revenue to 4.4 billion USD. This growth reinforced Broadcom’s pivotal role as a supplier of custom AI chips and networking solutions to major companies, such as Google, Meta, and ByteDance.

In Q2 of the 2025 financial year, the company repurchased shares worth 3.2 billion USD. This demonstrated management’s confidence in the long-term value of the business and its ability to generate stable cash flow.

Broadcom issued an optimistic outlook for Q3, anticipating revenue of 15.8 billion USD, slightly above Wall Street’s expectations. CEO Hock Tan emphasised that AI semiconductor revenue would increase to 5.1 billion USD next quarter, marking the tenth consecutive quarter of growth. This guidance reflected the company’s confidence in sustained demand for its AI and networking products, including the recently unveiled Tomahawk 6 switch, which enhances network performance and efficiency for AI workloads.

Despite strong financial results and a positive outlook, Broadcom’s shares fell by 5% following the release of the report. Market participants were concerned about a potential slowdown in the AI market, which could lead the company to miss its targets. In addition, Broadcom’s stock price had surged by 92% in the last two months, highlighting a high valuation that may be difficult to sustain amid trade restrictions. Nevertheless, analysts remained optimistic about the company’s future. For instance, Japanese investment banking and securities firm Mizuho Securities named Broadcom one of the best semiconductor stocks, citing its high profitability and strong free cash flow, supported by AI trends.

Overall, Broadcom’s Q2 2025 results confirmed its strategic leadership in the AI and semiconductor sector, with continued investment in AI technology, robust relationships with key clients, and a positive outlook, making the company’s shares an attractive investment.

Broadcom Inc. Q3 2025 financial results

On 4 September, Broadcom released its Q3 results for the 2025 financial year, which ended on 3 August 2025. The key figures are as follows:

- Revenue : 15.95 billion USD (+22% year-on-year)

- Net income : 8.40 billion USD (+37% year-on-year)

- Earnings per share (EPS) : 1.69 USD (+36% year-on-year)

- Operating profit (non-GAAP) : 10.45 billion USD (+31% year-on-year)

Net revenue by segment:

- Semiconductor solutions : 9.17 billion USD (+26% year-on-year)

- Infrastructure software : 6.79 billion USD (+17% year-on-year)

Broadcom’s Q3 2025 financial results exceeded analyst expectations and confirmed the company’s resilience amid intense competition and a rapidly growing AI sector. Revenue reached 15.95 billion USD, up 22% compared with the same period last year. The primary growth driver was AI-related solutions, where revenue grew 63% year-on-year to 5.2 billion USD.

The revenue mix was still split between two key areas: semiconductors and infrastructure software. The semiconductor business accounted for more than 75% of total revenue, with the emphasis in the quarter under review placed on orders for hyperscale data centres. Broadcom reported that its backlog of contracted orders reached 110 billion USD, with around half attributable to the AI segment. In the software segment (including VMware), steady growth was observed, supported by the transition to a subscription model and a focus on cloud-based solutions.

The company’s financial performance remained strong. Non-GAAP operating profit amounted to approximately 10.7 billion USD, with an EBITDA margin of 67%. Adjusted earnings per share reached 1.69 USD (+36% year-on-year), exceeding the consensus forecast. Gross margin declined slightly due to the higher share of deliveries in the AI segment; however, this was offset by strong operating efficiency.

Management provided a positive outlook for Q4 of the 2025 financial year. Revenue was expected at 17.4 billion USD, up 24% from a year earlier and above analyst expectations. In the AI segment, Broadcom expected to generate 6.2 billion USD, which implied growth of 66% compared with the same quarter in 2024. The company also confirmed that it had secured a contract with a new hyperscale customer worth more than 10 billion USD for the supply of server solutions with AI accelerators (XPU), to be delivered over the coming years.

Broadcom Inc. Q4 2025 financial results

On 11 December, Broadcom released its Q4 results for the 2025 financial year, which ended on 2 November 2025. The key figures are as follows:

- *Revenue* : 18.02 billion USD (+28%)

- *Net income (non-GAAP)* : 9.71 billion USD (+39%)

- *Earnings per share (non-GAAP)* : 1.95 USD (+37%)

- *Operating income (non-GAAP)* : 12.22 billion USD (+34%)

*Net revenue by segment*:

- *Semiconductor solutions* : 11.07 billion USD (+35%)

- *Infrastructure software* : 6.94 billion USD (+19%)

Broadcom’s results for Q4 of the 2025 financial year were strong and exceeded market expectations. Revenue amounted to 18 billion USD (+28% y/y), compared with a forecast of 17.5 billion USD, while adjusted earnings per share (non-GAAP EPS) reached 1.95 USD, above analysts’ expectations (1.87 USD). The main growth driver was AI chips: revenue from the semiconductor segment increased to 11.1 billion USD (+35% y/y), of which 6.5 billion USD came from AI-related products (+74% y/y). The infrastructure software business, including VMware, also grew to 6.90 billion USD (+19% y/y). As a result, Broadcom continues to generate stable earnings from both hardware solutions and software infrastructure. The company maintains high profitability, with non-GAAP EBITDA of 12.2 billion USD (68% of revenue), free cash flow of 7.5 billion USD, and a 10% dividend increase to 0.65 USD per share.

The outlook for Q1 2026 is also positive. Expected revenue is 19.1 billion USD (+28% y/y), the EBITDA margin is projected at 67%, and sales of AI chips are expected to rise to 8.2 billion USD. Broadcom also stated that it has an order backlog for AI solutions of 73 billion USD over the next 18 months.

Fundamental analysis for Broadcom Inc.

Below is a fundamental analysis for AVGO based on the Q4 results of the 2025 financial year:

- *Revenue and profitability* : in Q4 of the 2025 financial year, Broadcom delivered strong non-GAAP results. Revenue rose by 28% y/y to 18.02 billion USD, while adjusted net income increased to 9.71 billion USD from 6.97 billion USD a year earlier. Non-GAAP EPS climbed to 1.95 USD (compared with 1.42 USD a year earlier). EBITDA reached 12.22 billion USD, corresponding to a margin of 68%, up from 65% a year earlier, indicating that the company not only expanded revenue but also improved profitability. Growth was primarily driven by the semiconductor segment (AI chips and related solutions) and infrastructure software, creating a resilient business model that combines fast-growing hardware solutions with stable, high-margin software.

- *Cash flow and liquidity* : Broadcom continues to demonstrate robust cash generation. In Q4 2025, operating cash flow amounted to 7.7 billion USD, while CapEx totalled just 0.24 billion USD, resulting in free cash flow of 7.47 billion USD (around 41% of revenue). Cash and equivalents increased to 16.18 billion USD at the end of the quarter (up from 10.72 billion USD previously). The company is actively returning capital to shareholders, having paid 2.8 billion USD in dividends (0.59 USD per share) and announcing an increase in the quarterly dividend to 0.65 USD. For the full 2025 financial year, operating cash flow reached 27.54 billion USD, and free cash flow amounted to 26.91 billion USD (+39% y/y) on revenue of 63.89 billion USD, providing a substantial buffer for shareholder returns and debt servicing.

- *Debt position* : in terms of absolute liabilities, Broadcom remains a sizeable borrower, but its debt profile appears moderate. As of mid-2025, total debt stood at around 64.2 billion USD, primarily in the form of long-term bonds rather than short-term borrowings. Over the year, debt declined slightly due to repayments and refinancing. With an annual adjusted EBITDA of around 43 billion USD, the debt/EBITDA ratio is approximately 1.5, while after accounting for around 16.2 billion USD in cash, net debt is roughly 48 billion USD, implying a net debt/EBITDA of about 1.1. For a capital-intensive semiconductor company, this is a low level of leverage. Earnings and cash flow comfortably cover interest expenses, and the presence of an undrawn credit facility further supports liquidity and financial flexibility.

Fundamental analysis for AVGO – conclusion

Based on the Q4 2025 results, Broadcom appears financially resilient and well-balanced. Revenue and earnings are growing at double-digit rates, the EBITDA margin stands at around 68%, and free cash flow comfortably covers dividends and potential share buybacks. The company combines strong growth in AI semiconductors and infrastructure software with robust cash flow and a solid balance sheet. The key risks relate not to leverage, but to potential pressure on margins and growth rates in the AI segment.

Analysis of key valuation multiples for Broadcom Inc.

Below are the key valuation multiples for Broadcom Inc. for Q4 of the 2025 financial year, calculated at a share price of 390 USD.

| Multiple | What it indicates | Value | Comment |

|---|---|---|---|

| P/E (TTM) | Price paid for 1 USD of earnings over the past 12 months | 169 | ⬤ An extremely high valuation even for a top-tier chipmaker. |

| P/S (TTM) | Price paid for 1 USD of annual revenue | 25 | ⬤ Extremely expensive, with the price reflecting a massive upfront premium for long-term growth in the AI business. |

| EV/Sales (TTM) | Enterprise value to sales, accounting for debt | 26 | ⬤ A very aggressive valuation. |

| P/FCF (TTM) | Price paid for 1 USD of free cash flow | 60 | ⬤ Based on current cash flow, Broadcom appears very expensive. |

| FCF Yield (TTM) | Free cash flow yield to shareholders | 1.7% | ⬤ Free cash flow provides a yield of just 1.7%, which is low, as the investment case assumes that FCF will increase significantly in the future. |

| EV/EBITDA (TTM) | Enterprise value to operating profit before depreciation and amortisation | 38 | ⬤ A very high valuation even for a leader in AI chips. |

| EV/EBIT (TTM) | Enterprise value to operating profit | 50 | ⬤ A high valuation with virtually no margin of safety if growth slows. |

| P/B | Price to book value | 21 | ⬤ The market is paying 21 USD for 1 USD of book equity, reflecting very high expectations and a large share of intangible assets. |

| Net Debt/EBITDA | Debt burden relative to EBITDA | 1.1 | ⬤ Debt levels remain moderate. |

| Interest Coverage (TTM) | Ability to cover interest expenses with operating profit | 11 | ⬤ Interest expenses are well covered by operating profit. |

Valuation multiples analysis for AVGO – conclusion

From a financial standpoint, Broadcom appears very resilient: the company is delivering record levels of revenue, earnings, EBITDA, and free cash flow, while net debt relative to EBITDA remains moderate. However, at the current market capitalisation, all key valuation multiples – across revenue, earnings, EBITDA, and free cash flow – are firmly in the red zone, making the shares highly expensive. Such a valuation is justified only if the AI segment continues to grow rapidly for several more years without a decline in margins.

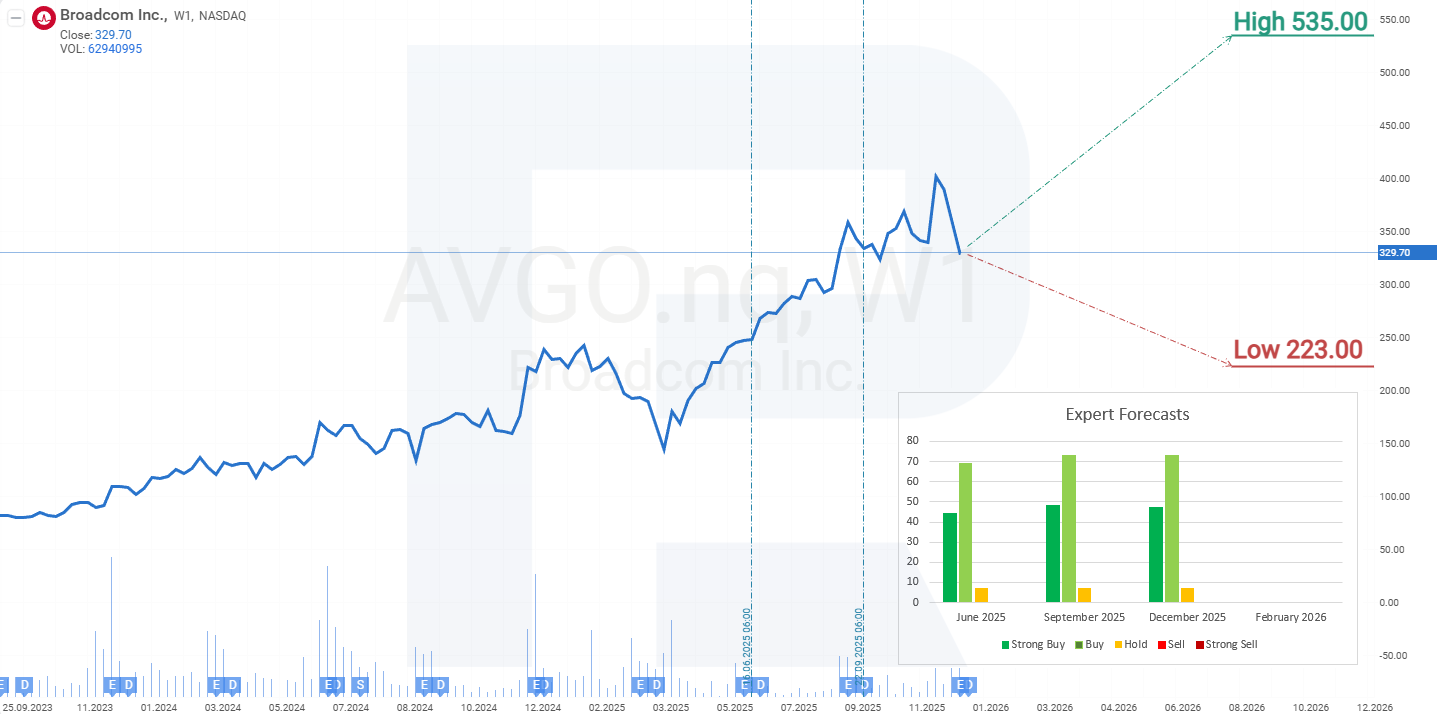

Expert forecasts for Broadcom Inc. stock

- *Barchart* : 34 of 40 analysts rated Broadcom shares as Strong Buy, 3 as Buy, and 3 as Hold. The upper price target is 535 USD, and the lower bound is 375 USD.

- *MarketBeat* : 31 of 33 analysts assigned a Buy rating to the shares, and 1 gave a Hold recommendation. The upper price target is 500 USD, and the lower bound is 300 USD.

- *TipRanks* : 27 of 29 surveyed analysts rated the shares as Buy, and 2 gave Hold recommendations. The upper price target is 525 USD, and the lower bound is 390 USD.

- *Stock Analysis* : 13 of 26 experts rated the shares as Strong Buy, 12 as Buy, and 1 as Hold. The upper price target is 500 USD, and the lower bound is 223 USD.

Broadcom Inc. stock price forecast for 2026

In July 2025, Broadcom shares broke above the upper boundary of an ascending channel and extended their advance, rising by an amount equal to the channel’s width, which represented the technical target of the move. As a result, an all-time high was established at 415 USD. However, a valuation above 400 USD already implied a noticeable premium to fair value, and following the release of the Q3 2025 results, some investors opted to lock in profits, leading to a decline of around 20%.

The move towards 415 USD was accompanied by pullbacks and increased volatility, which further signalled buyer fatigue and a willingness among short-term participants to exit positions. As of December 2025, the shares are trading near a key support level around 320 USD. The Q4 2025 results were strong and confirmed that Broadcom is generating sufficient cash both to invest in its AI segment and to pay rising dividends, reducing the incentive for long-term investors to cut positions. Against this backdrop, the majority of analysts maintain positive or neutral recommendations on AVGO.

Based on the current performance of Broadcom shares, the forecast for Broadcom Inc. stock implies a decline towards the channel support line at around 300 USD. A rebound from this level would indicate the end of the correction and a resumption of growth within the upward trend, with the next upside target at the resistance line around 450 USD.

Broadcom Inc. stock analysis and forecast for 2026Risks of investing in Broadcom Inc. stock

When investing in Broadcom’s stock, it is essential to consider the risks the company may face. Below are the key events that could negatively impact Broadcom’s revenue:

- *A slowdown in artificial intelligence spending* : as AI is a key growth driver, any reduction in spending due to market saturation, an economic downturn, or shifting priorities could directly affect semiconductor revenue. Although investor expectations for AI-related growth are high, slower-than-expected progress could undermine investor confidence and earnings forecasts.

- *Dependence on key clients* : CEO Hock Tan has mentioned three major cloud clients developing their own AI chips. If these companies succeed, their reduced reliance on Broadcom could harm the profitability of its semiconductor segment.

- *Geopolitical and trade risks* : Broadcom is exposed to risks from escalating trade tensions between the US and China. Potential tariffs under the Trump administration or export restrictions on AI chips to China could disrupt supply chains or limit access to traditional markets.

- *Competition in the semiconductor sector* : Broadcom faces competitive pressures from companies like AMD and NVIDIA in the AI and networking solutions space. NVIDIA’s dominance in AI GPUs and the potential revival of Intel (with Broadcom reportedly interested in its chip business) could reduce Broadcom’s market share.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.