Alibaba strengthens its position in cloud and AI, prioritising growth over profitability

Alibaba reported revenue growth and solid progress in its cloud and AI segments, though profitability declined significantly due to rising expenses and investment. Despite this, Alibaba’s shares remain in an upward trend.

Alibaba’s September 2025 quarter was mixed: revenue rose 5% year-on-year to 34.8 billion USD, slightly ahead of analyst expectations. Excluding the divested Sun Art and Intime businesses, organic growth would have been around 15% y/y. However, profitability disappointed – non-GAAP net income fell 72% to 1.45 billion USD, and adjusted EPS of about 0.61 USD came in roughly 20% below market forecasts.

The strongest performance came from the cloud and artificial intelligence segments: the Cloud Intelligence Group reported 34% revenue growth year-on-year, domestic e-commerce expanded by 16%, and international operations increased by 10%. Yet, much of this profit gain was offset by higher spending on subsidies, marketing, and logistics in quick commerce, as well as growing investment in AI infrastructure.

While management did not provide specific profit or revenue guidance, it noted that the September quarter likely marked the peak in quick-commerce subsidy spending, with profitability per order and overall cost efficiency expected to improve over the coming quarters.

This article examines Alibaba Group Holding Limited, outlining its main revenue sources and providing a fundamental analysis of Alibaba Group (BABA), as well as a technical analysis of BABA shares, forming the basis for the Alibaba stock forecast for 2025.

About Alibaba Group Holding Limited

Alibaba Group Holding Limited is the largest Chinese technology company. Founded in 1999 in Hangzhou by Jack Ma (also known as Ma Yun) and his team, the company operates in e-commerce, cloud computing, financial technologies, logistics, and the media and entertainment sectors. Its platforms (AliExpress, Taobao, and Tmall) connect millions of buyers and sellers worldwide. Alibaba is also actively advancing Artificial Intelligence (AI) and innovative technologies, playing a pivotal role in the global digital economy.

Alibaba’s initial public offering (IPO), which raised USD 25.0 billion, took place on 19 September 2014 on the New York Stock Exchange under the ticker symbol BABA. At the time, it was the largest IPO in history.

Image of the company name Alibaba Group Holding LimitedAlibaba Group Holding Limited’s main financial flows

Alibaba Group’s revenue streams are divided into the following key areas:

- E-commerce : revenues from Alibaba.com, AliExpress, Lazada, Taobao, and Tmall platforms, as well as commissions from sales, advertising services, and subscriptions.

- Cloud computing : revenue from Alibaba Cloud for providing cloud solutions, including data storage, AI-based products, analytical forecasts, and corporate technologies.

- Logistics : financial proceeds from the services of Cainiao Network, a logistics platform that facilitates domestic and international deliveries.

- Media and entertainment : revenue from digital services, such as the streaming platform Youku, film production, content creation, and advertising.

- Financial technology : through its partnership with Ant Group, Alibaba generates revenue from providing financial and payment services.

- Other services : this includes revenues from Alibaba Health, Lingxi Games, Freshippo, Intime, Sun Art, intellectual information platforms, Fliggy, DingTalk, and other company divisions. Revenue in this segment is mainly derived from direct sales.

The main contributor to the financial flow is the e-commerce segment, particularly domestic operations in the Chinese market.

Alibaba Group Holding Limited – September 2024 quarterly earnings results

On 15 November 2024, Alibaba Group Holding Limited released its quarterly results for the period ended on 30 September 2024. The key figures from the report are outlined below:

- Revenue : 33.70 billion USD (+5%)

- Net income : 6.20 billion USD (+63%)

- Earnings per share : 2.59 USD (+69%)

Revenue by segment:

- Taobao and Tmall Group : 14.10 billion USD (+1%)

- Cloud Intelligence Group : 4.22 billion USD (+7%)

- International Digital Commerce Group : 4.51 billion USD (+29%)

- Cainiao Smart Logistics Network : 3.51 billion USD (+8%)

- Local Services Group : 2.52 billion USD (+14%)

- Digital Media and Entertainment Group : 0.81 billion USD (–1%)

- All others : 7.43 billion USD (+9%)

In comments on the results, CEO Eddie Wu highlighted robust revenue growth from cloud solutions and AI products. He also cited strategic agreements with key partners aimed at improving payment and logistics services on the Taobao and Tmall platforms.

Alibaba Group’s net profit for the September 2024 quarter rose by an impressive 63% year-on-year, primarily driven by a positive revaluation of the company’s investments.

The e-commerce segment, which includes the Taobao and Tmall platforms, delivered solid growth supported by double-digit increases in order volumes and revenue from customer services, further strengthening Alibaba’s position in the domestic market. Revenue from Alibaba Cloud increased by 7%, primarily driven by triple-digit growth in income from AI-related products. Cost optimisation and improved operational efficiency across several business units also supported profitability, allowing the company to manage expenses effectively amid ongoing economic uncertainty.

However, despite the rise in net profit, non-GAAP net income, which excludes one-off items such as investment revaluations, declined by 9% to 5.20 billion USD. The company attributed this decline to substantial investments in Alibaba Cloud and refunds to merchants following the cancellation of annual service fees.

Alibaba also rewarded its shareholders with a share buyback worth 4.1 billion USD.

Alibaba Group Holding Limited – December 2024 quarterly earnings results

On 20 February 2025, Alibaba Group Holding Limited published its quarterly earnings report for the period ended 31 December 2024. The key highlights are outlined below:

- Revenue : 38.38 billion USD (+8%)

- Net income : 6.36 billion USD (+333%)

- Earnings per share : 2.93 USD (+13%)

Revenue by segment:

- Taobao and Tmall Group : 18.64 billion USD (+5%)

- Cloud Intelligence Group : 4.34 billion USD (+13%)

- International Digital Commerce Group : 5.17 billion USD (+32%)

- Cainiao Smart Logistics Network : 3.86 billion USD (–1%)

- Local Services Group : 2.32 billion USD (+12%)

- Digital Media and Entertainment Group : 0.75 billion USD (+8%)

- All others : 7.27 billion USD (+13%)

CEO Eddie Wu highlighted the company’s significant progress in advancing its user-first strategy and harnessing innovative AI technologies. He emphasised that Alibaba remains committed to making substantial investments in cloud technologies and AI infrastructure to maintain its competitive edge.

In the long term, Alibaba plans to invest 53.00 billion USD in cloud computing and AI over the next three years, aiming to become the world’s leading cloud provider.

Although the company did not provide a specific financial outlook for the next quarter, analysts anticipate continued growth. However, the announcement of the 53.00 billion USD investment has raised concerns among investors, as it could weigh on the company’s net profit.

Alibaba Group Holding Limited – March 2025 quarterly earnings results

On 15 May 2025, Alibaba Group Holding Limited released its quarterly report for the period ended 31 March 2025. The key figures are outlined below:

- Revenue : 32.58 billion USD (+7%)

- Net income : 1.65 billion USD (+1203%)

- Earnings per share : 0.71 USD (+296%)

Revenue by segment:

- Taobao and Tmall Group : 13.96 billion USD (+9%)

- Cloud Intelligence Group : 4.15 billion USD (+18%)

- International Digital Commerce Group : 4.62 billion USD (+22%)

- Cainiao Smart Logistics Network : 2.97 billion USD (–12%)

- Local Services Group : 2.22 billion USD (+10%)

- Digital Media and Entertainment Group : 0.77 billion USD (+12%)

- All others : 7.44 billion USD (+5%)

Alibaba Group Holding’s quarterly report demonstrated steady growth across key areas. The company’s revenue rose 7% compared with the same period last year. The main driver was the Taobao and Tmall e-commerce platforms, which recorded a 9% growth. The international e-commerce segment also showed resilience, rising by 22%, highlighting Alibaba’s ongoing efforts to expand globally.

The Cloud Intelligence Group division remained one of the key growth contributors, with strong demand for AI-related products playing a crucial role.

However, despite these strong figures, the company’s net income fell short of analysts’ expectations, causing Alibaba’s shares in the US to drop around 7%. Additional pressure came from weakening consumer activity in China and intensifying competition.

Alibaba’s management expressed confidence in achieving a return to double-digit revenue growth in the second half of 2025, driven by continued investment in cloud technology and artificial intelligence. The company’s strategic focus on innovation and digital transformation provides a firm foundation for further expansion.

Alibaba Group Holding Limited June quarter 2025 results

On 29 August 2025, Alibaba Group Holding Limited published its results for the June quarter 2025, ended 30 June. Key figures are as follows:

- Revenue : 34.57 billion USD (+2%)

- Net income : 5.92 billion USD (+76%)

- Earnings per share : 2.51 USD (+82%)

Revenue by segment:

- Alibaba China E‑commerce Group : 19.55 billion USD (+10%)

- Alibaba International Digital Commerce Group : 4.85 billion USD (+19%)

- Cloud Intelligence Group : 4.66 billion USD (+26%)

- All others : 8.18 billion USD (–28%)

Against the backdrop of slowing domestic consumer demand and increased investment in strategic priorities, Alibaba delivered mixed results for the June quarter 2025. Total revenue grew by just 2% year-on-year to 247.65 billion CNY (34.57 billion USD), falling slightly short of analysts’ expectations. However, after excluding divested assets Sun Art and Intime, organic growth in core segments was approximately 10%, signalling continued domestic business transformation.

The most positive momentum came from the cloud segment, where revenue increased by 26% year-on-year, driven by rising demand for AI solutions and ongoing investment in proprietary infrastructure. The company is advancing its own large language models under the Qwen brand and continues to develop specialised AI chips, aiming to reduce dependency on suppliers such as NVIDIA. The international segment, including AliExpress, Trendyol, and Cainiao, also delivered strong year-on-year growth of 19%, supported by expansion in key regions and strengthened logistics capabilities.

The domestic e‑commerce segment (China) grew by 10%, although margins came under pressure due to aggressive investment in instant-commerce initiatives. Alibaba faces intense competition from Meituan and JD.com in the space of rapid delivery, resulting in higher costs and reduced operational efficiency. Management expects this segment to contribute up to 1 trillion CNY (139.6 billion USD) in Gross Merchandise Value (GMV) annually over the next three years, even though it currently weighs on profitability.

GAAP net income rose 78% to 43.1 billion CNY (6.01 billion USD), largely due to one-off gains from the sale of the Trendyol stake and investment revaluations. Adjusted profit, however, fell 18% to 4.91 billion USD, and EBITDA declined 14%, reflecting a more accurate picture of the company’s underlying operational performance.

No specific forecasts were provided for revenue, margins, or investment expenditures. However, in the commentary accompanying the report, management emphasised that it continues to actively invest in two strategic focus areas:

Consumption and AI + Cloud. CapEx and cash outflows were expected to remain above normal levels over the coming quarters due to investment in cloud and AI infrastructure, after which the effect was projected to normalise as monetisation – primarily in cloud – progresses. Management anticipated further accelerated growth in the cloud business driven by GenAI workloads. In e‑commerce, the focus remained on expanding the user base and order volumes, followed by monetisation. In the international segment, emphasis was placed on strengthening positions in key regions (Europe, the Middle East, and Korea), enhancing efficiency (AliExpress, Trendyol), and further integrating logistics (Cainiao).

Alibaba Group Holding Limited’s September 2025 quarter results

On 29 August 2025, Alibaba Group Holding Limited released its report for the September 2025 quarter, which ended on 30 September. The key figures are as follows:

- Revenue : 34.81 billion USD (+5%)

- Net income : 1.45 billion USD (–72%)

- Earnings per share : 0.61 USD (–71%)

Revenue by segment:

- Alibaba China E-commerce Group : 18.62 billion USD (+16%)

- Alibaba International Digital Commerce Group : 4.89 billion USD (+10%)

- Cloud Intelligence Group : 5.59 billion USD (+34%)

- All others : 8.85 billion USD (–25%)

Alibaba’s September 2025 quarter report was mixed: while revenue rose more strongly than expected, profit dropped sharply. The company generated 34.8 billion USD (+5% y/y, or +15% excluding the divested Sun Art and Intime assets), slightly above analyst forecasts. Growth was driven by the cloud business (+34% y/y) and international e-commerce, including quick-commerce services.

However, profit declined steeply: adjusted net income fell to 1.45 billion USD (–72% y/y), while earnings per share came in at 0.61 USD, around 20% below expectations. The main reasons were heavy marketing spending, discounts, the expansion of quick commerce, and increased investment in AI and cloud infrastructure. Adjusted EBITA fell by 80% to 1.27 billion USD, and free cash flow turned negative (–3.1 billion USD) due to higher capital expenditure and working capital requirements.

Management stated that spending on quick commerce had already peaked: in the next quarter, subsidy and marketing costs are set to decline, while order-level profitability should improve. The company plans to grow its quick-commerce turnover to around 138 billion USD within three years and invest over 52 billion USD in cloud and AI development.

Overall, the report can be characterised as strong in growth but weak in profitability: the business continues to expand rapidly, and cloud revenue is outperforming expectations, but high investment requirements are keeping profit and cash flow under pressure. In the coming quarters, Alibaba is effectively prioritising market share and future leadership in AI and e-commerce, at the expense of short-term profitability.

Fundamental analysis of Alibaba Group Holding Limited

Below is the fundamental analysis of Alibaba based on the September 2025 quarter results:

- Balance sheet and liquidity : as of the end of September 2025, Alibaba maintained a strong liquidity position. Cash and short-term investments totalled 573.9 billion RMB (~80.6 billion USD). Current assets stood at 646.6 billion RMB (~90.8 billion USD), and current liabilities amounted to 444.1 billion RMB (~62.4 billion USD), resulting in a current ratio of around 1.5 – a comfortable level that raises no concerns.

However, operating cash flows weakened noticeably: operating cash flow for the quarter was just 10.1 billion RMB (~1.4 billion USD, –68% y/y), while non-GAAP free cash flow turned negative at –21.8 billion RMB (~3.1 billion USD) due to increased investment in quick commerce and cloud infrastructure. In other words, Alibaba’s liquidity remains strong thanks to accumulated reserves, but the company is currently deploying its cash reserves aggressively to fund business expansion and future-oriented investments.

- Operating profitability : GAAP operating profit fell to 5.4 billion RMB (~0.75 billion USD), with the operating margin contracting to 2% from 15% a year earlier. The main reasons were a near-doubling of marketing and selling expenses (66.5 billion RMB versus 32.5 billion RMB a year ago) and higher R&D costs.

Adjusted EBITA dropped 78% y/y to 9.1 billion RMB (~1.27 billion USD), while its margin fell from 17% to 4% – a typical pattern for a company deliberately increasing spending on discounts, subsidies, and AI infrastructure. Non-GAAP net profit came in at 10.35 billion RMB (~1.45 billion USD), down 72% from a year earlier, reflecting a real decline in operating profitability rather than one-off effects.

Although improved profitability in cloud and international e-commerce partly offsets the pressure from quick commerce, Alibaba is clearly sacrificing margins in the short term to strengthen market share and accelerate investment in AI and cloud.

- Debt structure and interest coverage : Alibaba’s debt burden remains moderate and fully covered by liquid assets. As of 30 September 2025, total debt stood at approximately 281.6 billion RMB (~39.5 billion USD), including 26.3 billion RMB (~3.7 billion USD) in short-term loans, 63.6 billion RMB (~8.9 billion USD) in long-term borrowings, 120.5 billion RMB (~16.9 billion USD) in senior notes, 57.5 billion RMB (~8.1 billion USD) in convertible bonds, and 13.8 billion RMB (~1.9 billion USD) in exchangeable bonds. With around 80.6 billion USD in cash and liquid investments, the company effectively maintains a net cash position rather than net debt.

Interest expenses for the quarter amounted to 2.52 billion RMB (~0.35 billion USD), while adjusted EBITDA was 17.26 billion RMB (~2.42 billion USD), implying interest coverage of roughly 7×. Moreover, Alibaba generated 20.1 billion RMB (~2.82 billion USD) in net interest and investment income, earning more on its investments than it pays in interest. Given the long-term structure of its borrowings and substantial cash reserves, refinancing and default risks remain minimal.

- Capital returns : Alibaba continues to focus on share buybacks and does not pay dividends. During the quarter, the company repurchased about 17 million shares for 253 million USD – a relatively modest amount given its financial capacity. Under the current buyback program, valid until March 2027, about 19.1 billion USD remains unused. While there is ample potential to expand repurchases, management is currently prioritising investment in AI, cloud, and quick commerce. As a result, the buyback policy is measured and supportive rather than aggressive.

Fundamental analysis of Alibaba – Conclusion:

Alibaba’s financial stability remains high: the company holds a substantial cash and liquidity buffer, maintains a net cash position, and has strong interest coverage, leaving no solvency risks even amid elevated investment activity. From a fundamental standpoint, Alibaba remains financially sound but is currently in a phase of large-scale strategic investment, deliberately sacrificing short-term profitability in pursuit of future growth.

Analysis of key valuation multiples for Alibaba Group Holding Limited

Below are Alibaba Group Holding Limited’s key valuation multiples based on the September 2025 quarter results, calculated using a share price of 146 USD.

| Multiple | What it indicates | Value | Comment |

|---|---|---|---|

| P/E (TTM) | The price of 1 USD of earnings over the past 12 months | 19.1 | ⬤ A normal level – no longer cheap, but still far from overheated growth valuations. |

| P/S (TTM) | The price of 1 USD of annual revenue | 2.4 | ⬤ A moderate valuation for a major e-commerce company with double-digit margins. |

| EV/Sales (TTM) | Enterprise value to revenue, including debt | 2.1 | ⬤ Taking net cash into account, the business is slightly cheaper than by P/S – attractive for investment. |

| P/FCF (TTM) | The price of 1 USD of free cash flow | 19 | ⬤ A solid level for a large-scale growth platform: the market is paying less than 20× annual FCF while the company holds a net cash position. However, FCF remains volatile due to investment activity. |

| FCF Yield (TTM) | Free cash flow yield for shareholders | 5.3% | ⬤ An FCF yield above 5% is attractive for a high-quality business – provided the company can sustain this level after the current CapEx cycle. |

| EV/EBITDA (TTM) | Enterprise value to EBITDA | 13.3 | ⬤ Slightly above the comfortable value-range of 10–12×, but not excessive. The market is pricing in growth and the AI story. |

| EV/EBIT (TTM) | Enterprise value to operating profit | 13.7 | ⬤ Close to EV/EBITDA, indicating a normal level of depreciation. The valuation appears reasonable. |

| P/B | Price to book value | 2.4 | ⬤ Slightly above its multi-year average but acceptable given the company’s healthy ROE |

| Net Debt/EBITDA | Debt load relative to EBITDA | –1.8 | ⬤ Strong liquidity position. |

| Interest Coverage (TTM) | Operating profit to interest expense ratio | 17 | ⬤ Interest expenses are comfortably covered by operating profit – excellent debt-servicing capacity. |

Analysis of Alibaba Group Holding Limited’s valuation multiples – conclusion

From a balance-sheet perspective, Alibaba remains highly reliable: the company holds substantial cash reserves, maintains a net cash position, generates positive trailing-twelve-month (TTM) free cash flow, and has a strong ability to service its debt. Meanwhile, the key valuation multiples – P/E around 19×, EV/EBITDA around 13×, P/FCF around 19×, and FCF yield above 5% – indicate not a clear discount but rather a valuation close to fair value for a large technology company with expanding cloud and AI operations.

Overall, at 146 USD, the shares appear fairly valued – this is a robust business with a strong balance sheet and reasonable valuation, albeit exposed to significant country-specific and strategic risks. For a cautious investor, Alibaba is not a classic bargain, but it remains a potentially attractive long-term opportunity.

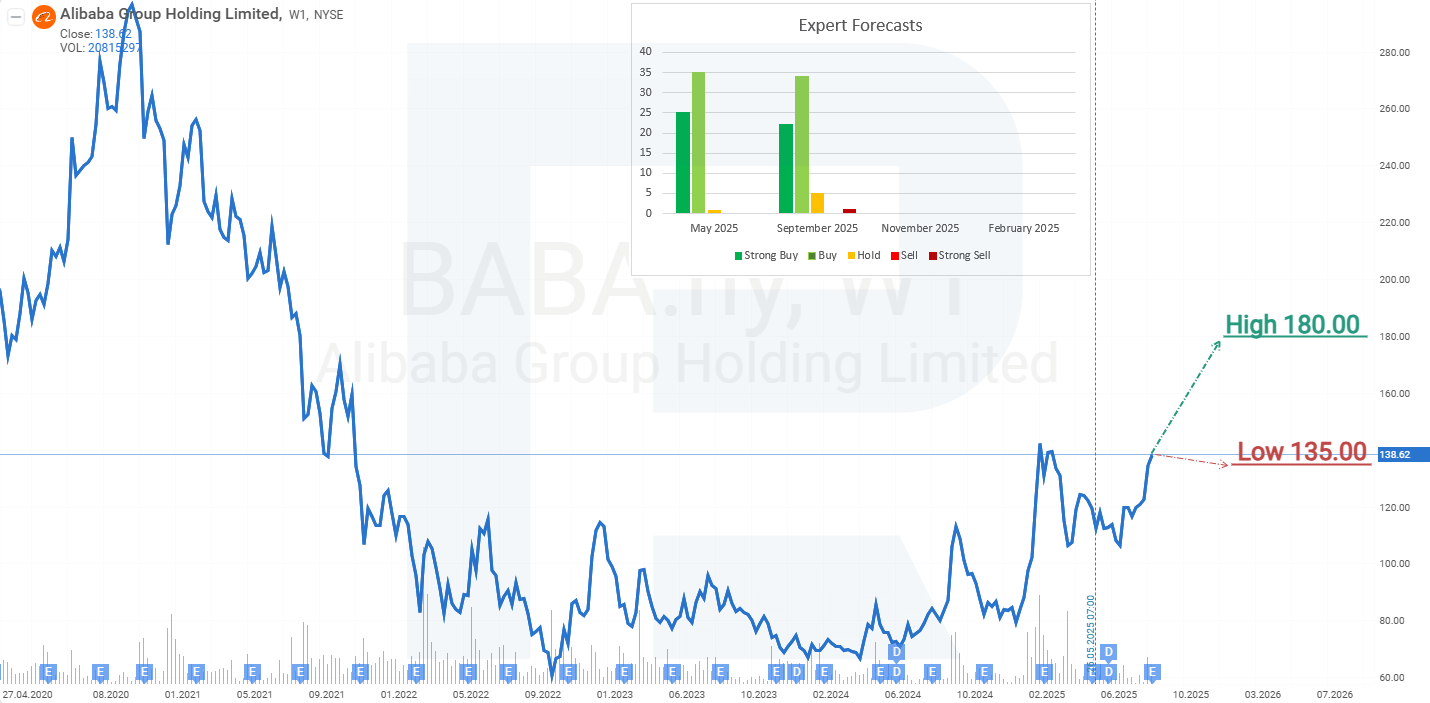

Expert forecasts for Alibaba Group Holding Limited’s stock for 2026

- Barchart : 22 out of 24 analysts rated Alibaba Group shares as a Strong Buy, 1 as Hold, and 1 as a Strong Sell. The highest price target is 230 USD, and the lowest is 152 USD.

- MarketBeat : 19 out of 20 analysts gave the stock a Buy rating and 1 a Sell. The highest price target is 230 USD, and the lowest is 152 USD.

- TipRanks : 19 out of 21 analysts rated the stock as Buy and 2 as Hold. The highest price target is 230 USD, and the lowest is 152 USD.

- Stock Analysis : 5 out of 13 analysts rated the stock as a Strong Buy, 8 as Buy, and 1 as Hold. The highest price target is 230 USD, and the lowest is 135 USD.

Alibaba Group Holding Limited stock price forecast for 2026

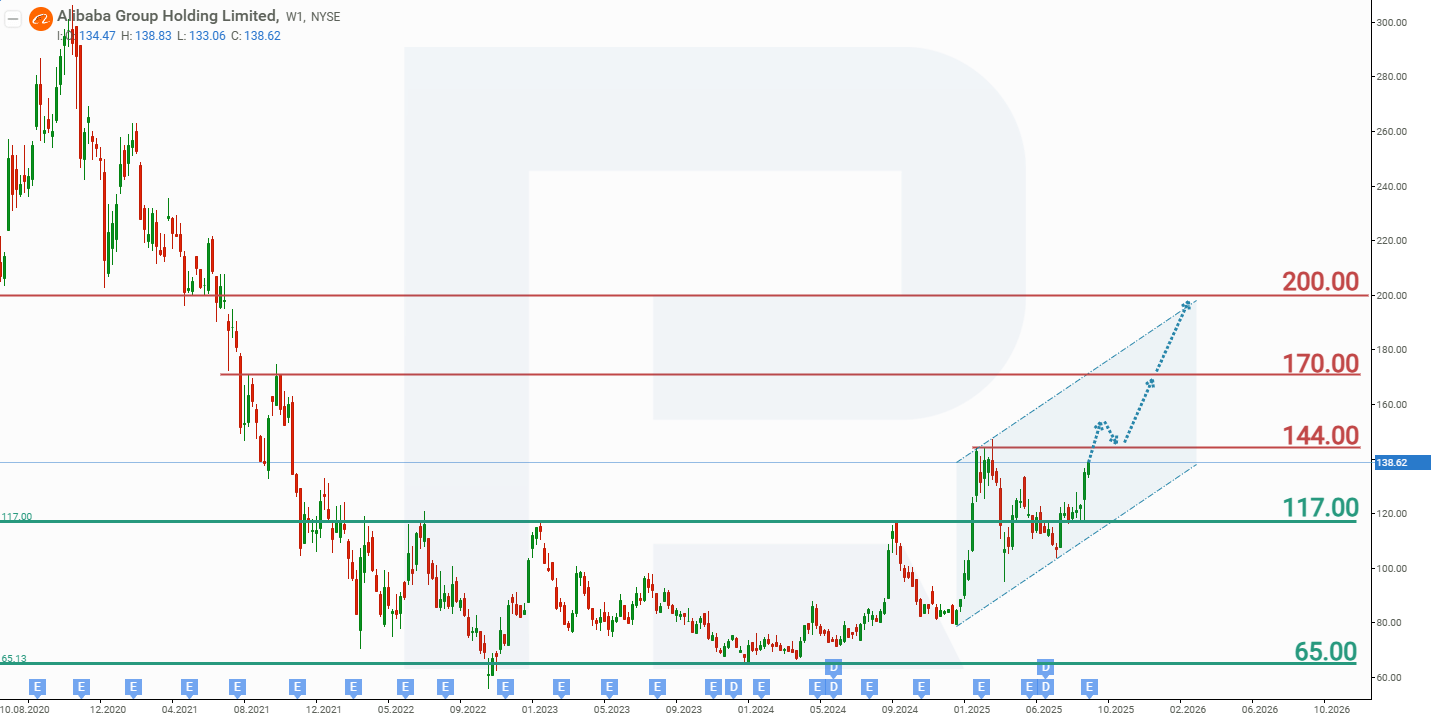

On the weekly chart, Alibaba shares are trading within an upward channel. At the end of September 2025, the price reached a local high of around 193 USD before entering a correction that continues at present. However, during this correction, a Flag pattern has formed on the chart, indicating a likely resumption of the uptrend. Based on the current performance of Alibaba Group Holding Limited shares, the potential price scenarios for 2026 are as follows:

The base-case forecast for Alibaba Group Holding Limited stock anticipates a breakout above the upper boundary of the Flag pattern, followed by an increase towards the channel line near 186 USD. A breakout above this level would signal further growth in BABA shares, with the next target at 230 USD.

The alternative forecast for Alibaba Group Holding Limited shares assumes a breakdown below support at 150 USD. In this scenario, the correction could extend towards the ascending trendline near 133 USD. A rebound from this level would indicate the end of the decline and the resumption of growth within the prevailing uptrend. The next upside target in this case would be the upper boundary of the channel, around 193 USD.

Alibaba Group Holding Limited’s stock analysis and forecast for 2026Risks of investing in Alibaba Group Holding Limited stock

Investing in Alibaba Group may involve several risks, which could be particularly significant amid China’s economic measures and policies. The main risks are listed below:

- Connection with the economic stimulus : if the Chinese government cancels or inadequately stimulates the economy, this could negatively impact Alibaba’s shares.

- Global economic conditions : like many large tech companies, Alibaba relies heavily on global markets. For example, economic instability, trade wars, or a decline in global demand could exert pressure on the company’s earnings.

- Trade risks : like other Chinese companies, Alibaba faces the risk of trade sanctions from the US. In particular, restrictions on Chinese companies’ access to Western markets, including US-based platforms, could hinder business expansion and reduce profitability.

- Regulatory and political risks : like other Chinese tech companies, Alibaba operates under strict control by Chinese authorities. In recent years, the Chinese government has tightened regulations in the technology and internet sectors, leading to a significant decline in Alibaba’s market capitalisation. The company is also actively expanding its financial services through its subsidiary, Ant Group, which offers lending, mobile payments, and other services. However, the Chinese government has already imposed restrictions on Ant Group’s growth, negatively affecting the company’s stock. At this stage, the realisation of regulatory risks is unlikely, as the Chinese government is implementing measures to stimulate the economy and is unlikely to complicate business operations in the current climate.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.