AMD stock forecast after the Q3 2025 earnings report – is a new rally ahead?

AMD exceeded expectations in Q3 2025, delivering strong revenue and profit growth. However, the market’s reaction was muted due to concerns over stretched valuations and intensifying competition with NVIDIA.

Advanced Micro Devices, Inc. (NASDAQ: AMD) delivered results for Q3 2025 that exceeded analyst expectations. Revenue totalled 9.25 billion USD (+36% y/y), while earnings per share came in at 1.20 USD (+30% y/y), compared with market forecasts of 8.8 billion USD and 1.17 USD, respectively. The company beat estimates on both revenue and profit.

The data centre segment was the main growth driver during the quarter, with revenue rising to 4.3 billion USD (+22% y/y). The client and gaming segments also posted strong performance, generating around 4 billion USD (+73% y/y) in revenue, driven by robust sales of Ryzen processors and Radeon graphics cards. The only weak spot remained the Embedded segment, which saw revenue declining by 8%.

In its Q4 outlook, AMD expects revenue of around 9.6 billion USD and continued high margins. Shipments of MI308 units to China are not yet included in this forecast, leaving potential for additional upside. At a recent investor meeting, the company announced that it expects annual revenue growth of over 35% and earnings per share above 20 USD over the next 3–5 years, supported by rapid expansion in the AI and server markets.

Following the release of AMD’s Q3 2025 report, the initial market reaction was negative: shares fell in pre-market trading. However, sentiment improved during the main session, and by the close, the stock had reversed higher, gaining around 2.5%. The strong quarterly results and upbeat outlook for the next period provided short-term support for AMD’s share price – but only briefly. Profit-taking began the next day, and the stock moved lower as investors remained concerned about stretched valuations, competition from NVIDIA (NASDAQ: NVDA), and AMD’s ability to deliver on its ambitious growth targets.

A week after the earnings release, AMD shares were trading close to their pre-report levels – reflecting a mixed market response. Investors recognised the company’s strong fundamentals but were not yet ready to price in a new rally.

This article examines AMD’s business model and revenue composition, outlines its position in the AI hardware market, and provides a fundamental and technical analysis of Advanced Micro Devices shares, forming the basis for the AMD stock forecast.

About Advanced Micro Devices, Inc.

Advanced Micro Devices, Inc. (AMD) is a US-based company founded in 1969 by Jerry Sanders and a group of fellow engineers. It designs and manufactures semiconductor devices, including processors, graphics chips, and server solutions. The company went public with an IPO on the NYSE in 1972 under the ticker AMD.

AMD is present in the rapidly expanding AI market with the following products:

- Graphics Processing Units (GPUs) for data centres : AMD produces Radeon Instinct microprocessors and has recently introduced new models in the MI series designed for high-performance computing and AI workloads. For example, the MI300 is a high-powered processor optimised for deep data analysis and large AI models.

- Radeon Open Compute (ROCm) software : AMD has developed an open-source software platform, ROCm, providing tools for AI development and high-performance computing on the company’s GPUs.

- Field-Programmable Gate Arrays (FPGAs) : following the acquisition of Xilinx, AMD expanded into FPGAs, which are widely used for AI applications, including signal processing and adaptive computing.

- Central Processing Units (CPUs) : AMD also optimises its EPYC series processors to support AI computing in server solutions.

- Products for end devices : in addition to server solutions, AMD develops specialised GPUs and FPGAs for AI-powered end devices, such as autonomous vehicles, smart cameras, and medical equipment.

Advanced Micro Devices, Inc.’s main revenue streams

AMD’s revenue is generated from four key segments:

1. Data Center: includes EPYC server processors, AMD Instinct graphics accelerators for AI and scientific computing, and Xilinx FPGA solutions for specialised workloads in data centres.

2. Client segment: includes Ryzen and Athlon processors for desktop PCs and laptops, delivering high performance for general users and enthusiasts, and integrated graphics solutions for hybrid devices.

3. Gaming segment: includes Radeon GPUs for gaming PCs, integrated solutions for gaming laptops, and custom processors for gaming consoles such as PlayStation and Xbox.

4. Embedded segment: covers high-performance processors and graphics solutions for embedded systems in automotive electronics, industrial automation, medical devices, and telecommunications.

Advantages of Advanced Micro Devices, Inc. in the semiconductor market

AMD has several strengths that enable it to compete effectively with key industry players such as Intel Corp. (NASDAQ: INTC) and NVIDIA Corp. (NASDAQ: NVDA). The company’s main advantages are outlined below:

- Processor architecture : AMD introduced the Zen architecture, which significantly enhanced performance and energy efficiency. The Ryzen (consumer) and EPYC (server) series have gained popularity thanks to their excellent performance-to-price ratio. In recent years, AMD has surpassed Intel in terms of core and thread counts in processors.

- Multi-core and multi-threaded solutions : AMD typically offers more cores and threads at the same price point, making its processors attractive to users requiring multitasking and high-performance computing (for example, for graphics, video editing, data streaming, etc.).

- Innovations in graphics technology : although AMD lags behind NVIDIA in some high-performance GPU functionalities, it maintains a strong position due to processors with high data processing throughput, offering a competitive price-to-performance advantage. With the RDNA and RDNA 2 series, AMD has significantly improved the energy efficiency and performance of its graphics cards.

- EPYC server solutions : AMD’s EPYC line delivers an impressive performance-to-price ratio in the server segment, gaining traction among large corporations and data centres. These processors support more core counts per socket, reducing scaling costs for server infrastructure.

- CPU and GPU integration : AMD manufactures both processors and graphics chips, allowing it to develop integrated solutions for laptops and gaming consoles. For example, AMD supplies processors for PlayStation and Xbox consoles, which ensures a stable revenue stream and reinforces its market presence.

- Competitive pricing : AMD frequently offers lower-priced alternatives to Intel and NVIDIA, making its products attractive to a broader customer base, from enthusiasts to corporate clients.

- Rapid adoption of new technological processes : AMD collaborates with TSMC to swiftly implement advanced process nodes (such as 7 and 5 nm), enhancing energy efficiency and performance across its processors and graphics chips.

Advanced Micro Devices, Inc. Q3 2024 results

AMD released its Q3 2024 earnings report on 29 October, confirming continued revenue and net income growth. Below are the report’s key figures:

- Revenue : 6.82 billion USD (+18%)

- Net income : 0.77 billion USD (+158%)

- Earnings per share : 0.47 USD (+161%)

- Operating profit : 0.72 billion USD (+223%)

Revenue by segment:

- Data Center : 3.55 billion USD (+122%)

- Client segment : 1.88 billion USD (+29%)

- Gaming segment : 462 million USD (–69%)

- Embedded segment : 927 million USD (–25%)

AMD benefitted substantially from AI advancements, reflected in its Data Center segment, where revenue surged by 122%, contributing 52% of total revenue. The Gaming segment suffered the steepest decline (–69%), making it its weakest performer.

For Q4 2024, AMD projected revenue in the range of 7.20–7.80 billion USD, with an average estimate of 7.50 billion. This implied a 22% year-on-year increase and a 10% rise compared to Q3 2024. However, the forecast fell slightly short of analysts’ expectations, sparking investor concerns, particularly amid intensifying competition in the AI market and a broader slowdown in segment growth.

Advanced Micro Devices, Inc. Q4 2024 results

AMD released its Q4 2024 earnings report on 4 February, showing a 37% decline in net income. The report highlights are outlined below:

- Revenue : 7.65 billion USD (+24%)

- Net income : 0.48 billion USD (–37%)

- Earnings per share : 0.29 USD (+29%)

- Operating profit : 0.87 billion USD (+155%)

Revenue by segment:

- Data Center : 3.86 billion USD (+69%)

- Client segment : 2.31 billion USD (+58%)

- Gaming segment : 563 million USD (–59%)

- Embedded segment : 923 million USD (–13%)

2024 financial performance:

- Revenue : 25.78 billion USD (+14%)

- Net income : 1.64 billion USD (+92%)

- Earnings per share : 1.00 USD (+88%)

- Operating profit : 1.90 billion USD (+375%)

In Q4 2024, AMD CEO Lisa Su highlighted the company’s impressive performance, reporting a record annual revenue of 25.80 billion USD, up 14% from the previous year. This growth was mainly driven by a 94% surge in Data Center revenue and a 52% increase in the Client segment. Su also emphasised that AMD prioritises total revenue rather than the number of processors shipped, particularly amid concerns about potential CPU oversupply in the PC market.

The company attributed the decline in Q4 net income to a 17% rise in operating costs, primarily due to higher research and development investments, especially in AI. Additionally, despite strong Data Center growth, AI GPU sales fell short of expectations, further impacting profitability.

For Q1 2025, AMD expects revenue of 7.10 billion USD, slightly exceeding analysts’ projections. However, Su warned about a potential slowdown in AMD Data Center sales, citing heightened competition, particularly from NVIDIA (NASDAQ: NVDA) in the AI processor market.

AMD management remains optimistic about 2025. Su projects strong double-digit growth in both revenue and EPS for the year. She also highlighted the long-term potential of AMD’s Data Center AI business, which generated over 5.00 billion USD in 2024 and is expected to eventually drive annual segment revenue into the tens of billions of dollars.

AMD management’s sentiment was cautiously optimistic, focusing on leveraging the company’s strengths in AI and computing to drive future growth while remaining agile in response to market shifts in weaker segments.

Advanced Micro Devices, Inc. Q1 2025 results

AMD released its Q1 2025 report on 6 May. Below are its highlights compared to the corresponding period in 2024:

- Revenue : 7.44 billion USD (+36%)

- Net income : 0.71 billion USD (+476%)

- Earnings per share : 0.44 USD (+529%)

- Operating profit : 0.81 billion USD (+2,139%)

Revenue by segment:

- Data Center : 3.67 billion USD (+57%)

- Client segment : 2.29 billion USD (+68%)

- Gaming segment : 647 million USD (–30%)

- Embedded segment : 823 million USD (–3%)

AMD’s Q1 2025 financial performance strengthened confidence in the company as one of the leaders in the AI and data centre segment. AMD exceeded Wall Street expectations, reporting a 36% increase in revenue and a 476% rise in net income. Meanwhile, the key segments showed even stronger growth. The data centre segment increased sales by 57%, while PC processor revenue rose by 68%, driven by sustained demand for EPYC server processors, Instinct accelerators, and Ryzen chips for consumer PCs.

For Q2 2025, AMD management projected revenue to range between 7.1 and 7.7 billion USD but cautioned about potential losses of about 800 million USD as the company might postpone or entirely abandon the sales of a significant amount of its AI chips in China. The reason is the new export restrictions imposed by the US government, which have banned advanced technology exports to the Chinese market. As a result, these chips cannot be sold, and their cost will likely be written off as losses. However, AMD management warned about this as early as 16 April, so this information was most likely already factored into the current stock price. For 2025, CFO Jean Hu estimated revenue losses of 1.5 billion USD due to export restrictions.

Nevertheless, AMD management remained optimistic about 2025. The company anticipated double-digit growth in both revenue and EPS for the year, driven by its expanding AI portfolio and strategic partnerships. This signalled that AMD’s long-term potential remained promising despite external risks and short-term stock volatility.

Advanced Micro Devices, Inc. Q2 2025 results

AMD released its Q2 2025 earnings report on 5 August. Below are its highlights compared to the corresponding period in 2024:

- Revenue : 7.69 billion USD (+32%)

- Net income : 0.78 billion USD (–31%)

- Earnings per share : 0.48 USD (–30%)

- Operating profit : 0.90 billion USD (–29%)

Revenue by segment:

- Data Center : 3.24 billion USD (+14%)

- Client segment : 2.49 billion USD (+67%)

- Gaming segment : 1.12 billion USD (+73%)

- Embedded segment : 824 million USD (–4%)

AMD ended Q2 2025 with record revenue of 7.7 billion USD, up 32% year-over-year. However, profitability was under pressure due to a one-time write-down of approximately 800 million USD, related to inventory and obligations tied to MI308 shipments to China, impacted by US export restrictions. This resulted in a decline in GAAP gross margin to 40% and non-GAAP margin to 43%. According to the company, the margin would have been around 54% without the write-down. The result was supported by record sales of EPYC server processors and Ryzen desktop processors, as well as a revival in the Gaming segment. However, the hit to margins and GAAP operating loss reminded the market of regulatory risks surrounding AI accelerators.

AMD’s segments delivered the following results: the Data Center segment generated approximately 3.2 billion USD in revenue, up 14% y/y, driven by EPYC sales, which partially offset the impact of restrictions on the MI308. The Client and Gaming segments together contributed around 3.6 billion USD, with the Client segment reaching 2.5 billion USD, fuelled by strong demand for Zen 5-based desktop processors and a more favourable product mix. The Gaming segment rose to 1.1 billion USD, boosted by higher shipments of semi-custom chips for consoles and steady demand for Radeon GPUs. The Embedded segment generated 824 million USD, down 4% year-on-year, reflecting mixed demand across end markets. The company stated that it had achieved record free cash flow for the quarter, providing an additional cushion for AI investments.

The outlook for Q3 FY25 was confident. The company expected revenue of 8.7 billion USD ± 300 million USD, representing around 28% year-over-year growth and approximately 13% sequential growth, with a projected non-GAAP gross margin of about 54%. AMD had not included MI308 shipments to China in its Q3 guidance, as the issue was still under review by the US government. It was later reported that a scheme had been agreed under which AMD would obtain export licences for the MI308 in exchange for remitting 15% of revenue from sales in China.

Advanced Micro Devices, Inc. (NASDAQ: AMD) Q3 2025 financial results

On 4 November 2025, AMD published its financial results for Q3 2025. The key figures, compared with the same period in 2024, are as follows:

- Revenue : 9.25 billion USD (+36%)

- Net income (non-GAAP) : 1.97 billion USD (+31%)

- Earnings per share : 1.20 USD (+30%)

- Operating profit : 2.24 billion USD (+31%)

Revenue by segment:

- Data Centre : 4.34 billion USD (+22%)

- Client segment : 2.75 billion USD (+46%)

- Gaming segment : 1.30 billion USD (+181%)

- Embedded segment : 857 million USD (–8%)

AMD reported a strong Q3 2025, beating market expectations. Adjusted (non-GAAP) revenue reached 9.25 billion USD, up 36% year-on-year, while adjusted earnings per share rose by 30% to 1.20 USD. This was slightly above analyst forecasts, which had anticipated revenue of 8.7–8.8 billion USD and EPS of 1.17 USD.

The gross margin remained high at 54%, indicating stable profitability and a recovery following a weak Q2 2025. Operating profit totalled 2.2 billion USD, with a margin of 24% – slightly below last year’s figure due to increased spending on research and development and the promotion of AI products. AMD’s balance sheet remains healthy, with 7.2 billion USD in cash and investments against 3.2 billion USD in debt, resulting in a net cash position, demonstrating that the company is not reliant on borrowing.

The main growth driver for the quarter was the Data Centre segment, where revenue rose to a record 4.3 billion USD (+22% y/y), supported by strong sales of EPYC server chips and Instinct MI350 accelerators. The Client and Gaming businesses together generated about 4 billion USD (+73% y/y): the Client segment grew to 2.8 billion USD following robust Ryzen sales, and Gaming rose to 1.3 billion USD, driven by GPUs and console solutions. The Embedded segment was the only weak spot, declining by 8% to 0.86 billion USD.

For Q4 2025, management expects revenue of around 9.6 billion USD, with a possible deviation of ±0.3 billion USD, implying year-on-year growth of 25%. The gross margin is projected at approximately 54.5%. The company anticipates further increases in the Data Centre and Client segments and a gradual recovery in Embedded. The forecast still excludes sales to China due to uncertainty surrounding export restrictions.

Additionally, AMD outlined a new strategic plan for the next three to five years. The company targets average annual revenue growth of more than 35%, an operating margin above 35%, and earnings per share exceeding 20 USD. For Data Centres, AMD aims for annual growth of over 60%, while other segments are expected to grow by more than 10%. Effectively, AMD indicated that in 2026 its focus will remain on AI accelerators and server processors, which are set to become the company’s primary sources of future growth.

Fundamental analysis of Advanced Micro Devices, Inc.

Below is a fundamental analysis of AMD’s financial results for Q3 2025:

- Balance sheet and liquidity : as of the end of Q3 2025, AMD appears highly solid from a liquidity perspective. Cash, cash equivalents, and short-term investments totalled 7.2 billion USD, up from 5.1 billion USD at the end of 2024 – a noticeable increase reflecting stronger business momentum. Total current assets reached 27 billion USD, while current liabilities stood at 11.7 billion USD, indicating that current assets are more than double short-term debt and accounts payable. A significant portion of current assets consists of inventories and assets classified as “held for sale,” related to ZT Manufacturing, the company’s manufacturing business, which AMD sold to Sanmina for 3 billion USD. The deal closed in October 2025, further strengthening the company’s cash position in Q4 and beyond.

- Cash flow and capital allocation : in Q3 2025, AMD generated 1.8 billion USD in operating cash flow from continuing operations and a record free cash flow (FCF) of about 1.5 billion USD, equivalent to an FCF margin of roughly 16% of quarterly revenue – a very high level for a capital-intensive semiconductor business. Over the first nine months of 2025, operating cash flow reached 5.1 billion USD, up from 1.7 billion USD a year earlier, indicating that cash generation accelerated sharply amid rising profits and more efficient working capital management.

Capital expenditure remains moderate relative to the scale of operations (around 0.3 billion USD per quarter), allowing the company to finance R&D and M&A activity while continuing to increase its net cash. AMD does not pay dividends, and the main use of free cash flow is share repurchases (around 89 million USD in Q3 and 1.3 billion USD over nine months) and investment in business development. Notably, total cash holdings have continued to increase rather than decline, demonstrating the company’s financial resilience even amid a period of high investment activity.

- Debt and capital structure : at the end of Q3 2025, AMD’s total debt amounted to 3.2 billion USD (0.9 billion USD short-term and 2.3 billion USD long-term). A substantial portion of this debt consists of long-term bonds maturing after 2030. Meanwhile, the company holds 7.2 billion USD in cash and short-term investments, resulting in a net cash position of about 4 billion USD and a negative net-debt-to-EBITDA ratio. Quarterly interest expenses total 37 million USD, compared with non-GAAP operating profit of around 2.2 billion USD – implying interest coverage of roughly 50–60×, well outside any area of financial risk. Additionally, AMD has an unused 3 billion USD revolving credit facility and a 3 billion USD commercial paper program with no current issuance, ensuring access to liquidity under potential stress scenarios.

Conclusion – fundamental view on AMD: from a financial perspective, AMD remains one of the most resilient companies in the semiconductor sector. Revenue is growing by more than 30% annually, the non-GAAP margin is steady at around 54%, and both operating and net profit exceed 2 billion USD per quarter. The balance sheet shows a positive net cash position, strong free cash flow, and readily available credit lines.

The main risks are not debt-related but operational – including high R&D and marketing expenditures, dependence on key suppliers and major customers, and geopolitical restrictions on AI chip exports.

AMD’s shares trade at a significant premium (P/E around 113), indicating that the market has already priced in the success of its AI strategy. AMD has a strong balance sheet and ample liquidity, but the key question is not the company’s financial stability – rather, whether the current valuation is justified given the industry’s cyclicality and elevated profit-growth expectations.

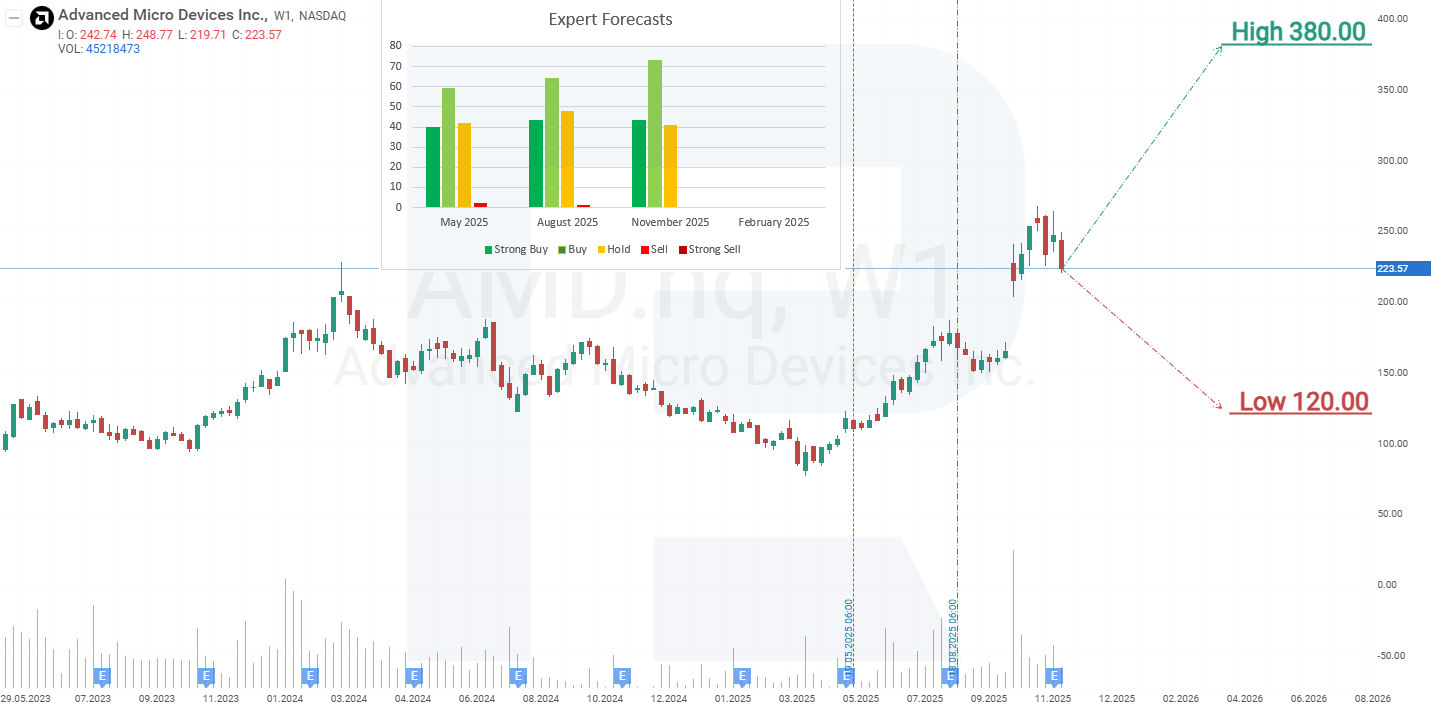

Expert forecasts for Advanced Micro Devices, Inc.’s stock

- Barchart : 28 out of 42 analysts rated AMD shares as a Strong Buy, 2 as a Moderate Buy, and 12 as Hold. The highest price target is 380 USD, and the lowest is 200 USD.

- MarketBeat : 31 out of 42 specialists rated the stock as a Buy, and 11 as Hold. The highest price target is 380 USD, and the lowest is 140 USD.

- TipRanks : 27 out of 37 professionals recommended a Buy, and 10 a Hold. The highest price target is 350 USD, and the lowest is 200 USD.

- Stock Analysis : 15 out of 36 experts rated the stock as a Strong Buy, 13 as a Buy, and 8 as Hold. The highest price target is 345 USD, and the lowest is 120 USD.

Advanced Micro Devices, Inc. stock price forecast for 2025

On the weekly chart, Advanced Micro Devices shares traded within an upward channel until October 2025. On 6 October 2025, a major agreement between AMD and OpenAI for the supply of AI chips, as well as an option granted to OpenAI to acquire up to 10% of the company’s shares, triggered a sharp rally in AMD’s stock, resulting in a breakout above the upper boundary of the ascending channel. Based on the current AMD stock performance, the potential scenarios for 2025 are as follows:

The base-case forecast for Advanced Micro Devices shares anticipates a test of the upper boundary of the breached channel at around 210 USD, which now serves as support, followed by a rebound and a potential rise in the share price to the height of the channel, up to 320 USD.

The alternative forecast for Advanced Micro Devices stock envisions a decline to around 170 USD. Following the announcement of the agreement with OpenAI, a gap formed on the AMD stock chart, with its lower boundary near 170 USD. As gaps tend to close over time, this scenario cannot be ruled out – AMD’s share price may fall to 170 USD, filling the gap, before resuming its upward movement. The recovery target in this case is 320 USD.

Analysis and forecast for Advanced Micro Devices, Inc. stock for 2025Risks of investing in Advanced Micro Devices, Inc. stock

When investing in AMD shares, it is essential to consider the following risks:

- Intense competition : AMD faces tough competition from Intel Corp. (NASDAQ: INTC) and NVIDIA, which may lower prices or accelerate the introduction of new technologies, potentially impacting AMD’s market share negatively.

- Reliance on TSMC : AMD relies on TSMC to manufacture its chips. Any supply disruptions or delays in the introduction of new technology processes at TSMC (NYSE: TSM) could affect AMD’s market position.

- Demand fluctuations : the PC and server market is cyclical and depends on macroeconomic conditions. A decrease in demand for devices may reduce AMD’s revenue.

- Development of proprietary AI chips by consumers : large tech companies like Amazon, Google, and Microsoft are investing in the development of their semiconductors for data centres and specialised tasks. This reduces their reliance on external suppliers, including AMD. If these corporations continue to increase spending on developing their proprietary chips, it could limit AMD’s overall market, reduce its share in the data centre segment, and slow its revenue growth over the long term.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.