US 500 forecast: the market has almost bought the dip, and there is a chance of resuming the uptrend

The US 500 index is undergoing a correction that may lead to a breakout above the resistance level and a reversal towards an uptrend. The US 500 forecast for today is positive.

US 500 forecast: key trading points

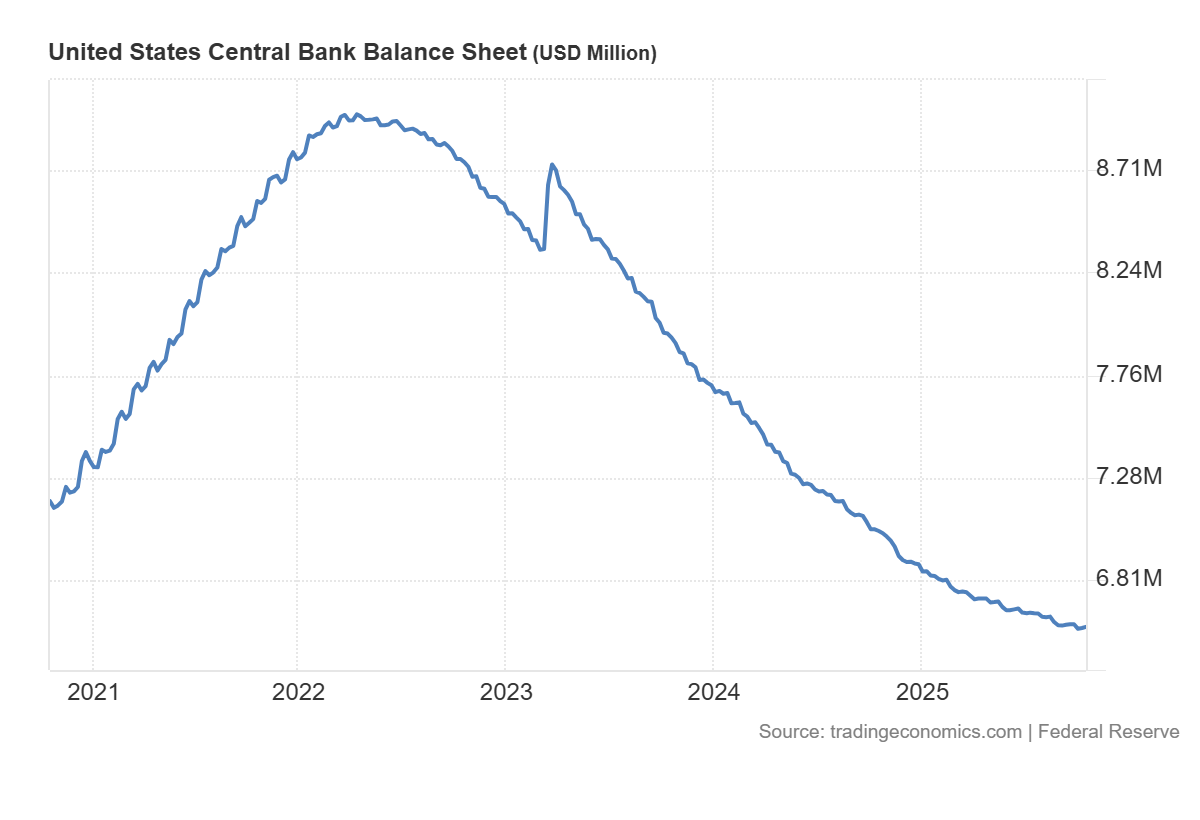

- Recent data: the US Federal Reserve balance sheet stands at 6.596 trillion USD

- Market impact: the figures are generally positive for the equity market

US 500 fundamental analysis

News about the potential end of the government shutdown is easing political uncertainty and typically supports risk appetite in the short term. The resumption of macroeconomic data releases and clarity in the fiscal process reduce the uncertainty premium and may provide a short-term boost to cyclical sectors. However, even after the shutdown ends, the high level of government borrowing will continue to support Treasury yields. Combined with the ongoing balance sheet reduction, this limits revaluation potential for equities and keeps the market sensitive to Treasury auctions and inflation data.

For the US 500, this creates a mixed picture. In the coming days, growth is likely in companies that benefit from improving economic expectations – some industrial issuers, part of the financial sector, and durable goods producers with steady demand. At the same time, large growth stocks and unprofitable tech developers may react more weakly due to persistent pressure from high rates and elevated capital costs.

US central bank balance sheet: https://tradingeconomics.com/united-states/central-bank-balance-sheetUS 500 technical analysis

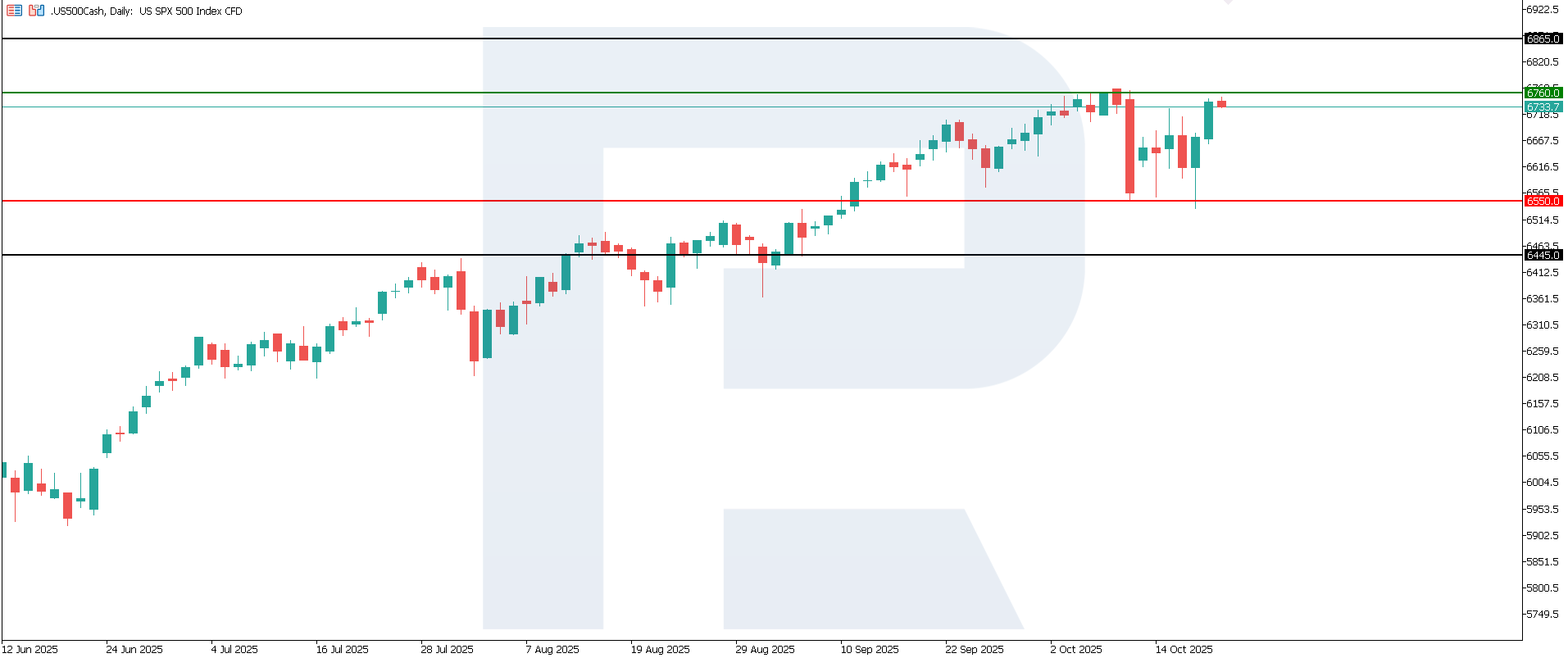

The US 500 index is undergoing a correction after a decline, with the support level at 6,550.0 and the nearest resistance at 6,760.0. The price is rising towards the resistance level and could break above it, reversing the trend upwards. The next target for potential growth is around 6,865.0.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 scenario: a breakout below the 6,550.0 support level could send the index down to 6,445.0

- Optimistic US 500 scenario: a breakout above the 6,760.0 support level could propel the index to 6,865.0

Summary

For the US 500, the baseline scenario suggests a volatile sideways movement with limited valuation expansion, where performance will depend primarily on earnings and cash flows. A sustained uptrend would require either a slowdown in the Fed’s liquidity withdrawal or clear signs of easing inflation, which could push yields lower. If statements confirming the imminent end of the shutdown are followed by favourable inflation and wage data, the index could gain further on improved sentiment. From a technical perspective, the US 500 index may rise towards 6,865.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.