US 500 forecast: global trend sharply reversed to downward after a new round of the US-China trade war

The US 500 index has entered a downtrend, which could become medium-term. The US 500 forecast for today is negative.

US 500 forecast: key trading points

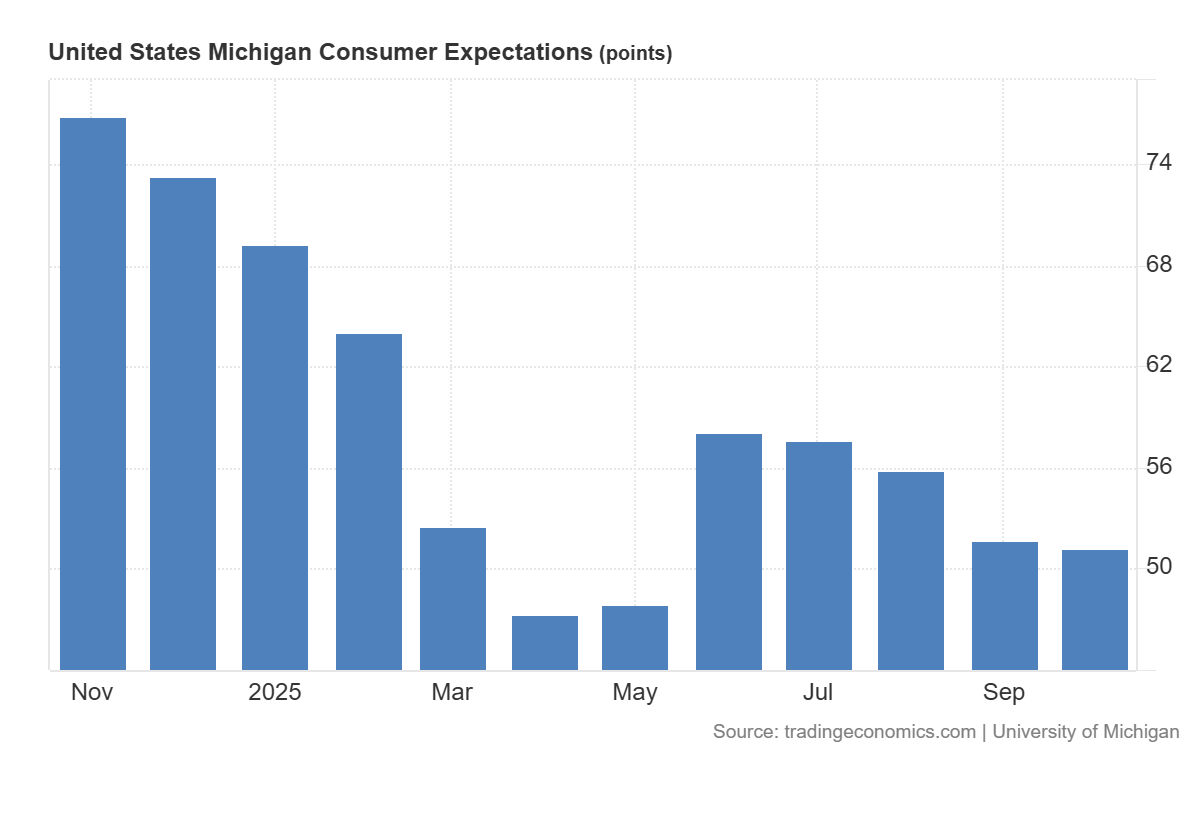

- Recent data: the Michigan Index of Consumer Expectations fell to 51.2 in September

- Market impact: the data has a negative impact on the US stock market

US 500 fundamental analysis

On Thursday, China’s Ministry of Commerce announced that starting from 1 December, foreign companies must obtain a licence to export any products containing more than 0.1% of rare earth metals sourced from China or produced using Chinese extraction, refining, magnet manufacturing, or recycling technologies. In response, the US intends to impose new 100% tariffs on Chinese imports in addition to all current tariffs, with effect from 1 November. The US government also plans to introduce export controls on any critical software.

For the US 500 index, these developments have a negative effect. At the same time, a statement from the US Treasury regarding the growing risk of a government shutdown has increased uncertainty for both businesses and households. A shutdown leads to partial suspension or slowdown of federal services, delays in contracts and payments to employees and contractors, and postponements of grants and loans. This temporarily dampens consumption and corporate revenues, particularly in industries reliant on government spending.

US Michigan Index of Consumer Expectations: https://tradingeconomics.com/united-states/michigan-consumer-expectationsUS 500 technical analysis

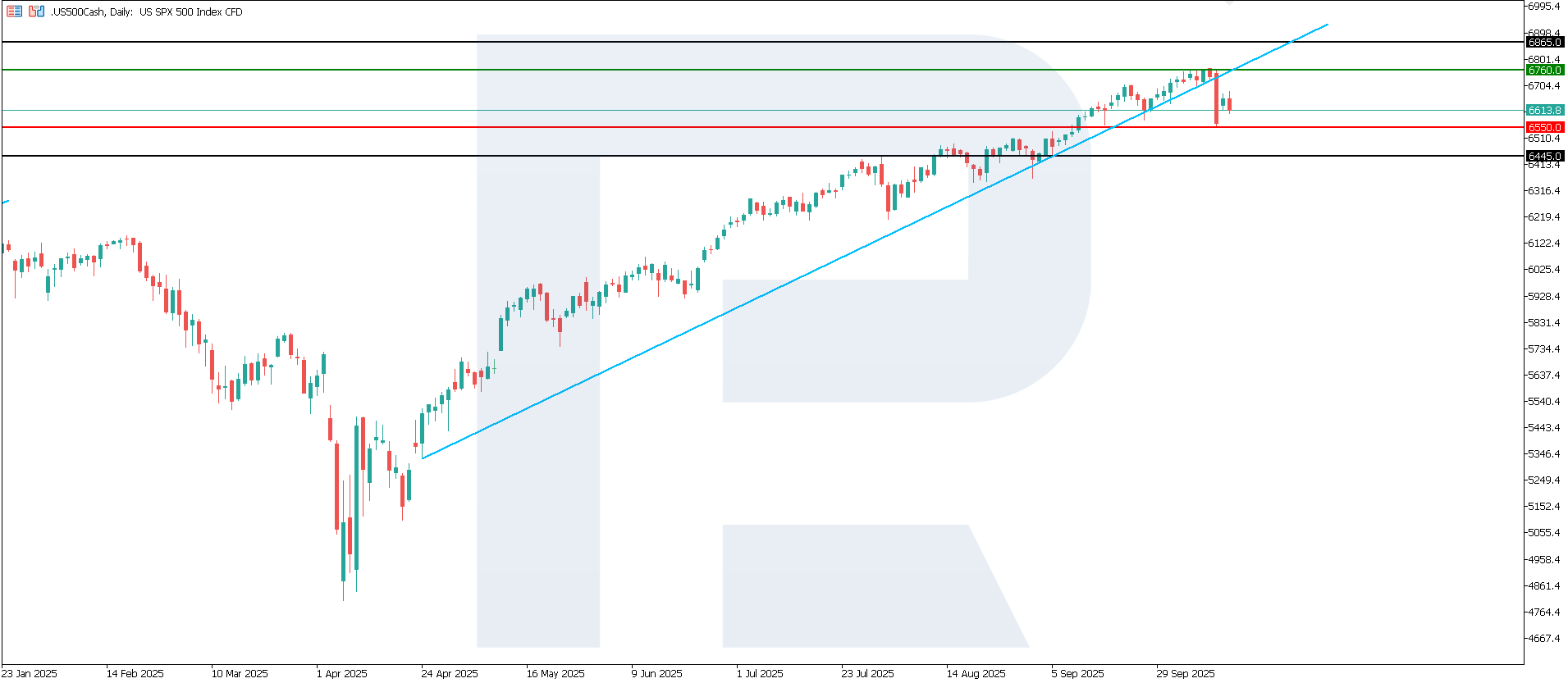

The US 500 index is undergoing a correction after a decline, with the support level at 6,550.0 and the nearest resistance at 6,760.0. The most likely scenario remains further downside, with a target near 6,445.0.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 scenario: a breakout below the 6,550.0 support level could send the index down to 6,445.0

- Optimistic US 500 scenario: a breakout above the 6,760.0 support level could propel the index to 6,865.0

Summary

The renewed trade conflict between the US and China has brought uncertainty back to the stock market. The additional pressure from the US government shutdown, which may drag on, further complicates sentiment. Investors are not receiving fresh economic statistics, as the responsible agencies are not working due to a lack of funding. From a technical perspective, the US 500 index will likely continue its decline towards 6,445.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.