US 30 forecast: the index hit a new all-time high and entered a correction

After reaching a new all-time high, the US 30 index has begun to decline, although the overall trend remains upward. The US 30 forecast for today is positive.

US 30 forecast: key trading points

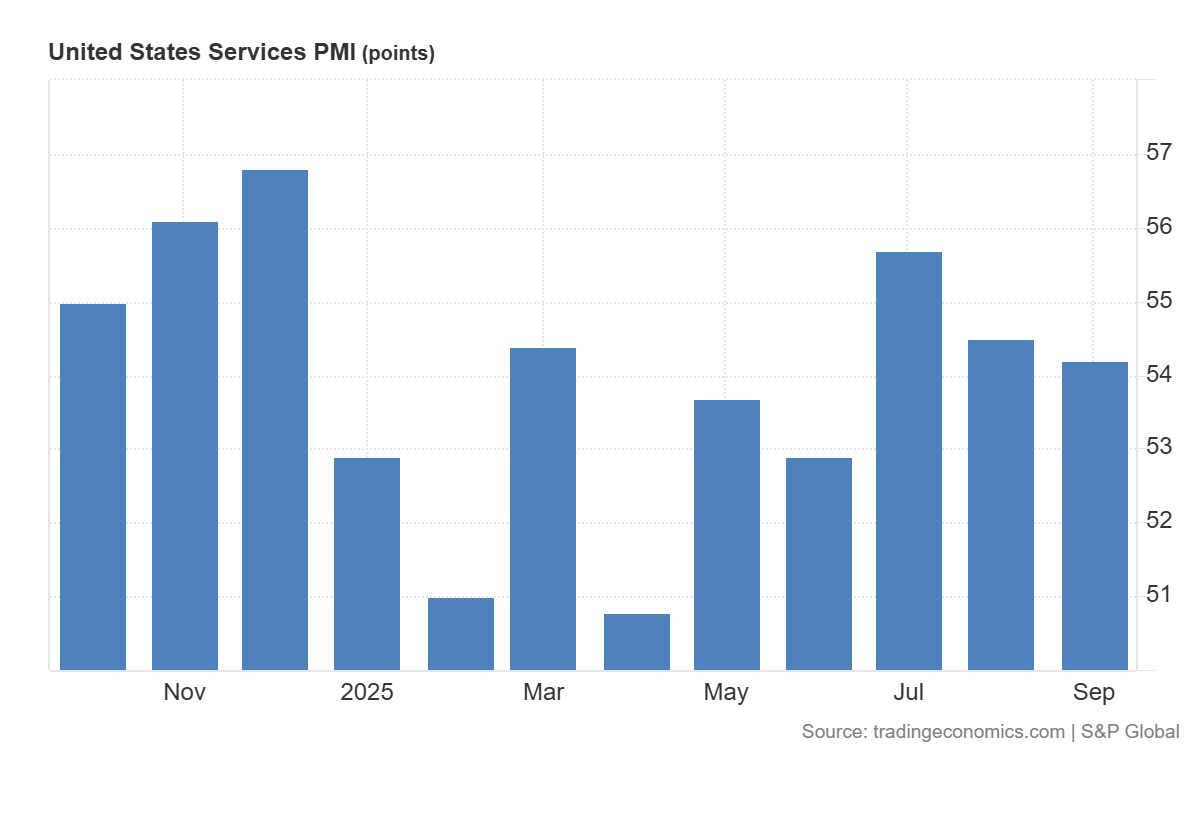

- Recent data: US services PMI (preliminary) came in at 54.2 in September

- Market impact: the data has a moderately positive effect on the stock market

US 30 fundamental analysis

The US services PMI for October 2025 stood at 54.2, slightly above the forecast of 53.9 but marginally below the previous reading of 54.5. A PMI reading above 50.0 indicates an expansion in business activity in the service sector, which remains the primary driver of the US economy. A stronger-than-expected reading signals steady demand and positive sentiment among businesses, supporting expectations of moderate economic growth without signs of overheating. For the equity market, such data is generally viewed positively, as it confirms the resilience of corporate earnings and overall economic activity.

However, the slight decline compared to the previous month may be interpreted as a sign that the economy is gradually stabilising after a phase of robust expansion. This reduces overheating concerns but may also temper excessive investor optimism. For the US 30 index, the PMI results are moderately positive.

US services PMI: https://tradingeconomics.com/united-states/services-pmiUS 30 technical analysis

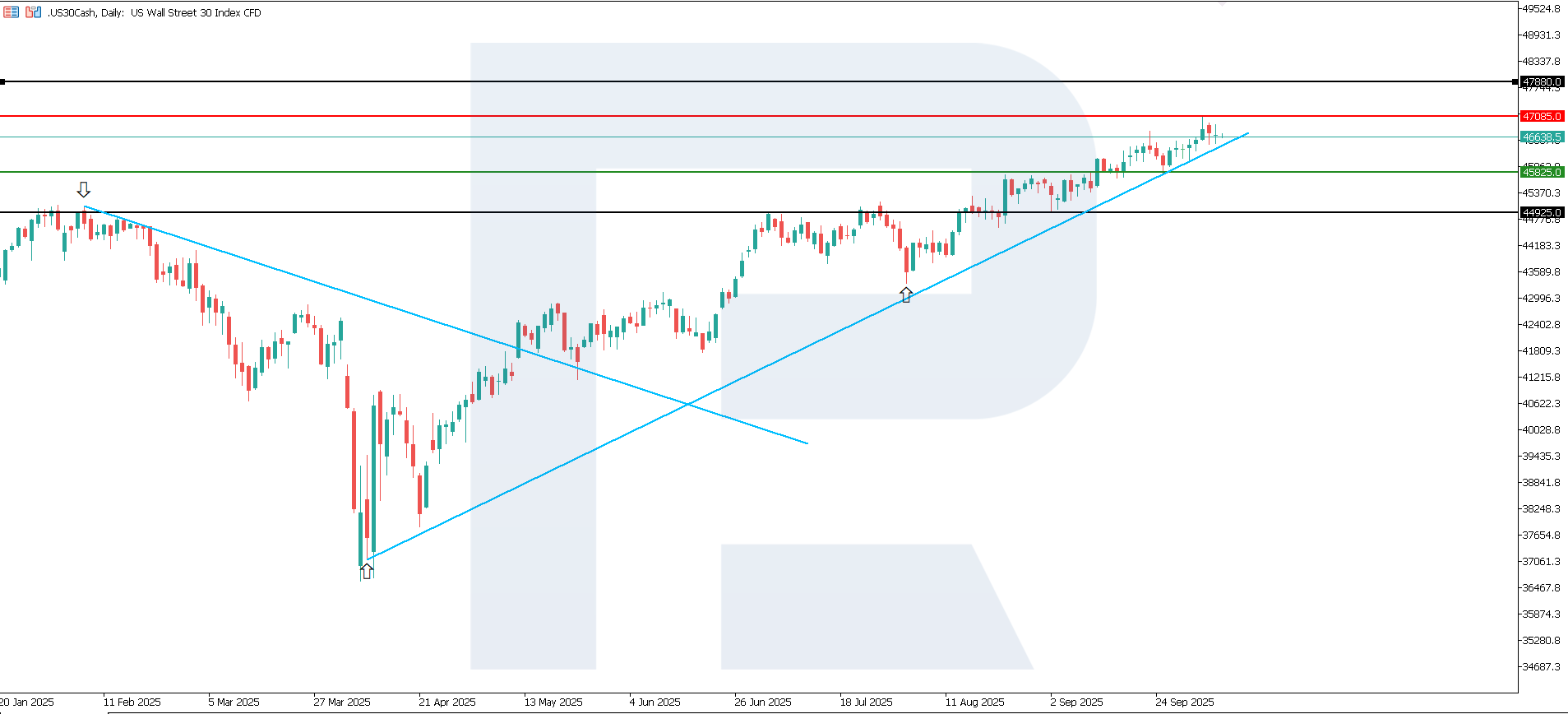

The US 30 index continues to move in an uptrend and has recently reached a new all-time high. Resistance has formed at 47,085.0, while support lies at 45,825.0. The persistent volatility indicates instability in the current dynamics, with near-term upside potential remaining capped.

The US 30 price forecast considers the following scenarios:

- Pessimistic US 30 scenario: a breakout below the 45,825.0 support level could push the index down to 44,925.0

- Optimistic US 30 scenario: a breakout above the 47,085.0 resistance level could drive the index up to 47,880.0

Summary

The stronger-than-expected US services PMI data reflects the healthy condition of the service sector, which benefits companies focused on domestic demand, including industrial, financial, and transportation firms. Meanwhile, the slight decrease from the previous reading indicates a balance between growth and stability, which may support steady US 30 performance without sharp fluctuations. The next upside target for the index could be at 47,880.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.