JP 225 forecast: the index has entered a sideways channel

After a nearly 8% decline, the JP 225 stock index has retained potential for further growth, although a sideways movement appears more likely in the short term. The forecast for JP 225 today is negative.

JP 225 forecast: key trading points

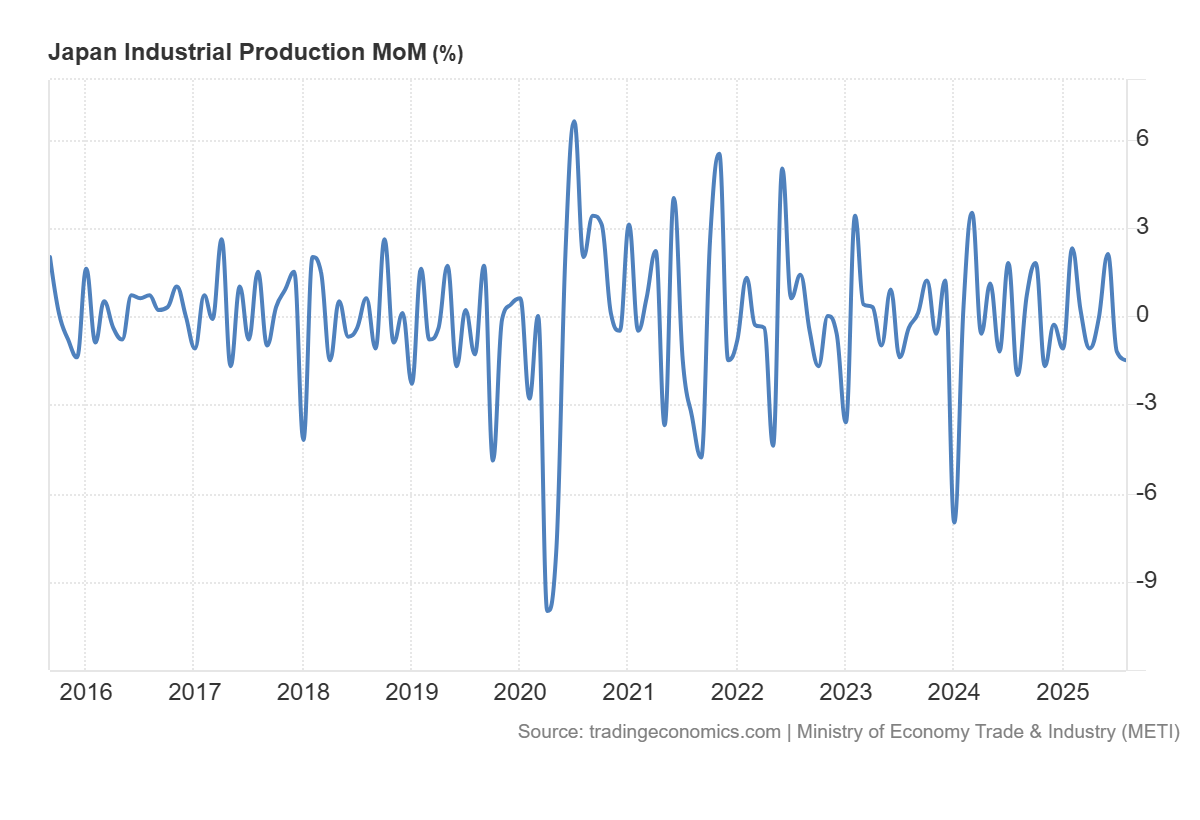

- Recent data: Japan’s industrial production decreased by 1.5% month-on-month in August

- Market impact: the effect is negative for the Japanese stock market

JP 225 fundamental analysis

Fresh industrial production data from Japan showed a decline of 1.5% month-on-month, compared with the forecast of -1.2% and the previous reading of -1.2%. This indicates that the manufacturing sector is losing momentum faster than expected. Such a downturn typically reflects weaker capacity utilisation, more cautious purchasing and investment decisions by management, and possible inventory accumulation among firms.

For the JP 225 index, the main influence channel is through corporate earnings expectations. Large Japanese corporations, particularly in capital goods, industrial equipment, electronics, and chemicals, are sensitive to global demand fluctuations and investment cycles. A fall in output raises the likelihood of lower sales volumes and margin pressure. If this weakness persists, corporate managements may revise their annual forecasts downwards, which could weigh on consensus profit expectations and valuations of these companies’ shares.

Japan’s industrial production m/m: https://tradingeconomics.com/japan/industrial-production-momJP 225 technical analysis

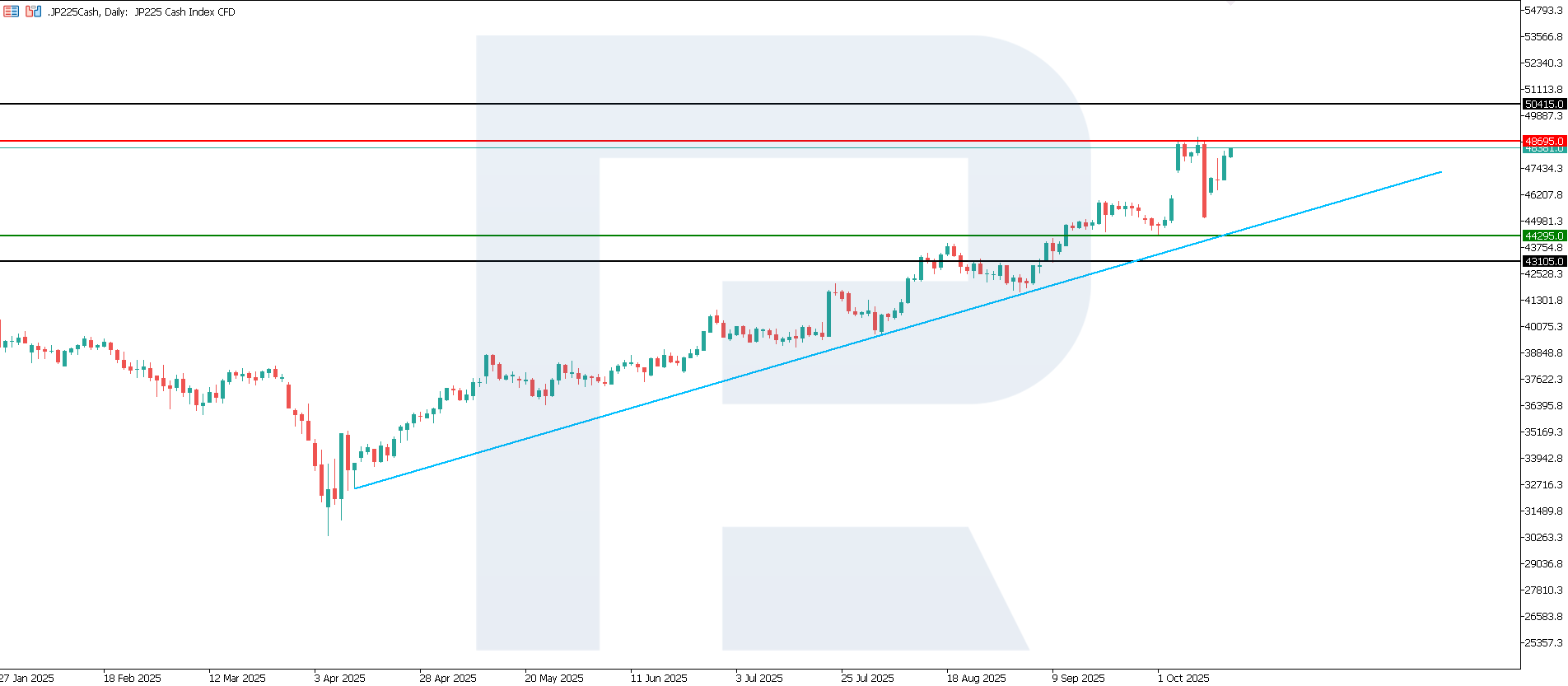

The JP 225 index has fallen by nearly 8%, yet the overall trend remains upward. However, before any resumption of growth, the index will likely trade within a sideways channel. The support level is located around 44,295.0, while resistance lies at 48,695.0.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 scenario: a breakout below the 44,295.0 support level could push the index down to 43,105.0

- Optimistic JP 225 scenario: a breakout above the 48,695.0 resistance level could drive the index to 50,415.0

Summary

In the short term, given the unexpectedly weak data, the JP 225 will likely face increased volatility and moderate downward pressure. The extent of the move will depend on the flow of daily news: if the yen weakens simultaneously, part of the decline could be offset by the strong weighting of exporters in the index. More pronounced and sustained weakness may occur in segments tied to domestic industrial demand and logistics. The next downside target for the JP 225 is at 43,105.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.