JP 225 forecast: the index hit two consecutive all-time highs

The JP 225 stock index continues to rise after reaching a new all-time high. The JP 225 forecast for today is positive.

JP 225 forecast: key trading points

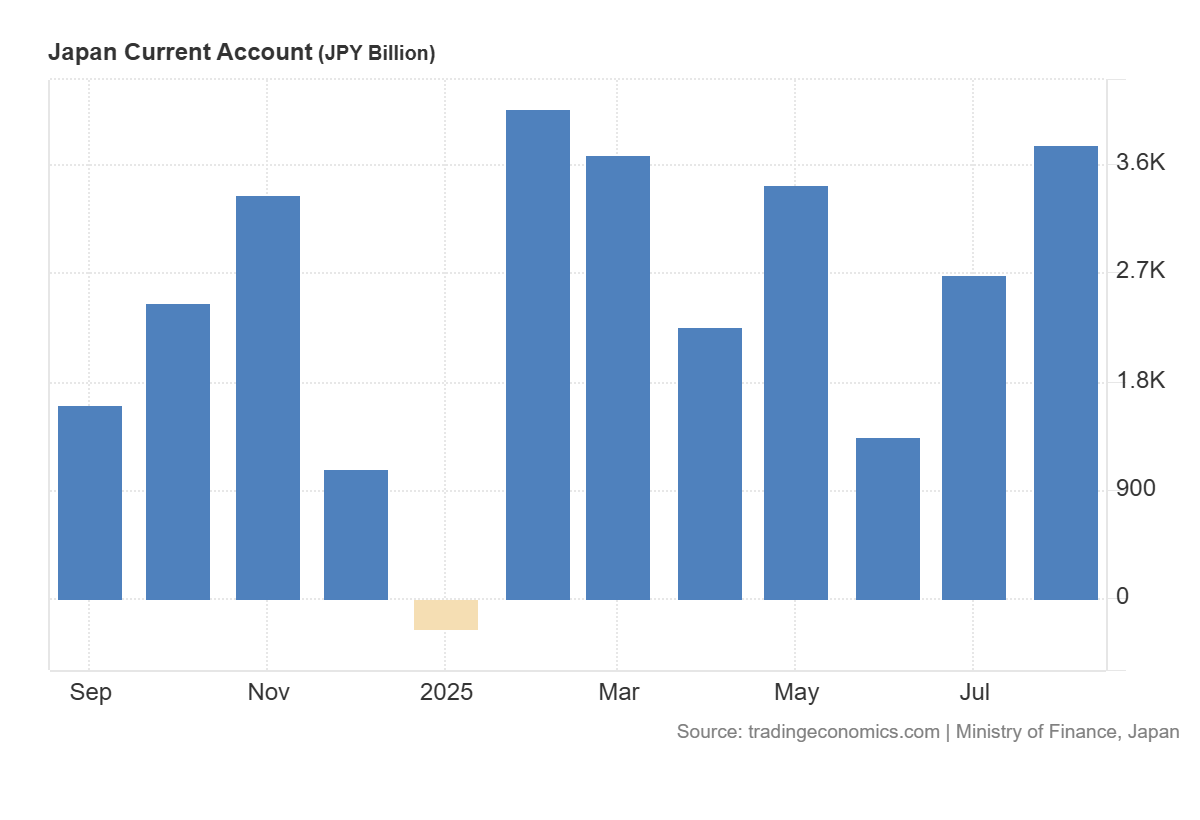

- Recent data: Japan’s current account for August 2025 stood at 3.77 trillion JPY

- Market impact: the data has a moderately positive effect on the Japanese stock market

JP 225 fundamental analysis

The increase in Japan’s current account surplus indicates a strong foreign economic position: exports of goods and services, along with income from overseas investments, exceed imports and external payments. This reflects the resilience of Japan’s economy and its ability to maintain a positive balance, which is generally viewed as a fundamentally supportive signal. A higher surplus can boost investor confidence in Japan’s economic stability, strengthen the yen, and attract additional capital inflows to domestic markets.

For the JP 225 index, the overall effect is moderately positive. Shares of semiconductor-related companies showed elevated volatility. The index hit another all-time high on Monday after the ruling Liberal Democratic Party elected staunch conservative Sanae Takaichi as its new leader on Saturday, paving the way for her to become Japan’s first female prime minister. This political development lifted investor sentiment.

Japan current account: https://tradingeconomics.com/japan/current-accountJP 225 technical analysis

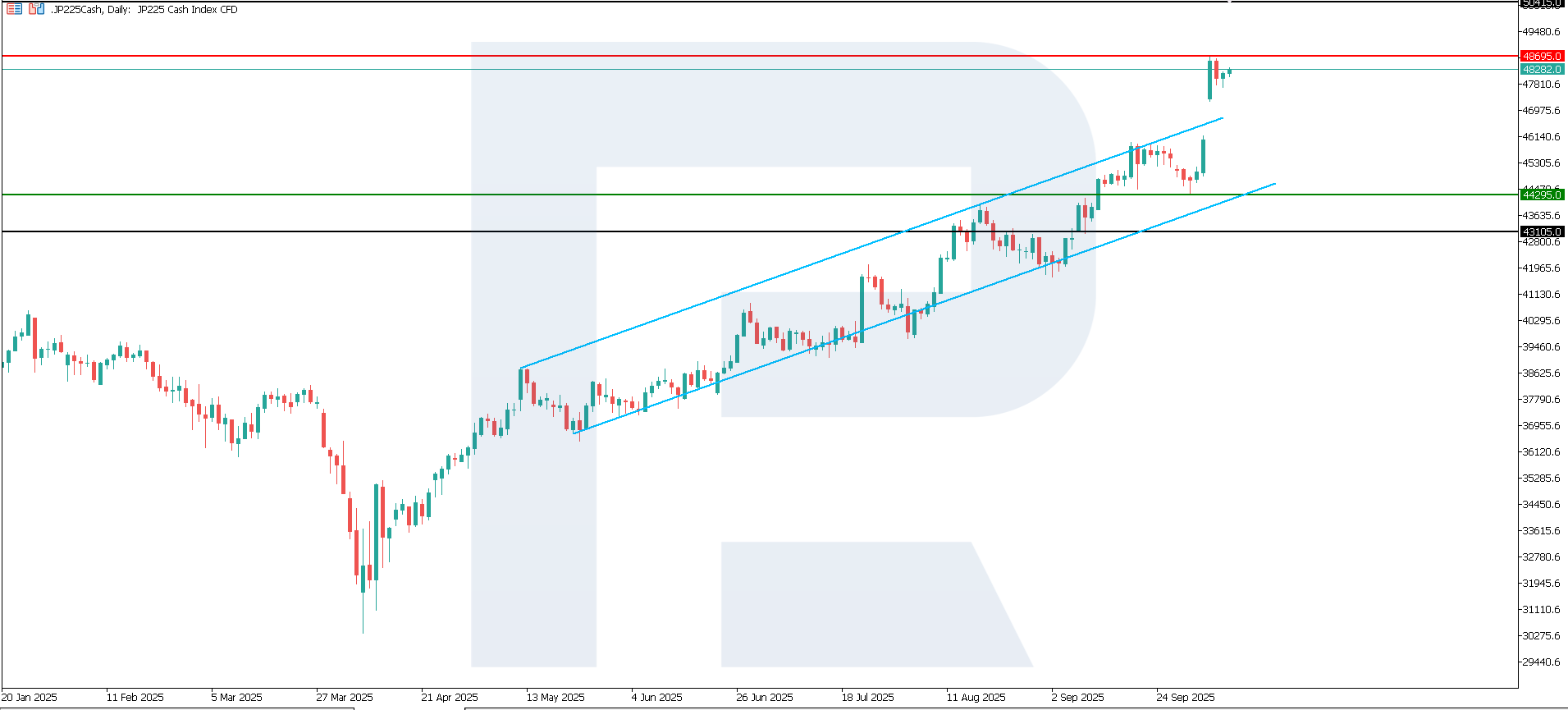

The JP 225 is steadily rising, with the support level located at 44,295.0 and resistance at 48,695.0. Currently, the price is highly likely to hit another all-time high.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 scenario: a breakout below the 44,295.0 support level could send the index down to 43,105.0

- Optimistic JP 225 scenario: a breakout above the 48,695.0 resistance level could propel the index to 50,415.0

Summary

The current account surplus data is moderately positive for the JP 225 index, as it reaffirms Japan’s solid macroeconomic foundation and the ability of its corporations to generate external income. In the short term, the index may show moderate growth amid improving economic expectations. However, if the market interprets the data as a factor likely to strengthen the yen, this could temporarily cap gains in export-oriented stocks. The next upside target for the JP 225 could be 50,415.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.