World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 19 June 2025

The armed conflict between Iran and Israel is escalating due to the growing risk of US intervention on Israel's side. Find out more in our analysis and forecast for 19 June 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: the US Federal Reserve rate stands at 4.5%

- Market impact: investors may remain cautious due to inflation and tariff risks, adding to uncertainty

Fundamental analysis

The current high rate puts pressure on stocks, particularly on companies with high debt levels and growth sectors, as borrowing costs increase. However, the projected rate cuts by 2026 create positive expectations for long-term recovery and market growth. High rates weigh heavily on technology companies due to more expensive financing and downward revisions of future earnings. Expectations of rate cuts in 2026 could support the sector’s recovery.

Based on 99% of corporate earnings reports, US 500 companies saw operating profits grow by 5% year-on-year in Q1. High interest rates and inflation may reduce consumer purchasing power and slow the growth of consumer-focused companies.

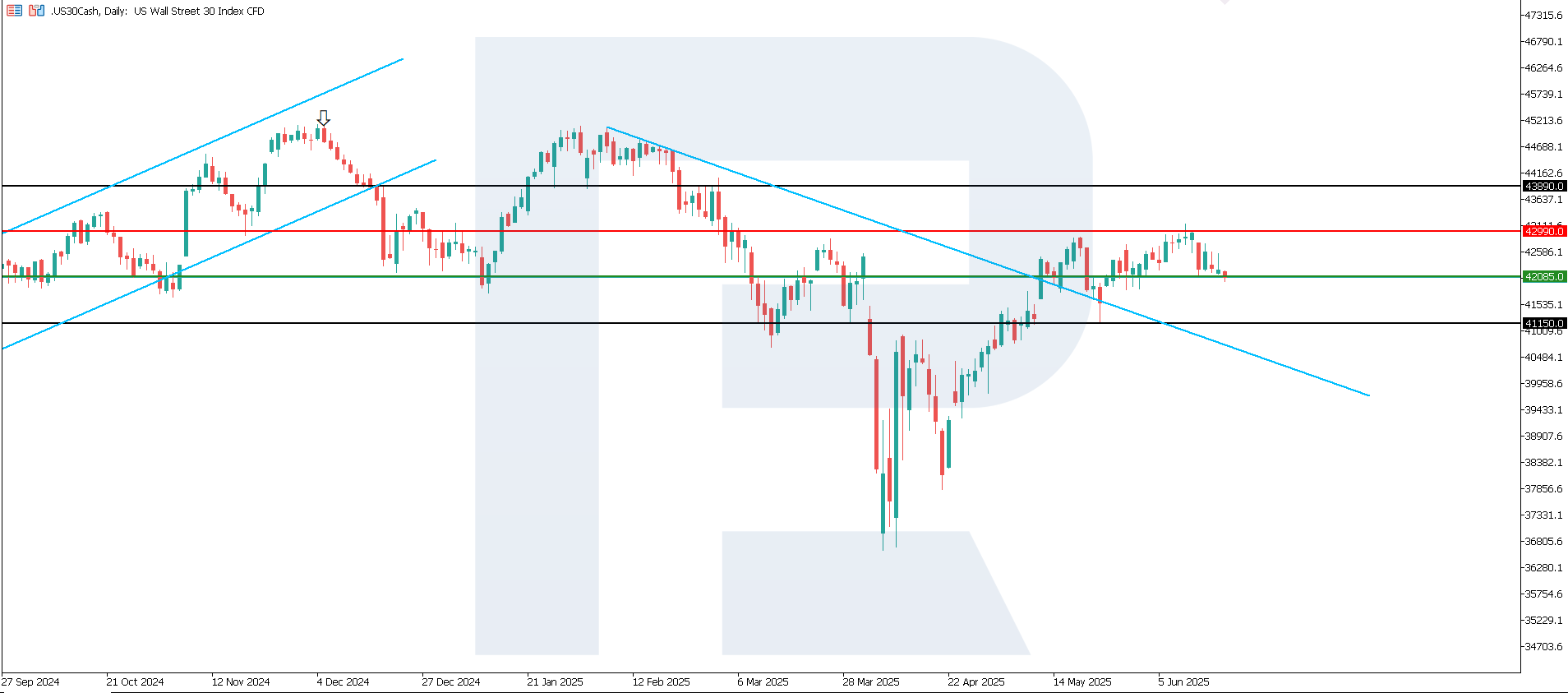

US 30 technical analysis

The US 30 index broke below the 42,570.0 support level, with a new one forming at 42,085.0. The resistance level shifted to 42,990.0. The current US 30 outlook remains unstable. The downward momentum is relatively weak, increasing the likelihood of a shift into a sideways pattern.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 42,085.0 support level could send the index to 41,150.0

- Optimistic US 30 forecast: a breakout above the 42,990.0 resistance level could boost the index to 43,890.0

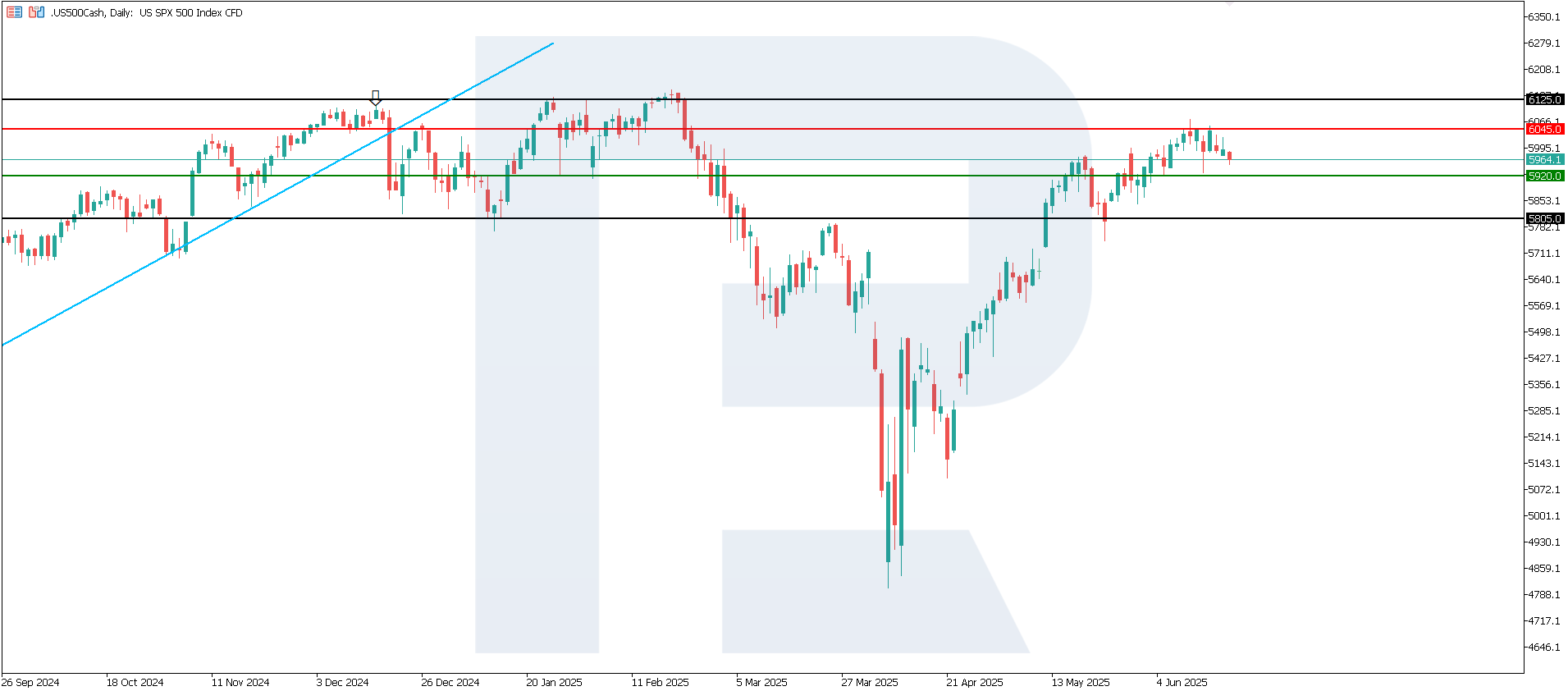

US 500 technical analysis

The US 500 index remained in an uptrend, with the support level shifting to 5,920.0 and resistance forming at 6,045.0. The index attempted to break above this level and reach a new all-time high. However, quotes are now testing the support level and might break below it.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,920.0 support level could push the index down to 5,745.0

- Optimistic US 500 forecast: a breakout above the 6,045.0 resistance level could propel the index to 6,125.0

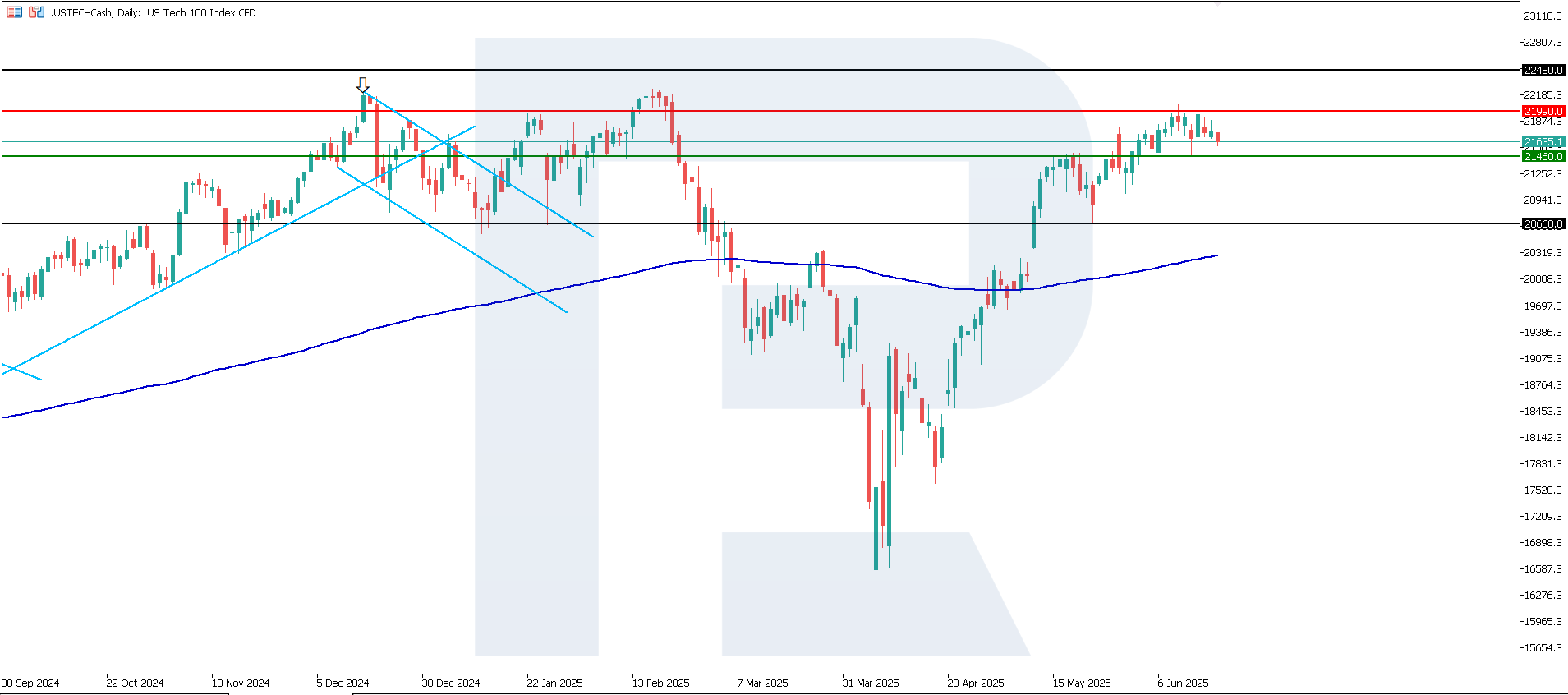

US Tech technical analysis

The US Tech index broke above the 21,780.0 resistance level, with a new one forming at 21,990.0. The support level has shifted to 21,460.0. The index has remained within an uptrend and shows potential for further growth.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 21,460.0 support level could send the index down to 20,660.0

- Optimistic US Tech forecast: a breakout above the 21,990.0 resistance level could drive the index to 22,480.0

Asian index forecast: JP 225

- Recent data: Japan's trade deficit totalled 637.6 billion JPY

- Market impact: widening trade deficit adds pressure on the yen and may raise investor concerns about the export sector and overall economic growth

Fundamental analysis

The trade balance reflects the difference between the value of exports and imports of goods and services during the reporting period. The deficit was less than the expected 893.0 billion JPY but significantly higher than the previous value of 115.6 billion JPY, indicating a worsening gap. This result may be viewed negatively in terms of economic growth, as it signals a weakening export component.

A growing trade deficit points to declining exports, which can negatively affect the earnings of companies in these sectors, dragging down share prices. This may cause stock market volatility and warrants close monitoring of macroeconomic indicators.

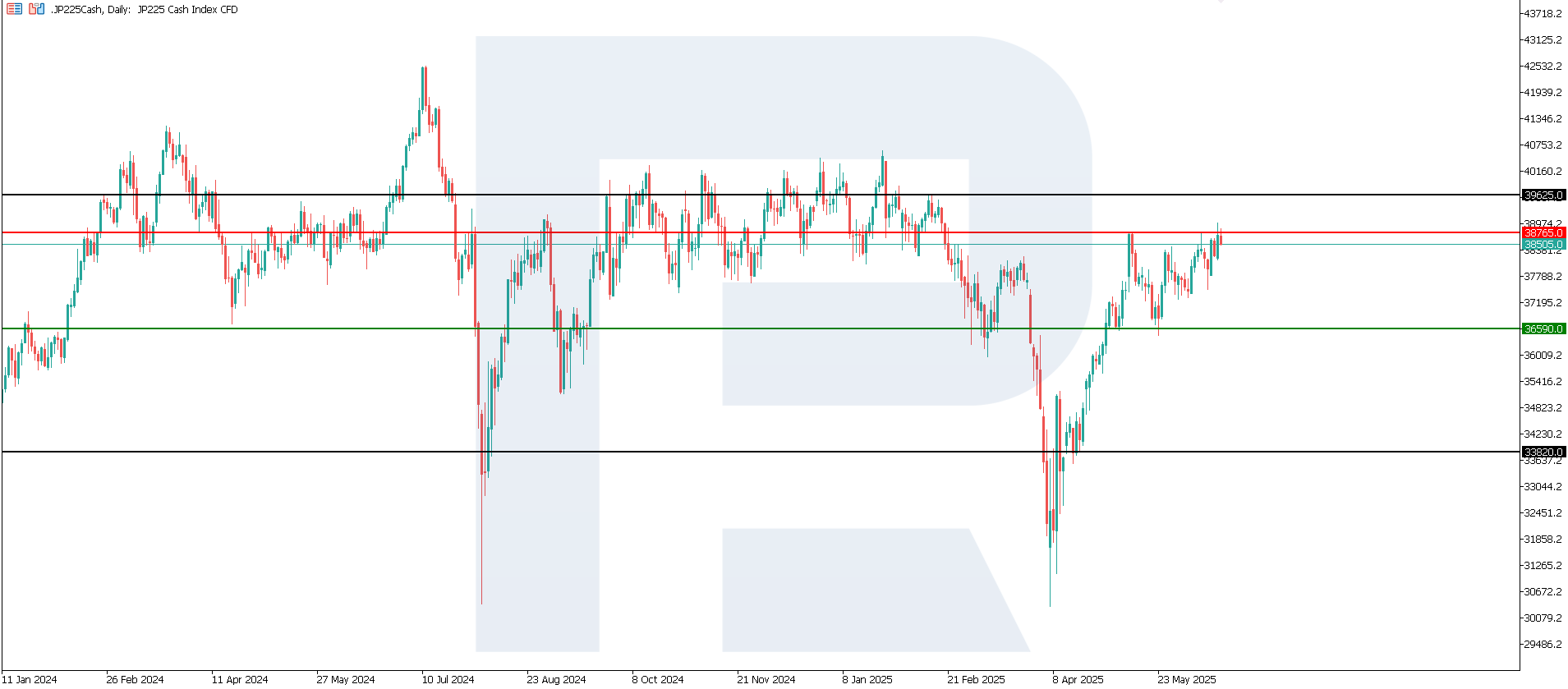

JP 225 technical analysis

The JP 225 index is recovering after rebounding from the 36,590.0 support level and is heading towards the 38,765.0 resistance level. An upward breakout would signal continued medium-term upward momentum. At this point, there are no signs of a possible trend reversal.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 36,590.0 support level could push the index down to 33,820.0

- Optimistic JP 225 forecast: a breakout above the 38,765.0 resistance level could propel the index to 39,625.0

European index forecast: DE 40

- Recent data: Germany's ZEW Economic Sentiment Index came in at 47.5

- Market impact: this is a positive signal for the market, which boosts investor confidence in economic growth and stability

Fundamental analysis

The ZEW index reflects six-month economic expectations based on a survey of institutional investors and analysts. A reading above zero (47.5) shows optimism about Germany's economic outlook. The actual result far exceeded the forecast of 34.8 and the previous reading of 25.2.

A strong rise in the ZEW Economic Sentiment Index highlights growing optimism among investors regarding Germany’s economic prospects. This supports stock market growth, particularly in the industrial, consumer, financial, and technology sectors.

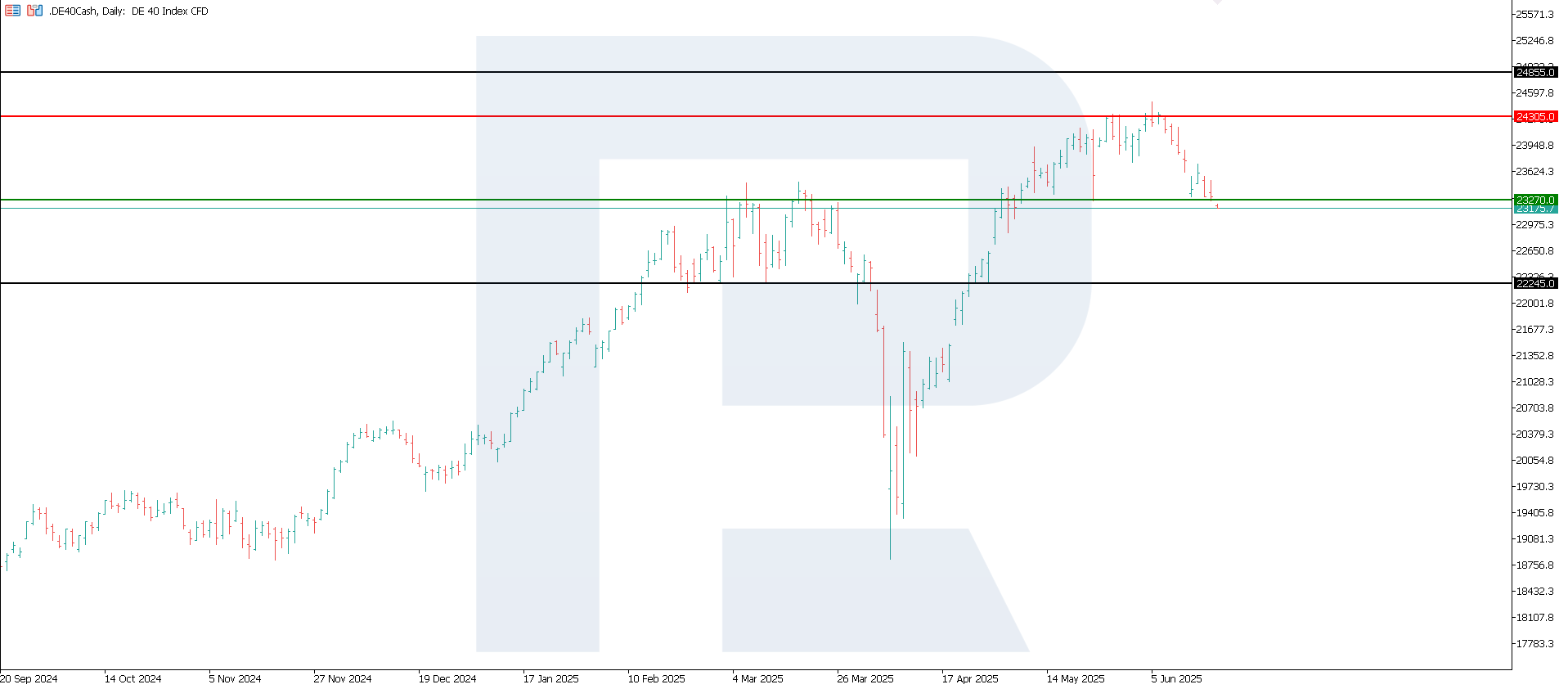

DE 40 technical analysis

The DE 40 index has formed key levels, with resistance at 24,305.0 and support around 23,270.0. Current price moves confirm a persistent uptrend, increasing the likelihood of new all-time highs in the near term. The support level remained intact following a correction.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 23,270.0 support level could send the index down to 22,245.0

- Optimistic DE 40 forecast: a breakout above the 24,305.0 resistance level could push the index higher to 24,855.0

Summary

The US Federal Reserve kept interest rates unchanged, in line with market expectations. The US 30 index remains unstable, with no clear trend formed. Japan’s JP 225 index is approaching the resistance level. The US 500 and US Tech indices continue their upward momentum.

Investor focus will remain on the Middle East: will the US get involved? If the situation does not escalate into a broader conflict, attention will likely return to US macroeconomic data.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.