USDJPY: risks of a break below key support remain

The USDJPY pair remains under pressure from fundamental factors and bearish technical signals. The current quote is 154.89. Details — in our analysis for 16 December 2025.

USDJPY forecast: key trading points

- Analysts expect US employment to increase by 40K

- Japan’s macroeconomic data provides moderate support for the yen

- Data point to a slowdown in the contraction of Japan’s manufacturing sector

- USDJPY forecast for 16 December 2025: 153.75

Fundamental analysis

The USDJPY pair is declining for the second consecutive trading session. Sellers are consistently testing the key support level at 154.65. The US dollar remains under pressure as investors prepare for the release of the combined US employment report for October and November. The data will be published today with a delay due to the government shutdown. Analysts expect employment growth of 40K, while the unemployment rate is forecast to remain at 4.4%.

Meanwhile, macroeconomic signals from Japan are providing partial support to the yen. The S&P Global Manufacturing PMI rose to 49.7 in December 2025 from 48.7 in November. The reading exceeded expectations of 48.8 and marked the highest level since August, indicating that the contraction in manufacturing activity is beginning to ease.

In contrast, the services sector is showing signs of moderate cooling. The preliminary S&P Global Services PMI fell to 52.5 in December 2025 from 53.2 in the previous month, marking its lowest level since June.

The combination of US dollar weakness ahead of the employment report and improving economic data from Japan increases pressure on the currency pair and keeps the risk of a break below the 154.65 support level elevated within today’s USDJPY forecast.

USDJPY technical analysis

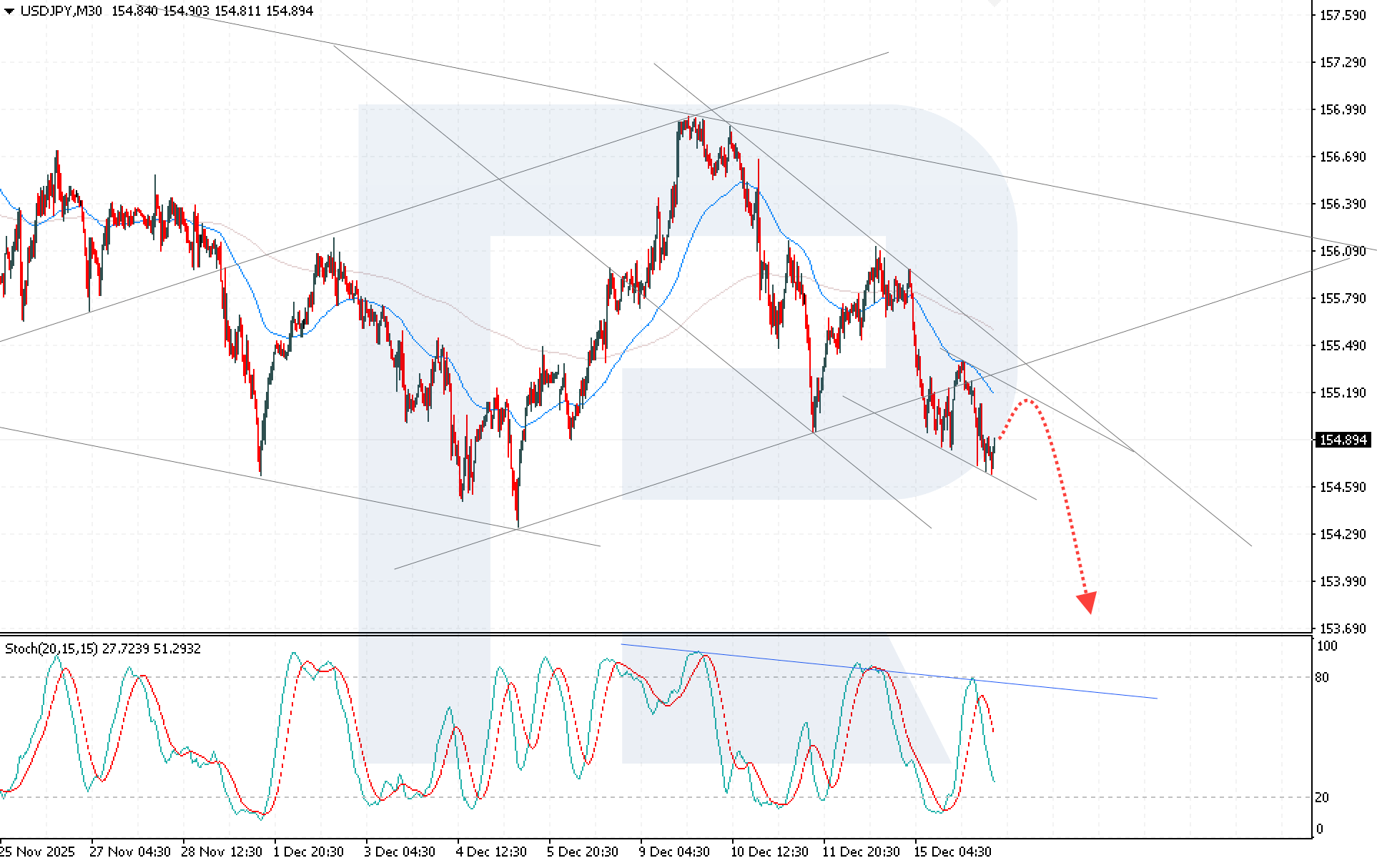

USDJPY is correcting after rebounding from the support level. Prices remain below the EMA-65 line, confirming sustained pressure from sellers.

The USDJPY forecast for today suggests the continuation of the downward impulse after a minor corrective move, with a downside target at 153.75. An additional bearish signal is generated by the Stochastic Oscillator: the signal lines have rebounded from the descending trendline and formed a bearish crossover, indicating a resumption of downside momentum.

A firm move and consolidation below the 154.35 level will confirm the realization of the bearish scenario.

Summary

USDJPY technical analysis points to persistent bearish pressure and a high probability of a renewed decline toward the 153.75 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.