Cautious BoJ stance restrains USDJPY decline

The USDJPY rate is moderately rising amid a mix of external pressure and Japan’s domestic economic signals. The current quote is 147.71. Find out more in our analysis for 19 August 2025.

USDJPY forecast: key trading points

- BoJ Governor Kazuo Ueda maintains a cautious stance, noting that core inflation remains below the 2% target

- Q2 2025 data showed Japan’s economy grew stronger than expected

- USDJPY forecast for 19 August 2025: 145.90

Fundamental analysis

The USDJPY rate is rising for the second consecutive session but remains within the range it has been stuck in for twelve trading days. Additional pressure on the yen came from Japanese officials’ attempts to smooth reactions to US Treasury Secretary Scott Bessent’s comments. He stated that the Bank of Japan lags behind in its policy, and markets interpreted this as a signal for possible tightening.

Meanwhile, BoJ Governor Kazuo Ueda sticks to a cautious line, noting that core inflation still stands below the 2% target. This stance allows the regulator to refrain from raising interest rates, adding pressure on the yen.

At the same time, Friday’s data showed that Japan’s economy grew stronger than expected in Q2 2025. Growth was mainly driven by net exports despite the negative impact of US tariffs. These results strengthen the case for tighter monetary policy.

USDJPY technical analysis

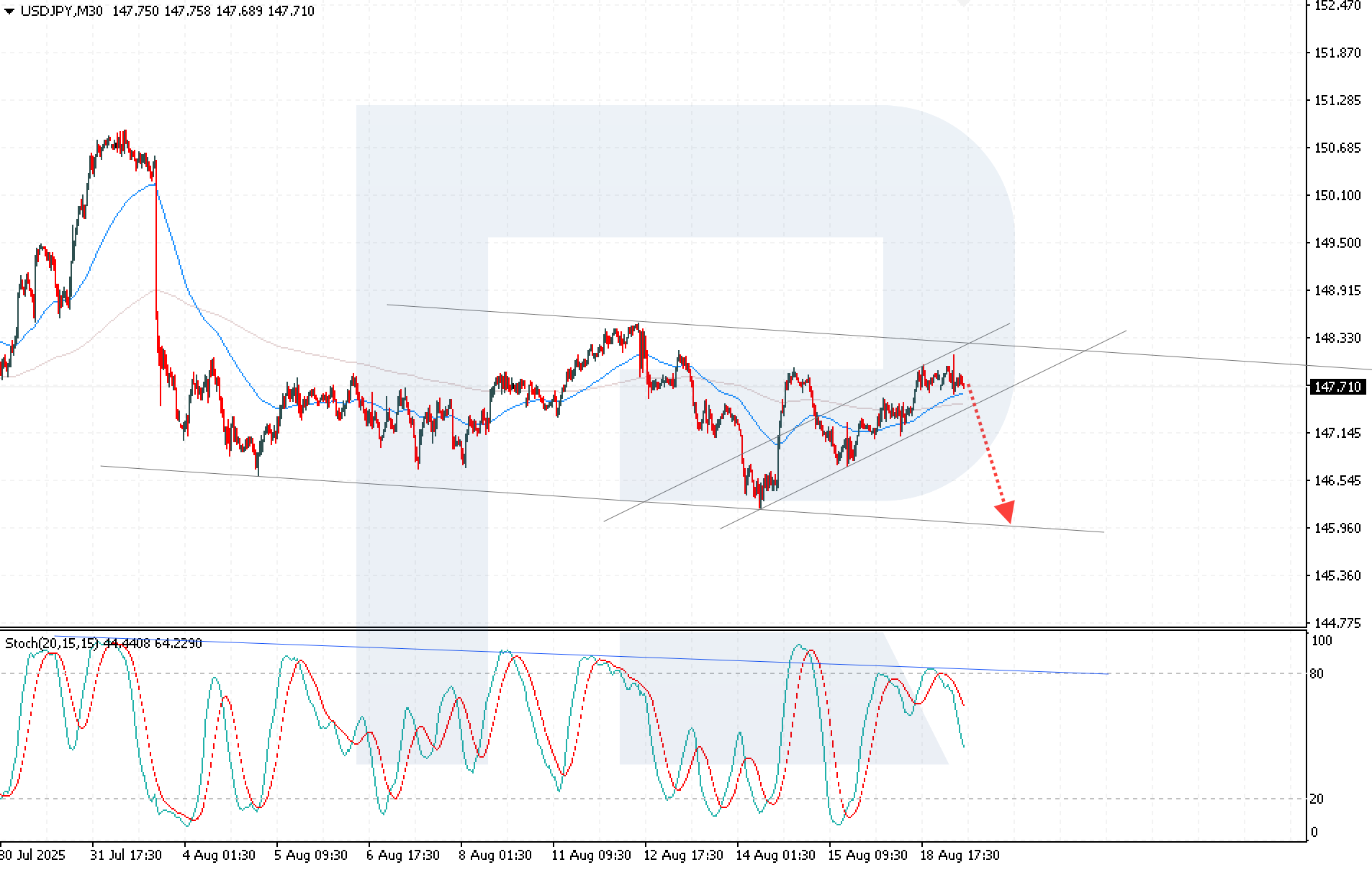

The USDJPY rate is trading within an upward correction channel and testing the key resistance level at 147.85. The price has consolidated above the EMA-65, indicating buyers’ activity, but several attempts to break above the resistance have failed.

The USDJPY forecast for today suggests a decline with a test of 145.90. The Stochastic Oscillator confirms the bearish scenario, with its signal lines reversing downwards from overbought territory, indicating growing selling pressure.

Consolidation below 147.15 would further confirm the downside scenario.

Summary

The USDJPY rate remains within the range, with pair growth supported by external pressure, while the BoJ’s cautious stance restrains sharp yen strengthening. USDJPY technical analysis points to a possible decline of the pair towards 145.90 if it consolidates below 147.15.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.