USDJPY in the eye of the storm, yen loses balance

As Japan awaits the upper house elections, the USDJPY pair may continue its upward movement towards 149.60. Find out more in our analysis for 18 July 2025.

USDJPY forecast: key trading points

- Nationwide core Consumer Price Index in Japan: previously at -3.7%, currently at -3.3%

- Yen awaits upper house elections

- USDJPY forecast for 18 July 2025: 149.60

Fundamental analysis

The USDJPY fundamental analysis for 18 July 2025 shows that the pair remains in an upward channel, having consolidated near the 148.60 level. Strong macroeconomic data from the US and political uncertainty in Japan continue to pressure the yen.

US retail sales reports and a drop in jobless claims further support the dollar – both as a reflection of domestic economic resilience and as a safe-haven asset. Expectations for a near-term Federal Reserve rate cut have weakened.

On the Japanese side, the market is pricing in risks related to the upcoming upper house parliamentary elections. A decline in the core CPI and growing political pressure on the current administration are adding to USDJPY volatility.

USDJPY technical analysis

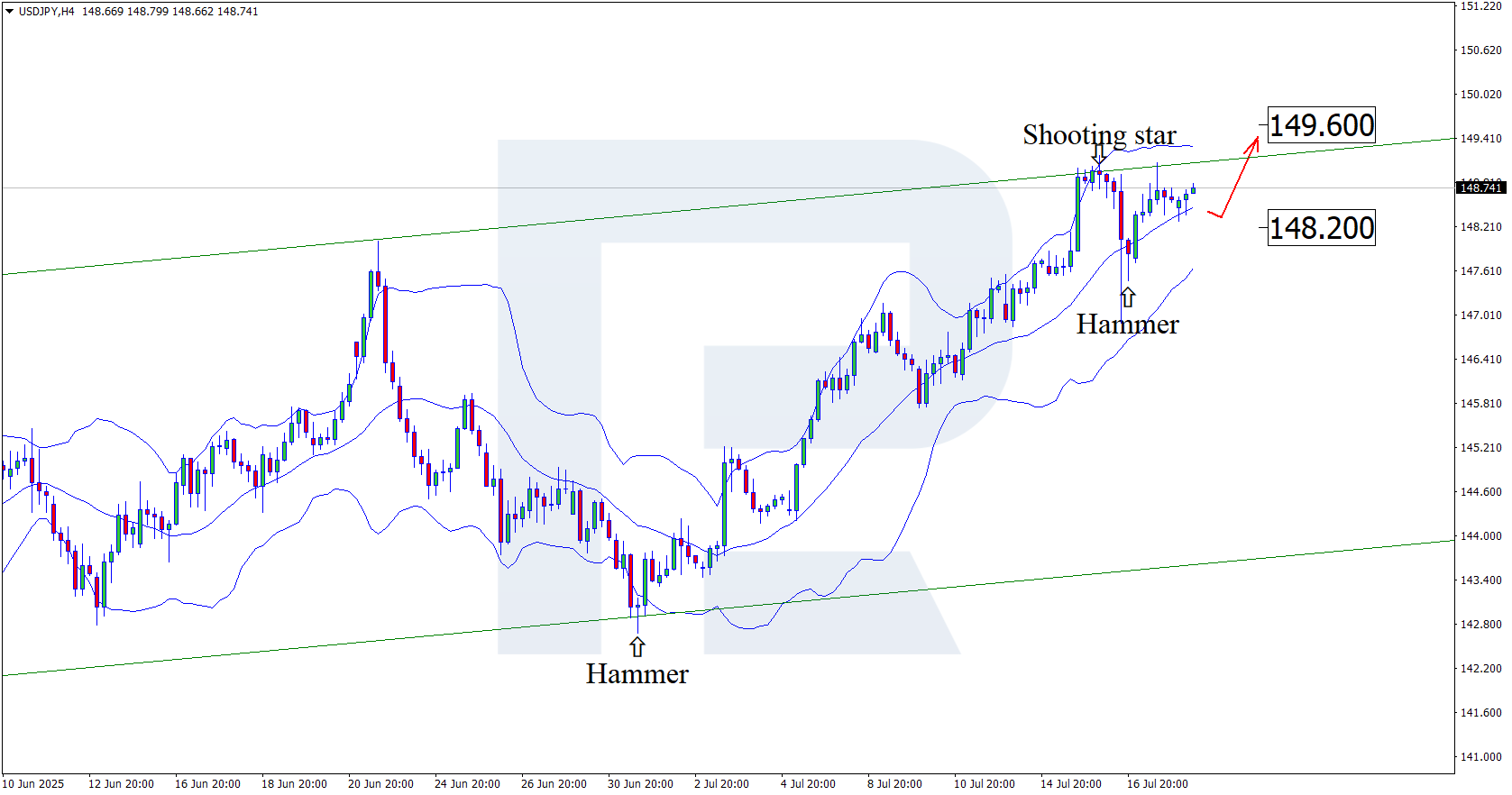

On the H4 chart, the USDJPY pair tested the middle Bollinger Band, formed a Hammer reversal pattern, and is currently trading around 148.70. At this stage, it may continue its upward wave in response to the pattern signal. Since the USDJPY pair remains within the ascending channel, it has a strong chance of extending its rise towards 149.60.

However, the USDJPY forecast also takes into account an alternative scenario, where the price corrects towards 148.20 before growth.

Summary

The USDJPY pair maintains its upward momentum. With no reversal signals in sight, the bullish scenario remains in focus, as confirmed by the USDJPY technical analysis.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.