USDJPY jumps above 149.00 on US inflation data

The USDJPY rate climbed into the 149.00 area as the dollar strengthened moderately after the release of US consumer inflation statistics. Find out more in our analysis for 16 July 2025.

USDJPY forecast: key trading points

- Market focus: today’s highlight is the US Producer Price Index (PPI) inflation data

- Current trend: moving upwards

- USDJPY forecast for 16 July 2025: 149.18 or 148.00

Fundamental analysis

The Japanese yen weakened to 149 per dollar, hitting its lowest level since early April, following the US dollar’s moderate strengthening after the release of the US consumer inflation data. The figures matched expectations and slightly cooled the likelihood of a Federal Reserve rate cut as early as July.

Domestically, Japanese producer sentiment improved somewhat in July, supported by a recovery in the semiconductor sector. However, concerns remain about the potential impact of US tariffs on Japan’s economy.

Today, market participants will focus on the June US PPI data, with the index expected to rise by 0.2% month-on-month and 2.5% year-on-year.

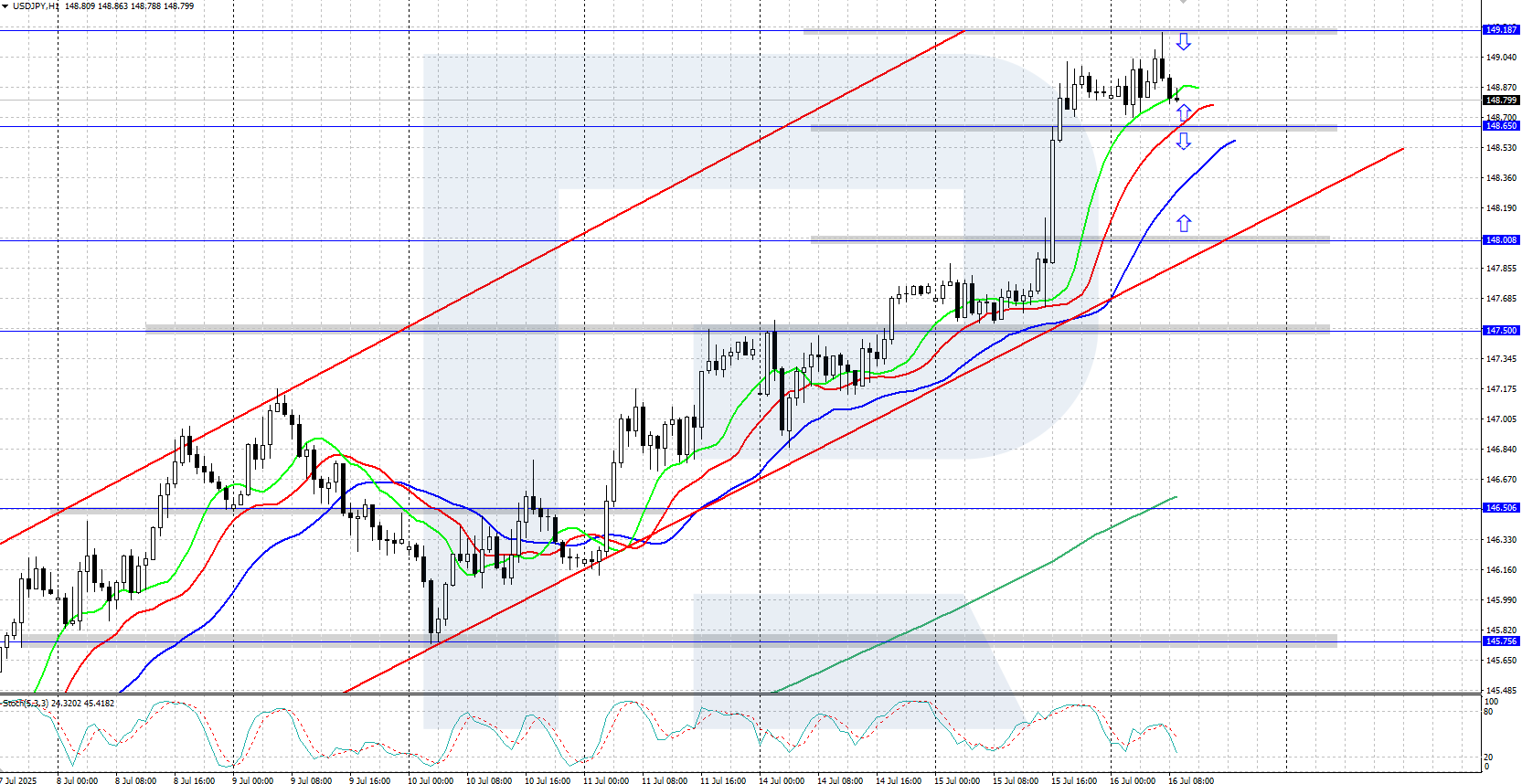

USDJPY technical analysis

On the H4 chart, the USDJPY pair continues to climb confidently, hitting an intraday high at 149.18. The Alligator indicator is trending upwards, confirming the current bullish momentum. However, the Stochastic indicator signals overbought conditions, which may trigger a corrective pullback.

The USDJPY forecast for today suggests that the pair could retreat to the 148.00 support level if bears gain control. Conversely, if bulls push the price higher and consolidate above 149.18, further growth towards the resistance at 150.00 could follow.

Summary

The USDJPY pair climbed to the 149.00 area during the ongoing uptrend. Today’s focus is on the US producer inflation data, with the PPI scheduled for release.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.