Record Japanese spending pressures the dollar: USDJPY prepares to fall

Amid Japan’s economic data, the USDJPY rate may form a downward wave towards 143.30. Details – in our analysis for 4 July 2025.

USDJPY forecast: key trading points

- Japan Household Spending Index: previous value -1.8%, actual - 4.6%

- BoJ continues attempts to reduce inflation

- USDJPY forecast for 4 July 2025: 143.30

Fundamental analysis

The Household Spending Index in Japan shows the volume of household funds spent, adjusted for inflation, over the previous reporting period compared with the same month of the previous year. The calculation includes spending on healthcare, utilities, food, housing, everyday goods, and so on.

Today’s USDJPY forecast factors in that the actual value came out at 4.7%, the highest figure since 2022. The significant increase may stem from consumers adapting to inflation. Higher spending supports the Japanese economy, which remains burdened by American tariffs.

The Bank of Japan continues its attempts to reduce inflation to 2%, but so far it remains above this level. The Japanese government still hopes that the outcome of trade negotiations with the US will have a positive impact on Japan’s economy.

The USDJPY forecast is positive for the yen, which continues to attempt strengthening against the USD.

USDJPY technical analysis

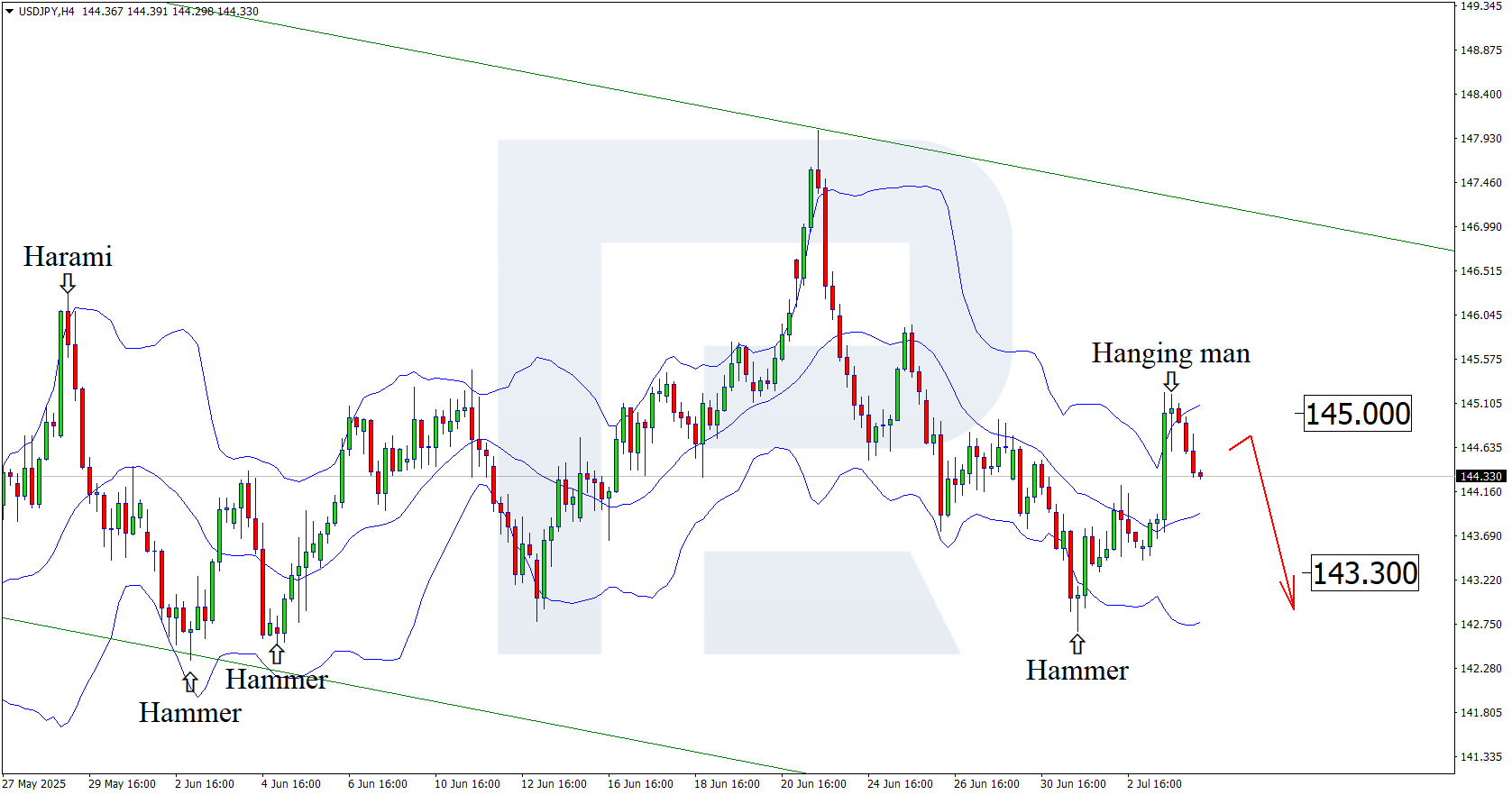

On the H4 chart, USDJPY, after testing the upper Bollinger Band, formed a Hanging Man reversal pattern and is now near 144.30. At this stage, it continues its downward wave in line with the pattern signal. USDJPY quotes remain within a descending channel, and based on this, it can be assumed that they have every chance of reaching support at 143.30.

However, the forecast for 4 July 2025 also considers another market development scenario – a price correction to 145.00 before declining.

Summary

Against the backdrop of rising Japanese household spending, the USDJPY forecast looks optimistic for the yen. USDJPY technical analysis suggests a decline towards 143.30.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.